resources

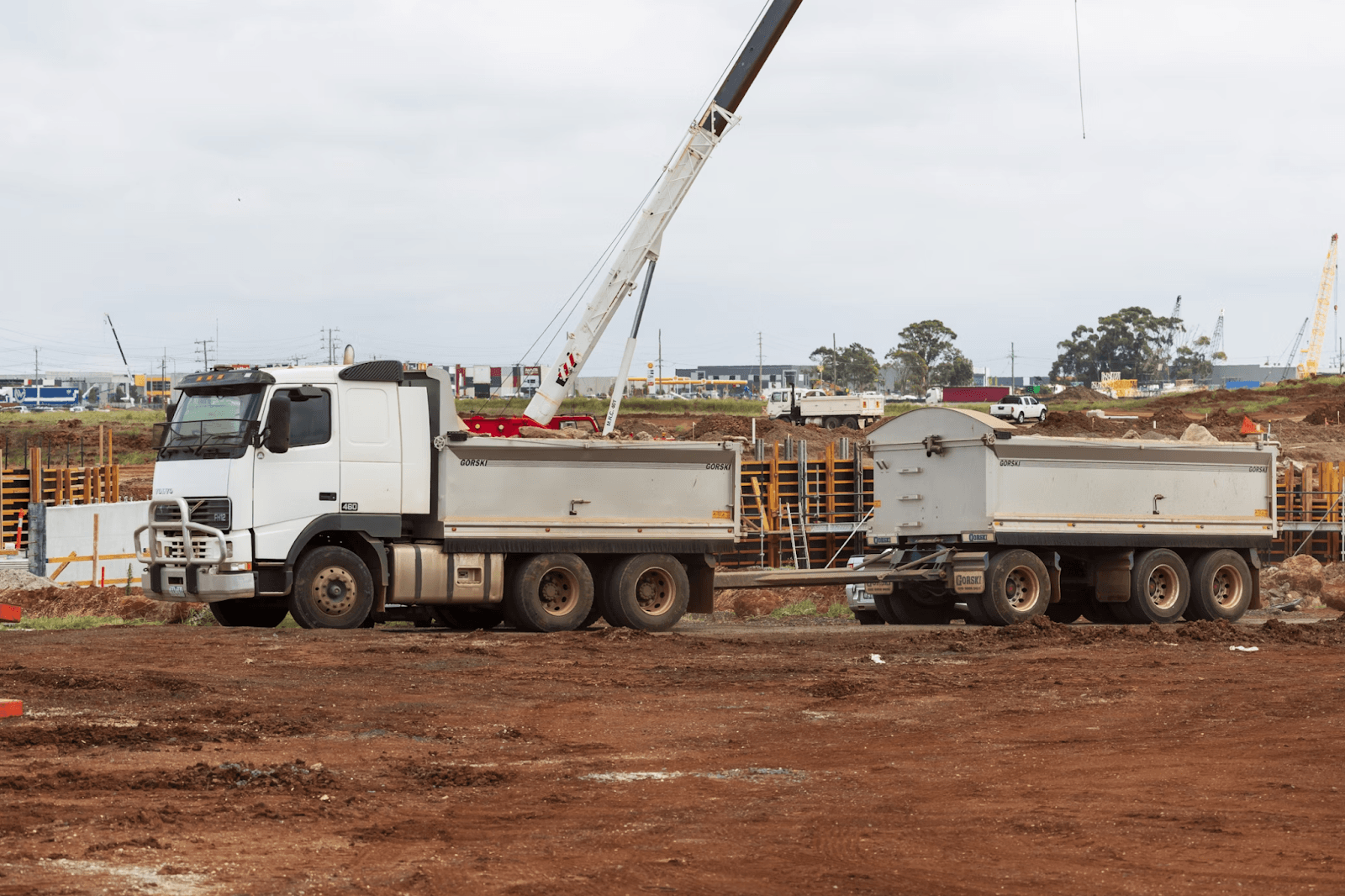

Is Heavy Equipment A Good Investment?

13 Feb 2025, 5:33 pm GMT

Investing in heavy equipment is a strategic move for any construction, agriculture, or mining company. The choice between purchasing and renting heavy equipment involves factors impacting a company's financial health and operational efficiency.

