business resources

Cybersecurity Funding Reaches $7.7 Billion in Q1 2025, Signalling Sector Rebound and Investor Confidence

10 Apr 2025, 1:57 pm GMT+1

Cybersecurity Funding Reaches $7.7 Billion in Q1 2025

Cybersecurity funding reaches $7.7 billion in Q1 2025, the highest in three years, marking a 140% year-on-year increase. Despite fewer deals, larger investments dominate, with U.S. companies receiving over 70% of funds. Global cybercrime growth drives investor interest, pushing cumulative cybersecurity funding to over $141 billion to date.

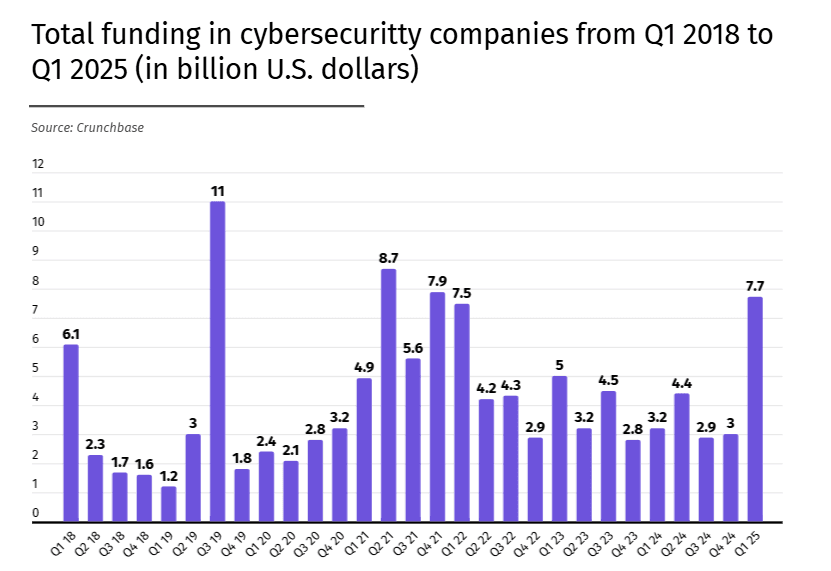

Cybersecurity investment has made a strong return in early 2025, with venture capital funding reaching $7.7 billion in the first quarter—the highest quarterly total in the past three years. The rise marks a renewed vote of confidence from investors as the global demand for cybersecurity solutions continues to grow alongside the rise in digital threats.

According to Stocklytics.com and Crunchbase, the figure represents a 140% increase compared to Q1 2024, when companies raised $3.2 billion. It also stands as the highest Q1 funding amount ever recorded for the sector, ahead of $7.5 billion in Q1 2022 and $6.1 billion in Q1 2018. Only Q4 2021 saw a higher total, at $7.9 billion.

Fewer deals, larger investments

While the total capital raised has risen significantly, the number of funding rounds has declined. In Q1 2025, cybersecurity companies closed 49 deals, down from 59 in the same period last year. This shift indicates that venture capital firms are now concentrating on fewer but larger investments, supporting more mature or scalable companies rather than spreading resources across early-stage startups.

The trend suggests a growing emphasis on backing well-established cybersecurity businesses with proven value propositions. The rising scale and complexity of cyber threats have made robust, enterprise-ready solutions more attractive to investors.

Regional funding highlights and sector outlook

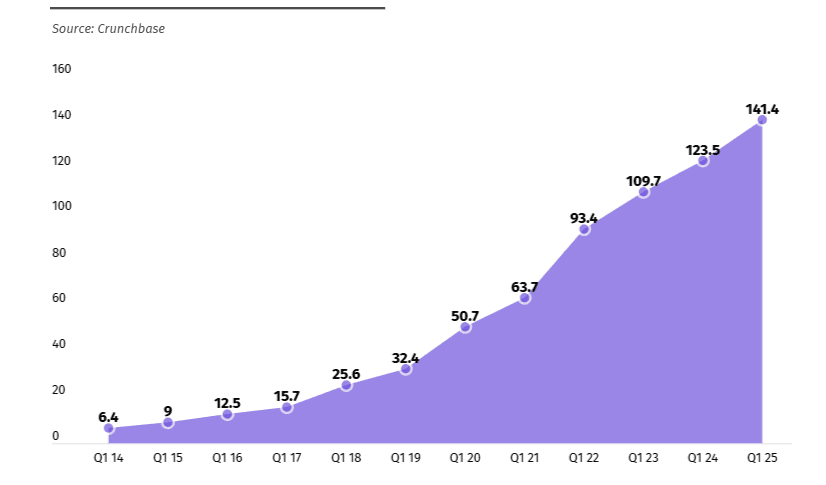

Cumulative cybersecurity funding now surpasses $141 billion globally. Of this, approximately $100 billion has gone to companies in the United States, accounting for more than 70% of the total. California remains the leading hub for cybersecurity investment. European firms have raised $22.8 billion, while Asian companies follow with $14.2 billion.

The strong performance in Q1 positions 2025 to potentially rival the record-breaking levels of 2021. This momentum is driven by the growing urgency to defend against cybercrime, which reached $9.2 trillion in damages in 2024 and is projected to climb to $15.6 trillion by 2030.

Cybersecurity remains a critical focus area in the investment landscape, as companies worldwide face continued digital risk and rising regulatory requirements.

Share this

Himani Verma

Content Contributor

Himani Verma is a seasoned content writer and SEO expert, with experience in digital media. She has held various senior writing positions at enterprises like CloudTDMS (Synthetic Data Factory), Barrownz Group, and ATZA. Himani has also been Editorial Writer at Hindustan Time, a leading Indian English language news platform. She excels in content creation, proofreading, and editing, ensuring that every piece is polished and impactful. Her expertise in crafting SEO-friendly content for multiple verticals of businesses, including technology, healthcare, finance, sports, innovation, and more.

previous

4 Startup Funding Models in the Age of AI: How Founders Are Building Differently in 2025

next

AI Readiness Scorecard To Evaluate Organisational Preparedness For AI Transformation