business resources

How to Get Financial Help: The Ultimate Guide

22 Jul 2025, 5:19 pm GMT+1

It can feel overwhelming to seek financial guidance and gain clarity on your monetary situation. Indeed, many individuals grapple with determining an appropriate starting point. This guide, however, aims to simplify the process. We'll delve into practical, actionable steps and provide clear, concise advice to enhance your comprehension of your finances, facilitate prudent decision-making, and foster a more secure future. It’s all about equipping you with the requisite tools to assume command of your financial well-being, one measured step at a time.

Key Takeaways

- Understand your current financial picture: Know what's coming in and going out, and where your debts and assets stand.

- Look for ways to boost your income and save more: This could mean earning more or just being smarter with your spending.

- Make a plan to pay down debt: Focus on high-interest debts first and consider options like debt consolidation.

- Think about investing for the long haul: Learn the basics and spread out your investments to help your money grow over time.

- Protect your financial future: This involves things like understanding insurance and planning for your estate.

Understanding Your Current Financial Situation

Before you can even think about improving your finances, it's essential to ascertain your current position. It is akin to planning a road trip without knowing your precise point of origin—you might just end up driving around aimlessly. This section, therefore, is dedicated to obtaining a lucid and comprehensive overview of your existing financial health. Although it may appear slightly daunting, rest assured that it constitutes the most crucial initial step.

Assessing Income and Expenses

Let’s start with the fundamentals: determining exactly how much capital is flowing in and out. This encompasses more than merely your regular paycheck—it embraces all sources of revenue. Do you, perhaps, engage in a side business or receive dividends from investments? Ensure comprehensive inclusion. Subsequently, meticulously track your expenditures. Yes, it may be a somewhat tedious undertaking, but it's nonetheless essential. Leverage a budgeting application, a spreadsheet, or even a simple notebook. The overarching objective is to discern precisely where your funds are being allocated.

Here's a simple example of how you might track your monthly income and expenses:

| Income Source | Amount ($) |

|---|---|

| Salary | 5000 |

| Side Hustle | 500 |

| Investment Dividends | 100 |

| Total Income | 5600 |

| Expense Category | Amount ($) |

|---|---|

| Rent/Mortgage | 1500 |

| Utilities | 200 |

| Groceries | 400 |

| Transportation | 300 |

| Entertainment | 200 |

| Debt Payments | 500 |

| Miscellaneous | 100 |

| Total Expenses | 3200 |

Evaluating Debts and Assets

Now, let’s turn our attention to the subjects of debt and assets. Debt isn't invariably detrimental—consider mortgages or student loans, for instance—but it's paramount to comprehend the extent of your liabilities and their associated costs. Itemize all your debts, including credit cards and loans, and meticulously record the corresponding interest rates and minimum payment obligations. Conversely, create a comprehensive inventory of your assets. Enumerate savings accounts, investments, properties, and any other items of considerable value. Determining your net worth—that is, assets less liabilities—provides a valuable snapshot of your overarching financial standing. For those keen to project potential retirement savings, a Vanguard Investment Calculator can prove to be an invaluable resource.

Identifying Areas for Improvement

Having now established a lucid understanding of your income, expenditures, debts, and assets, it is opportune to identify areas ripe for enhancement. Might you be overspending on non-essential items? Are you encumbered by high-interest debts? Is your savings rate inadequate? Employ absolute candor with yourself. This exercise isn’t about self-recrimination; rather, it aims to uncover opportunities for positive transformation. Perhaps you could curtail dining-out frequency, secure a more economical mobile service plan, or augment contributions to your retirement fund. Remember, even seemingly minor adjustments can compound significantly over extended periods. Those seeking insights into interpreting and leveraging bonds charts will find an abundance of resources readily available.

Understanding your current financial situation is the foundation for building a secure financial future. It allows you to make informed decisions and take control of your money.

Here are some things to consider:

- Are you living within your means?

- Are you prepared for unexpected expenses?

- Are you on track to meet your long-term financial goals?