Today, let’s explore the merits and considerations of investing in heavy equipment to determine if it is a beneficial strategy for your business.

Consider Equipment Usage

The frequency and duration of equipment use are critical factors in determining whether to buy or rent. Purchasing may be more cost-effective if the equipment is essential for daily operations and is used extensively. Owning equipment ensures availability and can reduce renting costs over many years. Conversely, renting equipment needed for specific projects or on a seasonal basis, such as telehandler rentals in Phoenix, can be more economical and prevent the issue of underutilization.

Assess Financial Stability

One of the first considerations in deciding whether to invest in heavy equipment is your business's financial stability. Buying heavy equipment requires a substantial upfront capital investment. For businesses with strong financial health and adequate capital, purchasing equipment can be a viable long-term investment that provides value over time.

However, for companies with limited cash flow or still growing, tying up a large amount of capital in heavy machinery might not be the best financial decision.

Evaluate Maintenance Costs

Ownership of heavy equipment also brings maintenance and upkeep responsibilities. While owning equipment allows for complete control over its maintenance and ensures that it can be kept in optimal working condition, these activities require additional budget allocations.

Regular maintenance, repair costs, and the potential need for replacement parts can significantly add to the total cost of ownership. Businesses must be prepared to manage these ongoing expenses.

Analyze Depreciation Impacts

Heavy equipment typically depreciates over time, which can impact the financial valuation of the asset on a company’s books. Depreciation can affect not only the resale value of the equipment but also has tax implications.

While it can provide some tax benefits in the form of depreciation deductions, the decreasing value of the equipment is a considerable factor to consider for long-term investment planning.

Review Market Flexibility

Market conditions can change rapidly, and having the flexibility to adapt is crucial. Owning heavy equipment can restrict a company’s flexibility to adapt swiftly to market shifts.

On the other hand, renting equipment offers more flexibility to adapt to the needs of different projects without the commitment of a significant financial investment. This can be particularly advantageous in industries experiencing rapid technological advancements or varying project demands.

Calculate Long-Term Benefits

Despite the significant upfront cost, the long-term benefits of purchasing heavy equipment can outweigh the initial investment for many businesses. Ownership eliminates rental fees, increases operational readiness, and may provide competitive advantages in project bidding.

Additionally, owning equipment can lead to higher profitability margins when used extensively across many projects and years.

Explore Financing Options

For businesses considering purchasing heavy equipment but are concerned about the financial outlay, financing options such as loans or leasing can provide an alternative to outright purchase.

These options help spread the cost over time and financially make the acquisition more manageable. Leasing, in particular, can offer the benefits of ownership with lower monthly payments, although it may result in higher overall costs in the long term.

Make an Informed Decision

Deciding whether heavy equipment is a good investment requires a thorough analysis of both the immediate financial impact and long-term operational benefits. Each business must consider its unique financial situation, project requirements, and market conditions.

Before deciding whether to buy or rent, it's important to assess key factors like how often the equipment will be used, maintenance costs, depreciation, and flexibility in changing market conditions.

On A Final Note

Heavy equipment can be a good investment if the conditions are right. It requires a strategic approach to decision-making, considering both the financial implications and the business's operational needs. For companies with stable financial footing and consistent use of the equipment, purchasing can offer long-term benefits.

However, renting may be a more prudent choice for businesses facing financial constraints or fluctuating project demands. Ultimately, the decision should align with the company's strategic goals and financial planning.

Read More:

Share this

Contributor

Staff

The team of expert contributors at Businessabc brings together a diverse range of insights and knowledge from various industries, including 4IR technologies like Artificial Intelligence, Digital Twin, Spatial Computing, Smart Cities, and from various aspects of businesses like policy, governance, cybersecurity, and innovation. Committed to delivering high-quality content, our contributors provide in-depth analysis, thought leadership, and the latest trends to keep our readers informed and ahead of the curve. Whether it's business strategy, technology, or market trends, the Businessabc Contributor team is dedicated to offering valuable perspectives that empower professionals and entrepreneurs alike.

previous

Marketing Lessons to Learn from Starbucks' Loyalty Program

next

Maximizing Longevity: The Role of Quality Parts in Routine Vehicle Maintenance