business resources

Healthcare Sector: 83% of Professionals Say The UK Will Not Be Attractive for Research And Manufacturing After Brexit

8 Sept 2022, 2:35 am GMT+1

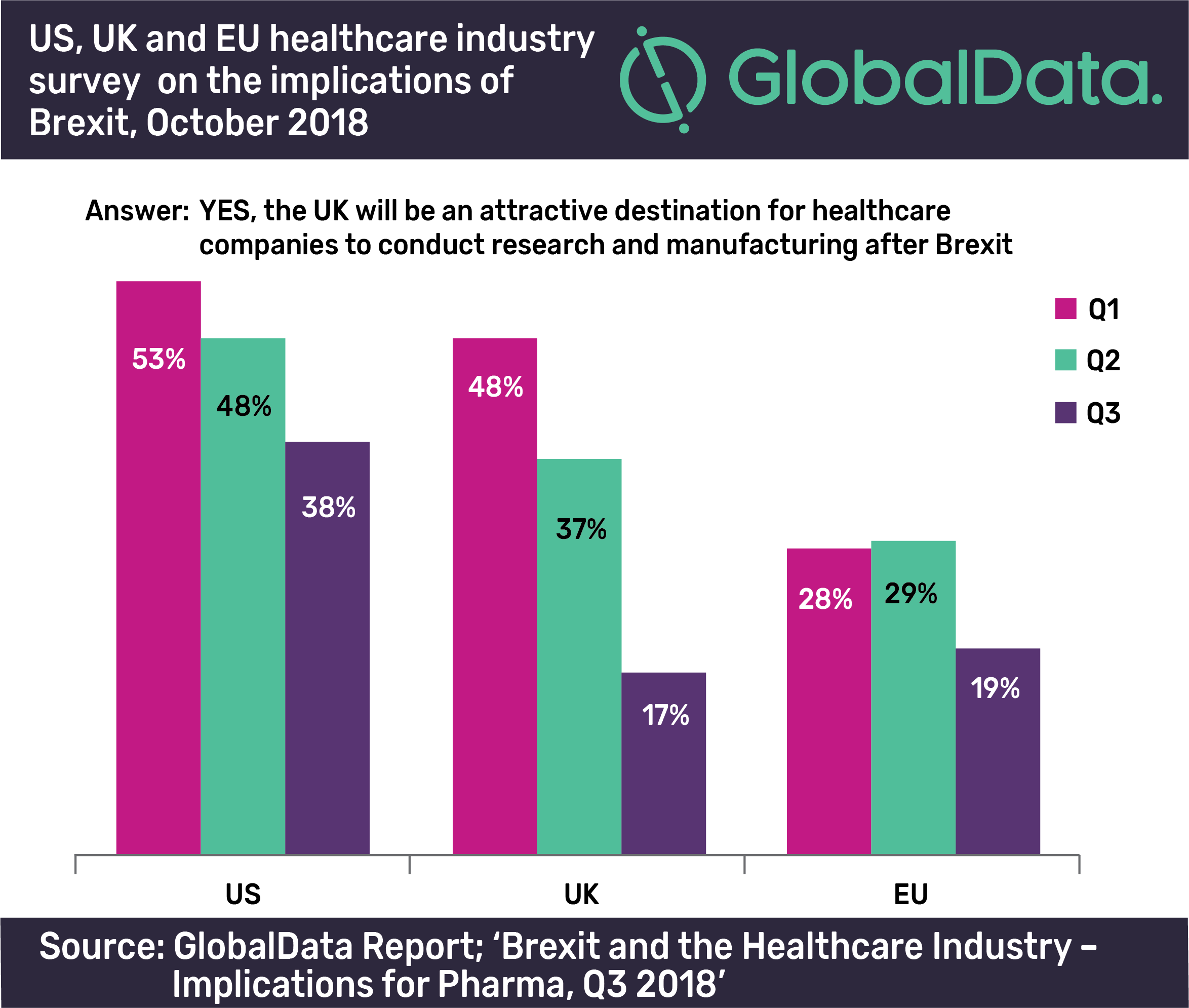

Healthcare industry professionals around the world have confirmed that the UK will not be as attractive a destination for research and manufacturing after Brexit in the latest survey from GlobalData, a leading data and analytics company. GlobalData’s latest report, ‘Brexit and the Healthcare Industry – Implications for Pharma, Q3 2018’, reveals that only 23% of healthcare professionals surveyed across the US, UK, and EU thought that the UK would be an attractive destination for healthcare companies to conduct research and manufacturing after Brexit. However, in the UK confidence has dropped sharply from a high of 48% who said the UK would be an attractive destination in Q1 2018, to a low of 17% who said it would be in the latest Q3 2018 survey. This leaves 83% of UK healthcare professionals who say the country WILL NOT be an attractive destination for healthcare research and manufacturing after Brexit. Alexandra Annis, MS, Managing Healthcare Analyst at GlobalData, commented, “Sentiment on this question has potentially been affected by the considerable amount of negative press associated with Brexit’s likely impact on the healthcare sector over the past three months. Stories such as the NHS requiring drug makers to stockpile drugs in preparation for a 'no-deal' Brexit and pharma companies like Sanofi and Novartis increasing medicine stockpiles, and AstraZeneca halting UK investments over Brexit uncertainties likely played a part in negatively affecting industry professionals confidence in the UK.”

The report is based on a quarterly survey of participants from the pharmaceutical industry, both within and outside the UK, who were asked about the impact of Brexit on the healthcare sector as well as their evolving sentiment towards Brexit.

US, UK and EU healtchare industry survey. Source: GlobalData

US, UK and EU healtchare industry survey. Source: GlobalData

The UK pharmaceutical industry is one of the country’s largest and most dynamic sectors, and a major contributor to the economy. As well as being the home to pharmaceutical giants GlaxoSmithKline and AstraZeneca, many other leading international pharmaceutical companies have sizeable operations in the UK. Annis continues: "The largest difference in attitudes to Brexit is seen in the US when compared to the UK and EU with less than 20% of respondents in the UK and EU viewing the UK as an attractive destination for healthcare research and manufacturing post Brexit, whereas pharma professionals in the US are more optimistic with 38% believing that this will be the case.”

Share this

Contributor

Staff

The team of expert contributors at Businessabc brings together a diverse range of insights and knowledge from various industries, including 4IR technologies like Artificial Intelligence, Digital Twin, Spatial Computing, Smart Cities, and from various aspects of businesses like policy, governance, cybersecurity, and innovation. Committed to delivering high-quality content, our contributors provide in-depth analysis, thought leadership, and the latest trends to keep our readers informed and ahead of the curve. Whether it's business strategy, technology, or market trends, the Businessabc Contributor team is dedicated to offering valuable perspectives that empower professionals and entrepreneurs alike.

previous

Tesco and Volkswagen Launch the UK's Largest Electric Vehicle Charging Network

next

The Lean Product Lifecycle: The Playbook for Making Products People Really Want