Maximizing Income and Savings Opportunities

Let's explore strategies for augmenting your income and optimizing your savings. This section is dedicated to boosting your earnings and discovering avenues for accumulating additional capital. While it may not invariably be effortless, the deployment of appropriate strategies can undoubtedly enhance your overall financial position. So, without further ado, let us commence.

Increasing Earning Potential

So, just how does one effectively augment their income? One viable avenue involves requesting a remuneration increase from your current employer. Diligently conduct thorough research, meticulously document your professional accomplishments, and construct a compelling rationale substantiating your entitlement to elevated compensation. Should this avenue prove infeasible, consider actively pursuing more remunerative employment opportunities. Revise and update your curriculum vitae, proactively engage in networking activities, and submit applications for positions commensurate with your proficiencies and professional experience.

Another viable alternative involves exploring supplementary income streams, such as engaging in freelance work or establishing a side business. Indeed, a plethora of opportunities abound, ranging from providing transportation services through ride-sharing platforms to offering specialized expertise as a consultant. The principal objective is to identify an endeavor that you find personally gratifying and that concurrently generates incremental income. Do consider romantic and stress-free car hire if your side hustle involves transportation.

Implementing Effective Budgeting Strategies

Effective budgeting is indispensable for prudent financial management. Initiate the process by meticulously tracking both your income and expenditures. Numerous applications and software tools exist to facilitate this process. Once you possess a comprehensive understanding of your cash flows, you can commence making judicious adjustments. Identify domains wherein expenditure reductions can be implemented, such as dining at external establishments or engaging in discretionary entertainment activities.

A well-structured budget is the cornerstone of financial stability.

Here's a simple example of how to categorize your expenses:

| Category | Example Expenses | Percentage of Income |

|---|---|---|

| Housing | Rent, mortgage, property taxes | 30% |

| Transportation | Car payments, gas, public transit | 15% |

| Food | Groceries, dining out | 15% |

| Utilities | Electricity, water, gas | 5% |

| Savings/Debt | Emergency fund, debt repayment | 20% |

| Discretionary | Entertainment, hobbies | 15% |

Creating a budget is not about restricting yourself; it's about making informed choices about where your money goes. It's about aligning your spending with your values and goals.

Building an Emergency Fund

An emergency fund represents a dedicated savings account earmarked for covering unforeseen or exigent expenses—for example, unanticipated medical bills or automobile repairs. Ideally, the quantum of such a fund should approximate three to six months' worth of customary living expenses. While this may initially appear to be a substantial amount, its existence provides a critical financial buffer, particularly in situations involving involuntary job loss or other exigencies. Initiate the process with modest contributions, and gradually augment the savings balance over time. Indeed, even increasing your retirement savings contributions can help.

Here are some tips for building an emergency fund:

- Set a savings goal.

- Automate your savings.

- Cut back on unnecessary expenses.

- Consider a high-yield savings account.

