business resources

Capital and Computing Power Become the New Battleground in AI

20 Feb 2026, 5:13 pm GMT

Anthropic closed its G-series investment round, raising $30 billion and bringing its valuation to $380 billion, more than double its previous valuation. The round was led by Singapore's GIC Fund and Coatue, and among the investors are Peter Thiel's Founders Fund, Accel, General Catalyst, and Qatar Investment Authority. According to Chief Financial Officer Krishna Rao, the scale of the capital raised reflects the steady growth in corporate demand for Claude models, which are increasingly integrated into everyday work processes. The funds are planned to be used for the development of corporate products and further scaling of the infrastructure.

The attraction of such a large sum comes amid increased competition with OpenAI, which is also preparing a new large-scale financing round of up to $100 billion. If successfully completed, the company's valuation could approach $830 billion, underscoring the growing concentration of capital around several leading AI model developers. Thus, the struggle is unfolding not only for technological leadership but also for financial stability, which enables investment in computing power and their own ecosystems.

At the same time, markets are reassessing the risks of the AI boom, as tools intended to enhance productivity may also disrupt existing business models, and expenditures may not generate the anticipated revenue. Uncertainty over the balance between potential gains and losses has weighed on indices and derivatives, resulting in a recent decline in NASDAQ and S&P 500 futures.

Currency dynamics remain an additional factor that investors inevitably consider when evaluating large-scale financing rounds. For international funds participating in the transaction, fluctuations in the EUR USD exchange rate can affect both the real return on investment and the cost of raised capital when converting funds. With European and Middle Eastern investors reportedly involved in Anthropic’s funding, the currency factor is becoming another element of the financial strategy, especially amid high volatility in global markets and rising U.S. interest rates.

In parallel, OpenAI demonstrates a strategy to diversify its hardware base. The company introduced the GPT-5.3-Codex-Spark model, a faster and lighter version of Codex for programming tasks, which became the first OpenAI model powered by the Wafer Scale Engine 3 accelerators from Cerebras Systems. Earlier, OpenAI entered into an agreement worth more than $10 billion to use Cerebras' equipment for model training, expanding the range of computing resource providers.

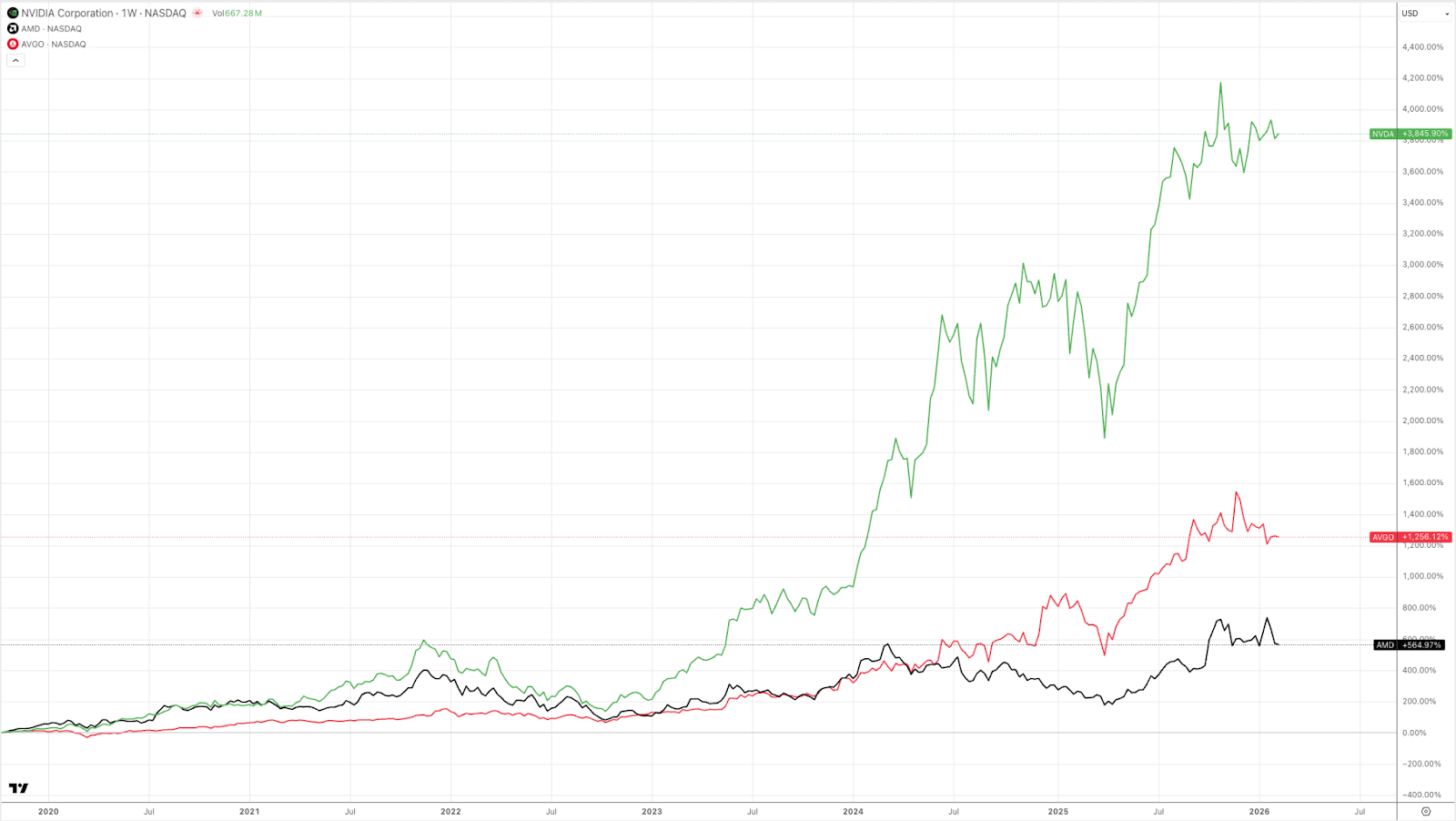

At the same time, cooperation with Nvidia remains a core element of OpenAI's infrastructure. Despite reports of tension, both sides publicly reaffirm their commitment to partnership. Additionally, OpenAI entered into agreements with AMD to build an AI infrastructure with a capacity of 6 GW and to supply specialized chips and network components from Broadcom. This collaboration model reduces dependence on a single supplier and enables more flexible scaling of AI model training and outputs.

As a result, a new market configuration is being formed. The largest AI developers compete simultaneously for capital, computing power, and corporate clients. The Anthropic round strengthens its position in the fight for market share, while OpenAI's hardware strategy aims to build a more diversified and sustainable infrastructure. In the short term, this means a further acceleration of the investment race, and in the long term, an increase in entry barriers for new players without comparable financial and technological resources.

Share this

Peyman Khosravani

Industry Expert & Contributor

Peyman Khosravani is a global blockchain and digital transformation expert with a passion for marketing, futuristic ideas, analytics insights, startup businesses, and effective communications. He has extensive experience in blockchain and DeFi projects and is committed to using technology to bring justice and fairness to society and promote freedom. Peyman has worked with international organisations to improve digital transformation strategies and data-gathering strategies that help identify customer touchpoints and sources of data that tell the story of what is happening. With his expertise in blockchain, digital transformation, marketing, analytics insights, startup businesses, and effective communications, Peyman is dedicated to helping businesses succeed in the digital age. He believes that technology can be used as a tool for positive change in the world.

previous

What Are the Best Security Games to Master Cybersecurity?

next

Why Domestic Family Violence Lawyers Matter in Abuse Cases