business resources

Gold Experiences Historic Single-Day Decline

18 Nov 2025, 6:40 pm GMT

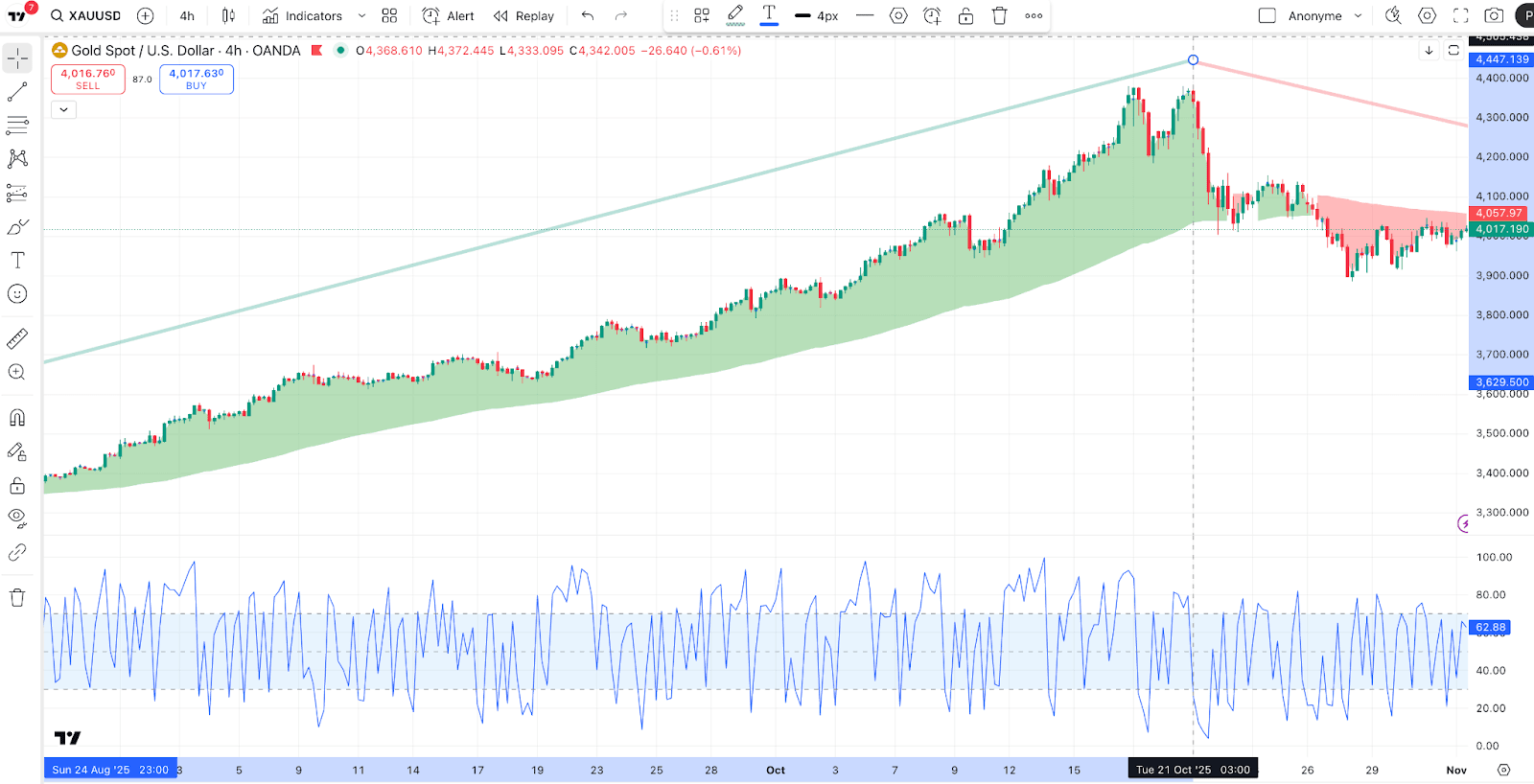

On October 21, 2025, gold experienced one of the most pronounced declines in a single day over the past decade, bringing a record-breaking rally to an abrupt halt. Spot gold prices, according to Business Today, fell to around $4,082 per ounce, reflecting a 6.3% decline, the largest one-day drop since 2013.

There is a consensus among many analysts regarding the reasons for the decline: profit-taking, stronger macroeconomic indicators, and technical factors all played a part.

After months of prolonged price growth fueled by inflation fears and geopolitical uncertainty, the most impatient investors who had benefited from gold’s rally began taking profits, which became one of the major causes of the subsequent drop.

This was due to good news about trade talks between Trump and Xi Jinping, as well as a lessening of global tensions, which made the need for safe-haven assets less urgent. Gold's attractiveness was further diminished by the robust U.S. dollar and increasing real yields.

A stronger dollar pushes gold higher for foreign traders, while rising real interest rates increase the opportunity cost of holding non-yielding assets. These macroeconomic factors influenced the initial adjustments on the XAUUSD chart.

Additionally, technical factors also contributed to the sell-off. MKS PAMP analysts informed the Financial Times that the market had been heavily overbought and vulnerable to a sell-off triggered by automated traders once the essential price points were exceeded.

The majority of experts, however, view the decline not as a structural downturn but a technical correction. The price of gold remained several times higher compared to the same period of the previous year and also benefited from strong buying by central banks.

The incident represents a technical correction rather than a change in fundamental demand. The support for gold’s long-term strength — such as protection against inflation, diversification, and geopolitical risk — remains, even if it is currently overshadowed.

The October flash sale has provided several clear lessons for investors. To start with, no matter how “safe” an asset might be considered, it can still go through a period of extreme volatility. For instance, gold's status as a winner or loser in the game of rapid price swings does not prevent it from serving as a store of value or a portfolio hedge.

Secondly, investors need to match their positions with the investment realities of the promised time and their risk tolerance. The ones who possess gold, believing it will be a long-term hedge against inflation will view the price drop as a temporary phase, whereas short-term traders will see it as a sign of passing momentum.

Thirdly, macroeconomic indicators — such as the US dollar index, bond yields, and global risk appetite — should be monitored closely, as they can cause sudden market movements. The last point is that some experts, including those quoted by Binance Square, believe the downward price movement may present a buying opportunity for investors who recognise the metal’s long-term strengths.

On the other hand, the October 21 sell-off shows how quickly sentiment can shift in today's algorithm-driven markets. Gold remains an essential part of the portfolios and reserves of central banks worldwide, but its reputation as a safe haven should not be mistaken for immunity to price fluctuations.

Share this

Shikha Negi

Content Contributor

Shikha Negi is a Content Writer at ztudium with expertise in writing and proofreading content. Having created more than 500 articles encompassing a diverse range of educational topics, from breaking news to in-depth analysis and long-form content, Shikha has a deep understanding of emerging trends in business, technology (including AI, blockchain, and the metaverse), and societal shifts, As the author at Sarvgyan News, Shikha has demonstrated expertise in crafting engaging and informative content tailored for various audiences, including students, educators, and professionals.

previous

Where Payments And Compliance Meet Customer Lifetime Value

next

B2B Lead Generation for Small Businesses