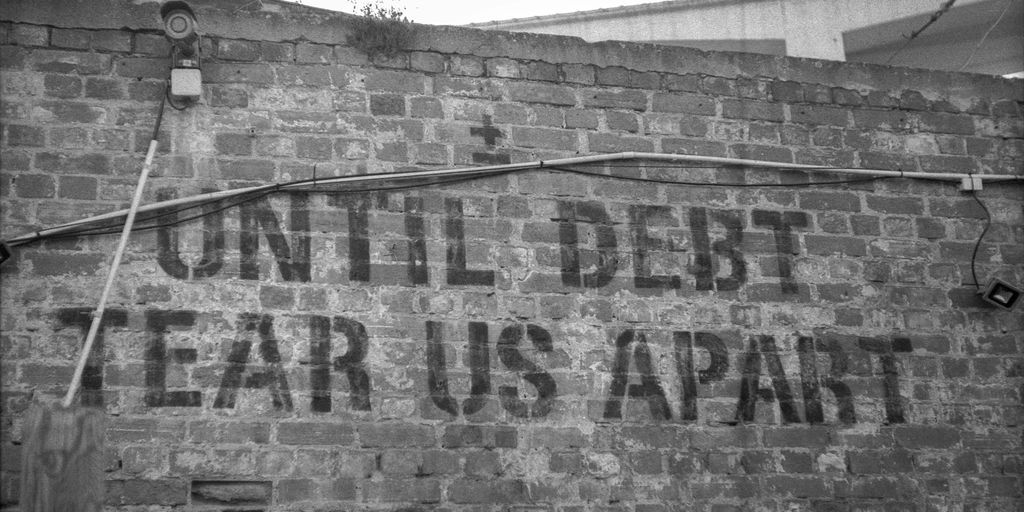

Strategizing Debt Elimination

Debt, as many know, can be a significant impediment, hindering one's progress toward achieving optimal financial well-being. Therefore, the implementation of a well-defined and meticulously crafted debt management strategy is paramount to attaining financial autonomy. Let's explore some effective methodologies for strategically addressing and mitigating debt burdens.

Prioritizing High-Interest Debts

The first step in any debt elimination strategy is to identify and prioritize debts based on their interest rates. High-interest debts, such as credit card balances and payday loans, should be your primary focus. These debts erode your financial resources quickly due to the compounding effect of interest. Consider the following:

- List all your debts, including the outstanding balance, interest rate, and minimum monthly payment.

- Calculate the total interest you will pay over the life of each debt if you only make minimum payments. This can be an eye-opening exercise.

- Focus on paying off the debt with the highest interest rate first, while making minimum payments on all other debts. This approach, known as the debt avalanche method, minimizes the total interest paid over time. If you have more than one high-interest debt, this is the way to go.

Paying off high-interest debt is like plugging a hole in a sinking ship. The sooner you address these debts, the more money you save and the faster you progress toward financial stability.

Exploring Debt Consolidation Options

Debt consolidation entails amalgamating multiple distinct debts into a singular, unified loan instrument, often characterized by a reduced interest rate and more advantageous repayment conditions. This strategic maneuver can streamline personal financial management practices and potentially yield considerable cost savings. Common debt consolidation options include:

- Balance Transfer Credit Cards: These cards offer a promotional period with a low or zero percent interest rate on transferred balances. This can be a great way to pause interest accrual and aggressively pay down your debt. Be mindful of balance transfer fees and the interest rate after the promotional period ends.

- Personal Loans: Unsecured personal loans can be used to consolidate various types of debt, such as credit cards, medical bills, and student loans. Interest rates on personal loans are typically fixed, providing predictable monthly payments.

- Home Equity Loans or HELOCs: If you own a home, you may be able to borrow against your home equity to consolidate debt. However, be cautious when using your home as collateral, as you risk foreclosure if you cannot repay the loan.

Developing a Debt Repayment Plan

Once you have prioritized your debts and explored consolidation options, it's time to create a detailed debt repayment plan. This plan should outline how you will allocate your resources to pay down your debts as quickly and efficiently as possible. Consider these strategies:

- The Debt Snowball Method: This method involves paying off the smallest debt first, regardless of its interest rate. This provides a quick win and motivates you to continue paying off your debts. As each debt is paid off, you roll the payment amount into the next smallest debt, creating a snowball effect.

- The Debt Avalanche Method: As mentioned earlier, this method focuses on paying off the debt with the highest interest rate first. This minimizes the total interest paid over time and is the most mathematically efficient approach. It's important to eliminate debt strategically.

- Budgeting and Expense Tracking: A detailed budget is essential for identifying areas where you can cut expenses and allocate more funds to debt repayment. Track your spending carefully and look for opportunities to reduce discretionary expenses, such as dining out, entertainment, and subscription services.

| Strategy | Description <th>

789951297643654654:43 1

Investing for Long-Term Growth

Investing is not the exclusive domain of the affluent; rather, it is an instrument accessible to all, facilitating the construction of a more robust and secure future. It involves strategically employing your capital to generate returns and merits consideration irrespective of one's prevailing income stratum. Let us explore salient dimensions of long-term investment strategies.

