business resources

AI Startups Secure Record-Breaking $32.9 Billion in Funding for 2025

11 Jun 2025, 1:15 pm GMT+1

AI Startups Secure Record-Breaking $32.9 Billion in Funding for 2025

AI startups have raised $32.9 billion in funding in 2025, nearly matching total VC investments in 2022 and 2023. This surge reflects strong investor confidence, with AI accounting for 58% of global VC investments in Q1. Despite global economic challenges, AI continues to outperform other tech sectors, setting the stage for a record-breaking funding year.

The AI startup sector continues to show remarkable resilience and growth, securing a total of $32.9 billion in funding over the first five months of 2025. This surge in investment is a strong indicator of the industry's potential, even amid global economic challenges, regulatory hurdles, and shifting trade dynamics. Despite rising interest rates, economic slowdown, and tougher regulations on both big tech and AI, the sector has managed to outpace almost every other area of technology, with AI emerging as a dominant force in venture capital (VC) investments.

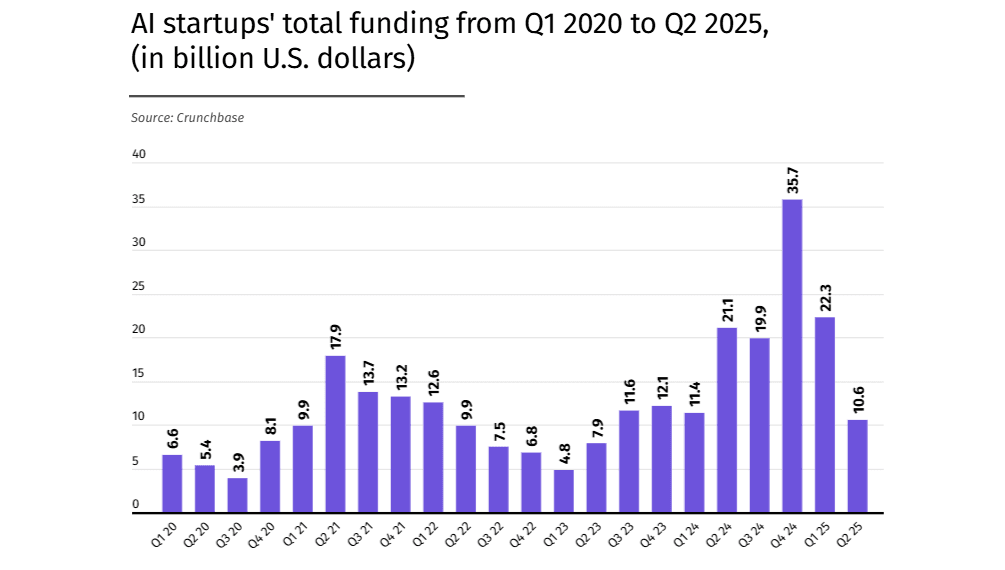

The first quarter of 2025 saw AI startups raise an impressive $22.3 billion, nearly double the amount raised in Q1 2024. This marks the second-highest quarterly total ever, trailing only Q4 2024, which saw a staggering $35.7 billion raised. With Q2 maintaining strong momentum, the year-to-date total has already reached $32.9 billion—almost matching the entire value raised by AI startups in 2022 and 2023 combined.

The rapid pace of funding is further driven by high-profile deals, including Elon Musk’s xAI targeting $10 billion and Figure AI securing $1.5 billion. These deals are reflecting growing investor confidence and the increasing demand for practical, real-world AI solutions.

Investor Confidence Bolsters the Sector

Despite global trade tensions, Donald Trump's tariff policies, and stricter regulations on the tech sector, the AI market has shown exceptional investor enthusiasm. According to data presented by Stocklytics.com, AI startups accounted for nearly 58% of global VC investments in Q1 2025, a dramatic increase from the same period in the previous year. This shift signifies a growing recognition of AI’s transformative potential across industries.

The momentum from Q1 carried into Q2, setting 2025 on track to outperform previous years. With a massive $32.9 billion raised in less than five months, the AI sector is poised to break its previous funding records, despite a challenging investment environment.

Comparing AI to Other Sectors

AI startups have clearly outpaced other high-growth sectors in terms of VC investments this year. The $32.9 billion raised by AI companies in 2025 is 2.5 times more than fintech startups, which have secured $12.7 billion. IT startups have raised $6.4 billion, while biotech companies have raised $11 billion. The disparity becomes even more evident when comparing AI to other sectors like cryptocurrency and cybersecurity, which have raised significantly less at $2 billion and $4.2 billion, respectively.

This dramatic investment growth in the AI sector is part of a broader trend. As of 2025, total funding in AI startups has surpassed $310 billion, with 80% of this amount ($244 billion) raised over the past five years. The acceleration of funding reflects a strong belief in AI's potential to disrupt industries, enhance business capabilities, and create new opportunities across various markets.

Share this

Himani Verma

Content Contributor

Himani Verma is a seasoned content writer and SEO expert, with experience in digital media. She has held various senior writing positions at enterprises like CloudTDMS (Synthetic Data Factory), Barrownz Group, and ATZA. Himani has also been Editorial Writer at Hindustan Time, a leading Indian English language news platform. She excels in content creation, proofreading, and editing, ensuring that every piece is polished and impactful. Her expertise in crafting SEO-friendly content for multiple verticals of businesses, including technology, healthcare, finance, sports, innovation, and more.

previous

Selling Your Mineral Rights in Oklahoma: Key Factors to Consider Before Making a Decision

next

What’s the Average Settlement for a Slip and Fall in California?