International Debt-Free Crowdfunding Model Aims To Provide an Alternative To Buy-to- Let Investors

8 Sept 2022, 1:25 am GMT+1

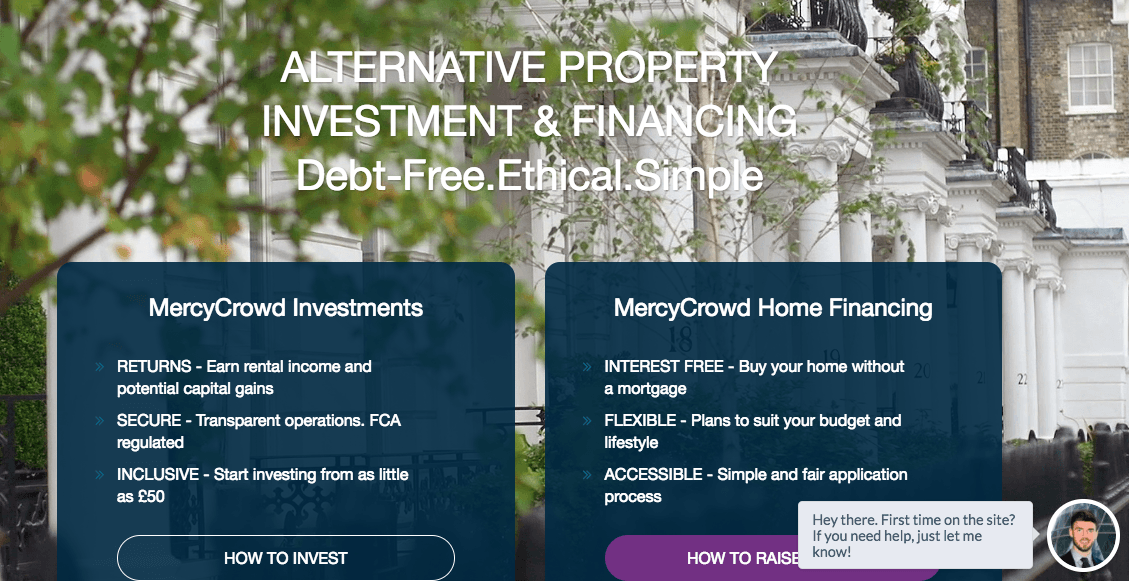

- MercyCrowd launches equity-only offering

- Properties available in Britain, France and Dubai means impressive international asset diversification - with annual returns of up to 7.2%

- Investment from just £50, maximum maturity term of five years

London, 23th October 2017

- Ethical investment platform

has become the first international crowdfunder to enable investment in debt-free buy-to-let properties. MercyCrowd has designed its ‘equity only’ model to help shield investors from negative leverage risk in a flat or falling housing market. Unlike other property crowdfunding platforms, MercyCrowd insists that every deal is 100% debt free. Investors can buy equity in properties across Britain, France and Dubai and realise typical rental returns of between 3.2% and 7.2%

1

. MercyCrowd handles all property management issues including finding tenants, collecting rent, maintenance, and charges - enabling investors to enjoy the benefits of buy-to-let without the administrative burden. As well as rent, investors can also benefit from potential capital appreciation MercyCrowd sources each buy-to-let property and negotiates a price before listing it on the platform for investment. Once the investment target is reached in full, the property is purchased and the process of letting it out begins. Rental returns are paid, proportional to an investor’s equity holding, on a quarterly basis. The investment will typically be sold between three and five years after purchase. MercyCrowd invests its own money in each property, demonstrating that the interests of both the platform and investors are aligned. One property, a £176,750 apartment in Manchester, has already been fully funded, purchased and let out.

screenshot of website

screenshot of website

MercyCrowd founder and CEO Anouar Adham comments:

‘’We are delighted to officially launch MercyCrowd and offer people the chance to realise the benefits of investing in property, without the drawbacks of taking on debt. ‘’By focusing on an international outlook through our diverse selection of properties across Britain, France and Dubai, we believe there is something of potential value for a variety of investors, from a first time investor to those with dozens of assets. ‘’The economy’s continual reliance on debt is concerning, which is why MercyCrowd is an equity-only platform. ‘’Debt-free property ownership is the next big thing and we want to be at the forefront of the trend.’’

Investing in property involves risks, including loss of capital, illiquidity and lack of dividends - it should only be done as part of a diversified portfolio. This type of investment is only for those who understand these risks. Please visit MercyCrowd.com and read our full risk warning before deciding to invest

Read More:

pedrovazpaulo business consulting

pedrovazpaulo real estate investment

.

Share this

previous

UK Businesses Are The Second Biggest Buyer Of Software In The World

next

44% of Americans Would Struggle To Find $400 To Pay For An Emergency, Observes GlobalData