Understanding Investment Basics

Prior to embarking on any investment endeavor, it behooves one to acquire a fundamental comprehension of core concepts. What, precisely, are stocks? What constitutes a bond? What delineates a mutual fund from an Exchange Traded Fund (ETF)? These represent pivotal questions warranting elucidation. Comprehending the diverse array of investment vehicles and their attendant risk profiles constitutes a critical preliminary step. While it is not imperative to attain instantaneous mastery, a modicum of knowledge can yield substantial benefits. For instance, long-only equity strategies may present an auspicious point of inception for nascent investors.

- Risk Tolerance: How comfortable are you with the possibility of losing money? Different investments carry different levels of risk.

- Time Horizon: How long do you have until you need the money? A longer time horizon allows you to take on more risk.

- Investment Goals: What are you saving for? Retirement? A down payment on a house? Your goals will influence your investment choices.

Diversifying Investment Portfolios

Prudent investment management dictates against the concentration of assets within a single vehicle. Diversification constitutes a pivotal strategy for mitigating potential risks. By strategically allocating investments across a spectrum of asset classes, industries, and geographic regions, one can effectively attenuate the impact of underperformance exhibited by any solitary investment. Give thought to incorporating a heterogeneous admixture of stocks, bonds, and other asset categories within your portfolio. One might also consider investigating growth-oriented public equity funds.

Here's a simple example of how diversification might look:

| Asset Class | Percentage of Portfolio |

|---|---|

| Stocks | 60% |

| Bonds | 30% |

| Real Estate | 10% |

Planning for Retirement

Though retirement may seem a distant prospect, it is never premature to commence planning. Capitalize on employer-sponsored retirement programs, such as 401(k) plans, particularly when employers offer matching contributions. Explore the potential of establishing an Individual Retirement Account (IRA) to augment your retirement savings. The exponential power of compounding can operate advantageously over extended time horizons.

Retirement planning involves estimating your future expenses, determining how much you need to save, and choosing investments that will help you reach your goals. It's a process that requires careful consideration and ongoing adjustments as your circumstances change.

- Estimate your retirement expenses: Consider housing, healthcare, food, travel, and other costs.

- Determine your retirement income sources: Social Security, pensions, and investment income.

- Calculate the gap: The difference between your expenses and income sources. This is how much you need to save.

Protecting Your Financial Future

Financial stewardship transcends mere wealth accumulation; it encompasses safeguarding and securing assets for enduring stability. This section accentuates strategies designed to shield assets and ensure financial resilience against unforeseen exigencies. Consider it the construction of an impenetrable fortification enveloping your financial well-being.

Understanding Insurance Needs

Insurance constitutes a keystone element of financial protection, functioning as a safety mechanism against potential losses arising from unforeseen occurrences. The paramount imperative resides in evaluating your individualized risk exposures and electing insurance policies that furnish adequate coverage without imposing undue financial strain. Consider the subsequent insurance categories:

- Health Insurance: Covers medical expenses, protecting you from potentially devastating healthcare costs.

- Life Insurance: Provides financial support to your beneficiaries in the event of your death. Term life insurance is often more affordable than whole life.

- Disability Insurance: Replaces a portion of your income if you become unable to work due to illness or injury.

- Property Insurance: Protects your home and belongings from damage or loss due to fire, theft, or other covered perils.

Regularly review your insurance policies to ensure they still meet your needs. Life changes, such as marriage, children, or a new home, may require adjustments to your coverage.

Estate Planning Essentials

Estate planning encompasses the premeditated formulation of arrangements governing the administration and dispensation of one's assets post-mortem. It transcends mere applicability to the affluent, extending to all individuals desirous of ensuring the execution of their directives and the sustained welfare of their dependents. Here’s a succinct synopsis:

- Will: A legal document that specifies how your assets should be distributed.

- Trust: A legal arrangement that allows you to transfer assets to a trustee, who manages them for the benefit of your beneficiaries.

- Power of Attorney: Grants someone the authority to act on your behalf if you become incapacitated. You can find more information about estate planning online.

Safeguarding Against Financial Scams

Financial scams are becoming increasingly sophisticated, and it's important to be vigilant. Scammers often target vulnerable individuals, preying on their fears or desires. Here are some tips to protect yourself:

- Be wary of unsolicited offers or requests for money, especially if they come with high-pressure tactics.

