business resources

Cross-Border European Deals Drive Growth in Private Credit Market

29 May 2025, 10:24 am GMT+1

Cross-Border European Deals Drive Growth in Private Credit Market

Cross-border direct lending deals are driving strong growth in Europe’s private credit market, with 90% of professionals noting increases. The UK and Ireland lead in loan volume, and technology is the fastest-growing sector. Key drivers include rising capital demand, falling interest rates, and reduced bank lending. Private equity increasingly relies on private credit for M&A.

New research from Nordic Trustee, part of global capital markets provider Ocorian, shows that cross-border deals in Europe are helping private credit grow strongly compared to last year and the previous three years. About 90% of private credit professionals surveyed across the UK & Ireland, Germany, Switzerland, Benelux, the Nordics, and Eastern Europe say cross-border direct lending deals are increasing, with 37% saying they are increasing a lot.

The original study, done in March, included professionals working in private credit, debt fund management, private debt investing, private equity, companies using private credit for funding, and debt advisory firms. They are all expecting strong growth this year. The study was repeated a few weeks after “liberation day” to check if recent market changes had affected growth expectations.

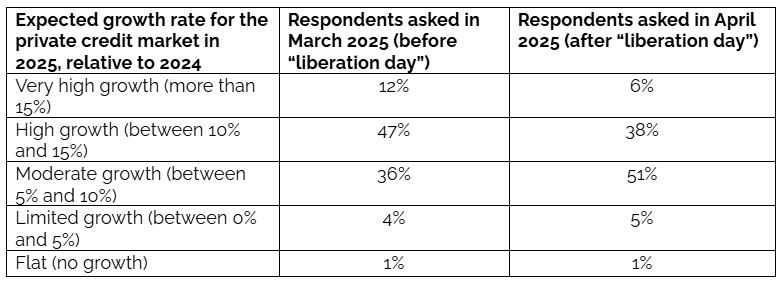

Surprisingly, private credit investors do not seem very worried. Before “liberation day,” respondents expected 11% growth this year. After the market unrest, their expectation dropped slightly to 9.9% for 2025.

In March, 59% of people expected high growth between 10% and 15%, or very high growth above 15% this year. But in April, only 44% expected that. Instead, over half (51%) of those asked in April expected moderate growth compared to 2024.

Sectoral and regional growth trends

The technology sector is projected to experience the highest growth in direct lending in Europe over the next three to five years, ahead of real estate, energy and renewables, infrastructure, and healthcare. Geographically, the UK and Ireland rank highest in expected volume of new private credit loans in the next 12 months, followed by the DACH region (Germany, Austria, Switzerland), Benelux, and the Nordics. Italy, Spain, and Portugal are forecasted to see lower growth.

Key drivers behind growth

The main factors propelling the growth of direct lending include increased demand for capital, falling interest rates, and a reduced appetite from traditional banks coupled with uncompetitive terms. Other contributors include heightened M&A activity, regulatory changes, and a more competitive approach from private credit lenders. Notably, private equity’s reliance on private credit for leveraged buyouts and acquisitions is expected to increase, with 83% of respondents recognising this trend.

Cato Holmsen, CEO at Nordic Trustee, comments:

“Cross-border direct lending deals are becoming increasingly important in Europe and that is highlighted by our study, which forecasts strong growth this year compared with last year. While tariff wars have ratcheted up and de-escalated, stock and bond markets have corrected and rebounded, and forecasts for economic growth have changed with dizzying speed, the private credit market has stoically looked beyond all this turmoil.

The key drivers of direct lending growth over the next three to five years are expected to be rising demand for private capital and falling interest rates as well as traditional banks not competing or wanting to compete.

Growing use by private equity of private credit to fund M&A and buyouts is also making a major contribution highlighting the need for expertise and experience in the market.”

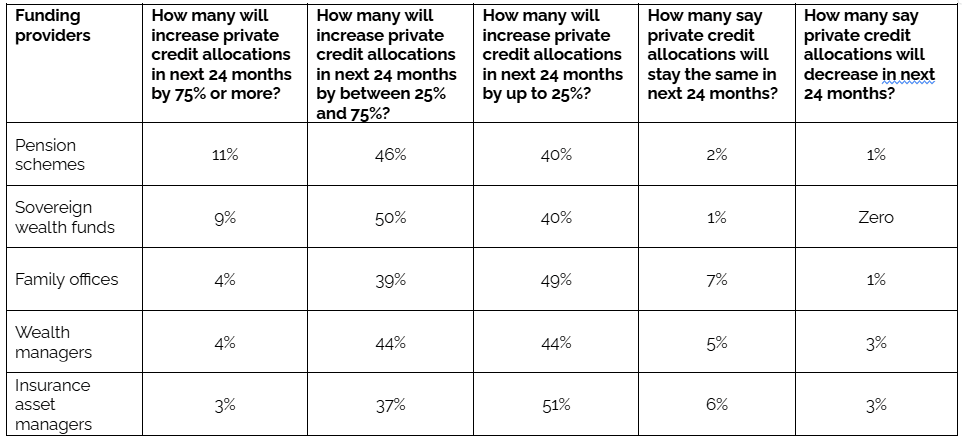

Increasing private credit allocations across funding providers

The research also indicates that various funding providers plan to increase their allocations to private credit significantly over the next two years. Pension schemes and sovereign wealth funds lead the way, with 11% and 9% respectively expecting to raise allocations by 75% or more. Family offices, wealth managers, and insurance asset managers also anticipate growth in private credit exposure.

About Nordic Trustee

Nordic Trustee is a leading and experienced provider of bond trustee and loan agency services in the Nordic region. It manages over 3,000 active assignments in non-bank lending for more than 850 issuers and lenders from 30 countries. Nordic Trustee also supplies high-quality bond market data through its subsidiaries Stamdata and Nordic Bond Pricing. This data includes detailed information on Nordic debt securities issued by the public sector, financial institutions, and companies. Since October 2021, Nordic Trustee has been part of the Ocorian group.

About Ocorian

Ocorian is a global leader in fund services, corporate and trust services, capital markets, and regulatory support. It focuses on creating new value for clients across different countries and services. Ocorian manages over 17,000 structures for more than 8,000 clients, including financial institutions, large international organisations, and wealthy individuals.

The company offers fully compliant, tailored solutions that meet each client’s specific needs, regardless of where they hold financial interests or how they are organised. Ocorian provides a full range of corporate, fund, and private client services through offices located in major financial centres worldwide. These include Bermuda, BVI, Cayman Islands, Denmark, Finland, Germany, Guernsey, Hong Kong, Ireland, Isle of Man, Jersey, Luxembourg, Mauritius, Netherlands, Norway, Singapore, Sweden, UAE, the UK, and the US.

Share this

Himani Verma

Content Contributor

Himani Verma is a seasoned content writer and SEO expert, with experience in digital media. She has held various senior writing positions at enterprises like CloudTDMS (Synthetic Data Factory), Barrownz Group, and ATZA. Himani has also been Editorial Writer at Hindustan Time, a leading Indian English language news platform. She excels in content creation, proofreading, and editing, ensuring that every piece is polished and impactful. Her expertise in crafting SEO-friendly content for multiple verticals of businesses, including technology, healthcare, finance, sports, innovation, and more.

previous

The Importance of Search Engine Optimization for Small Businesses

next

Commercial Property Law: What Every Business Should Know