- Never give out personal information, such as your Social Security number or bank account details, unless you're absolutely sure you're dealing with a legitimate organization. You can learn more about cryptocurrency investment online.

- Do your research before investing in anything. Check out the company or individual with the Better Business Bureau or other consumer protection agencies.

- If something sounds too good to be true, it probably is. Always trust your gut instinct. If you suspect you've been targeted by a scam, report it to the Federal Trade Commission (FTC) immediately.

| Scam Type | Description <th>

789951297643654654:43 1

Seeking Professional Financial Guidance

Sometimes, despite our best efforts, navigating the complexities of personal finance can feel overwhelming. That's where professional financial guidance comes in. Knowing when and how to seek help from a financial expert can make a big difference in achieving your financial goals. It's not about admitting defeat; it's about recognizing the value of specialized knowledge.

When to Consult a Financial Advisor

There are several situations where seeking advice from a financial advisor is particularly beneficial:

- Major Life Changes: Events like marriage, divorce, having children, or a significant career change can drastically alter your financial landscape. A financial advisor can help you adjust your financial plan accordingly.

- Complex Financial Situations: If you have a high net worth, multiple investment accounts, or complex tax situations, a financial advisor can provide tailored strategies to manage your assets effectively.

- Lack of Time or Expertise: If you simply don't have the time or interest to manage your finances, a financial advisor can take the burden off your shoulders and ensure your investments are aligned with your goals.

- Retirement Planning: Planning for retirement involves many factors, such as estimating expenses, determining withdrawal rates, and managing investment risk. A financial advisor can help you create a comprehensive retirement plan that meets your needs.

Choosing the Right Financial Professional

Selecting the right financial professional is a critical step. Not all advisors are created equal, and it's important to find someone who is qualified, trustworthy, and aligned with your values. Here are some factors to consider:

- Credentials and Qualifications: Look for advisors who hold relevant certifications, such as Certified Financial Planner (CFP), Chartered Financial Analyst (CFA), or Chartered Financial Consultant (ChFC). These designations indicate that the advisor has met certain educational and ethical standards.

- Fee Structure: Understand how the advisor is compensated. Some advisors charge a fee based on the assets they manage (AUM), while others charge an hourly rate or a commission on the products they sell. Choose a fee structure that is transparent and aligns with your interests.

- Experience and Expertise: Consider the advisor's experience and expertise in areas that are relevant to your needs. For example, if you're interested in retirement planning, look for an advisor who specializes in that area.

- References and Reviews: Ask for references from current or former clients, and check online reviews to get a sense of the advisor's reputation.

Benefits of Professional Financial Planning

Professional financial planning offers numerous benefits that can significantly improve your financial well-being. A good advisor can help you:

- Develop a Comprehensive Financial Plan: A financial plan provides a roadmap for achieving your financial goals, taking into account your income, expenses, assets, and liabilities.

- Make Informed Investment Decisions: A financial advisor can help you understand different investment options and create a portfolio that is aligned with your risk tolerance and time horizon.

- Minimize Taxes: A financial advisor can help you identify tax-saving strategies and ensure you are taking advantage of all available deductions and credits.

- Stay on Track: A financial advisor can provide ongoing support and guidance to help you stay on track with your financial goals, even when faced with unexpected challenges.

Seeking professional financial guidance is an investment in your future. While it may involve some upfront costs, the long-term benefits can far outweigh the expenses. A qualified financial advisor can provide the expertise and support you need to achieve your financial goals and secure your financial future. Don't hesitate to reach out for help when you need it – your financial well-being is worth it.

Consider exploring brokerage accounts to manage your investments effectively. If you need immediate assistance, E*TRADE offers 24/7 phone support.

Maintaining Financial Discipline

It's easy to get excited when you start seeing progress with your finances. But the real key is sticking with it for the long haul. It's about building habits that will keep you on track, even when things get tough or when you're tempted to splurge. Let's look at how to make financial discipline a part of your life.

Regular Financial Reviews

Consider this a routine health check for your finances. Dedicate time each month to thoroughly examine your income, expenditures, debts, and investment portfolios. Are you adhering to your budgetary constraints? Are your investments yielding anticipated returns? This presents an invaluable opportunity to proactively identify potential challenges and effectuate requisite adjustments. While I personally favor a straightforward spreadsheet-based approach, an abundance of alternative applications are available to provide supplementary assistance. Regularly reviewing your financial situation financial situation helps you stay informed and in control.

Adapting to Changing Financial Landscapes

Life invariably presents unforeseen circumstances. You might, for instance, experience involuntary job displacement or, conversely, receive an unexpected remuneration increase. Furthermore, equity markets may undergo precipitous declines, while interest rates may be subject to upward adjustments. Consequently, it is imperative that your overarching financial strategy possesses sufficient adaptability to accommodate such dynamic vicissitudes. Accordingly, do not hesitate to modify your budgetary allocations, investment strategies, or debt repayment schemas as necessitated by prevailing conditions. The primary objective remains consistent, namely, maintaining adherence to your protracted financial goals even amidst environmental fluctuations.

It's important to remember that financial discipline isn't about depriving yourself. It's about making smart choices that allow you to enjoy your money now while still building a secure future. It's a balancing act, and it takes practice.

Continuous Financial Education

The domain of finance is perpetually in a state of flux. Novel investment instruments are routinely introduced, modifications are enacted to extant taxation statutes, and broader economic trends are subject to constant recalibration. To maintain a position of perspicacity and control, one must engage in perpetual learning. Peruse pertinent books, meticulously monitor authoritative financial blogs, subscribe to illuminating podcasts, or enroll in relevant online curricula. The profundity of one’s financial literacy will invariably correlate with an enhanced capacity to make astute and judicious financial decisions. Staying encouraged by peers encouraged by peers can also help you stay motivated and on track.

Conclusion

Gaining financial proficiency constitutes a protracted journey—not merely a fleeting expedition. It necessitates deliberate contemplation, steadfast adherence to established strategies, and unwavering commitment over extended temporal horizons. By diligently cultivating a comprehensive comprehension of one's prevailing financial circumstances, formulating an efficacious budgetary regimen, systematically discharging outstanding indebtedness, prudently allocating capital toward judicious investments, and meticulously planning for future retirement, one can effectively construct a formidable foundation conducive to the realization of a secure and prosperous financial trajectory. Consequently, recall that the ultimate realization of financial independence resembles the protracted demands of a marathon rather than the instantaneous exertion of a sprint. Maintain unwavering focus, exhibit judicious patience, and persistently endeavor toward the attainment of designated objectives. Ultimately, the tranquility of mind and pervasive security attendant to the attainment of comprehensive financial autonomy will indubitably validate the magnitude of the requisite efforts expended.

Frequently Asked Questions

What does 'financial help' mean?

Financial help refers to various ways to get your money matters in order. It includes learning how to manage your money well, paying off what you owe, saving for the future, and getting advice from money experts.

How do I begin to understand my money situation?

To start, you need to look closely at your money. Figure out how much money you make, what you spend it on, how much you owe, and what you own. This helps you see where you stand and what changes you might need to make.

What are some ways to earn more money and save more?

You can make more money by asking for a raise at work, finding a second job, or starting a small business on the side. You can save more by making a budget and sticking to

Share this

Peyman Khosravani

Industry Expert & Contributor

Peyman Khosravani is a global blockchain and digital transformation expert with a passion for marketing, futuristic ideas, analytics insights, startup businesses, and effective communications. He has extensive experience in blockchain and DeFi projects and is committed to using technology to bring justice and fairness to society and promote freedom. Peyman has worked with international organisations to improve digital transformation strategies and data-gathering strategies that help identify customer touchpoints and sources of data that tell the story of what is happening. With his expertise in blockchain, digital transformation, marketing, analytics insights, startup businesses, and effective communications, Peyman is dedicated to helping businesses succeed in the digital age. He believes that technology can be used as a tool for positive change in the world.

previous

Is It Possible to Get Everyday Protection Without Compromising Flexibility at Worksites?

next

Why Is the Heart Associated with Love?