business resources

NVIDIA Reports Record Financial Results for Q4 and Fiscal 2025

28 Feb 2025, 10:01 am GMT

NVIDIA Corporation (NASDAQ: NVDA) has announced its financial results for the fourth quarter and fiscal year 2025, reporting record revenues and significant growth across its key business segments.

The company's revenue for the fourth quarter, which ended on January 26, 2025, reached $39.3 billion, representing a 12% increase from the previous quarter and a 78% rise compared to the same period last year. Full-year revenue for fiscal 2025 amounted to $130.5 billion, marking a 114% growth year-over-year.

Financial highlights

NVIDIA’s strong financial performance is largely attributed to the expansion of its data centre business and the increasing demand for AI computing solutions.

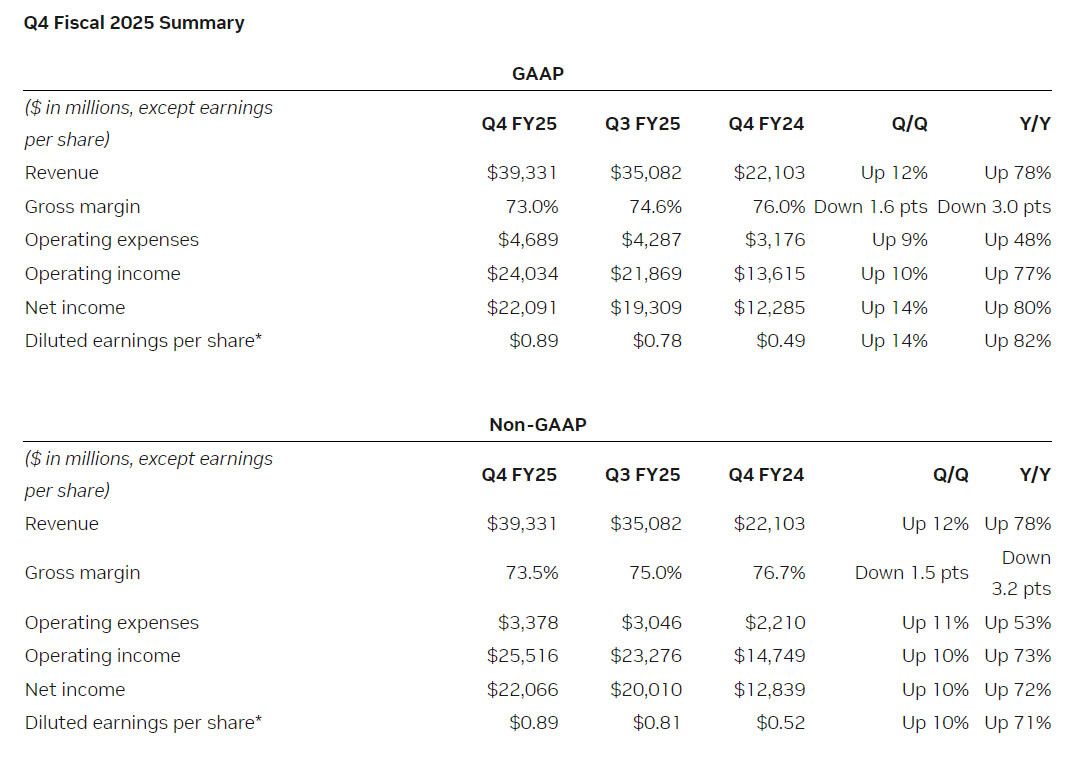

Fourth Quarter Financial Results:

- Revenue: $39.3 billion (up 12% quarter-over-quarter, 78% year-over-year)

- GAAP Gross Margin: 73.0%, down from 76.0% in Q4 FY24

- GAAP Net Income: $22.1 billion (up 14% quarter-over-quarter, 80% year-over-year)

- GAAP Earnings Per Share (EPS): $0.89 (up 14% quarter-over-quarter, 82% year-over-year)

- Non-GAAP EPS: $0.89 (up 10% quarter-over-quarter, 71% year-over-year)

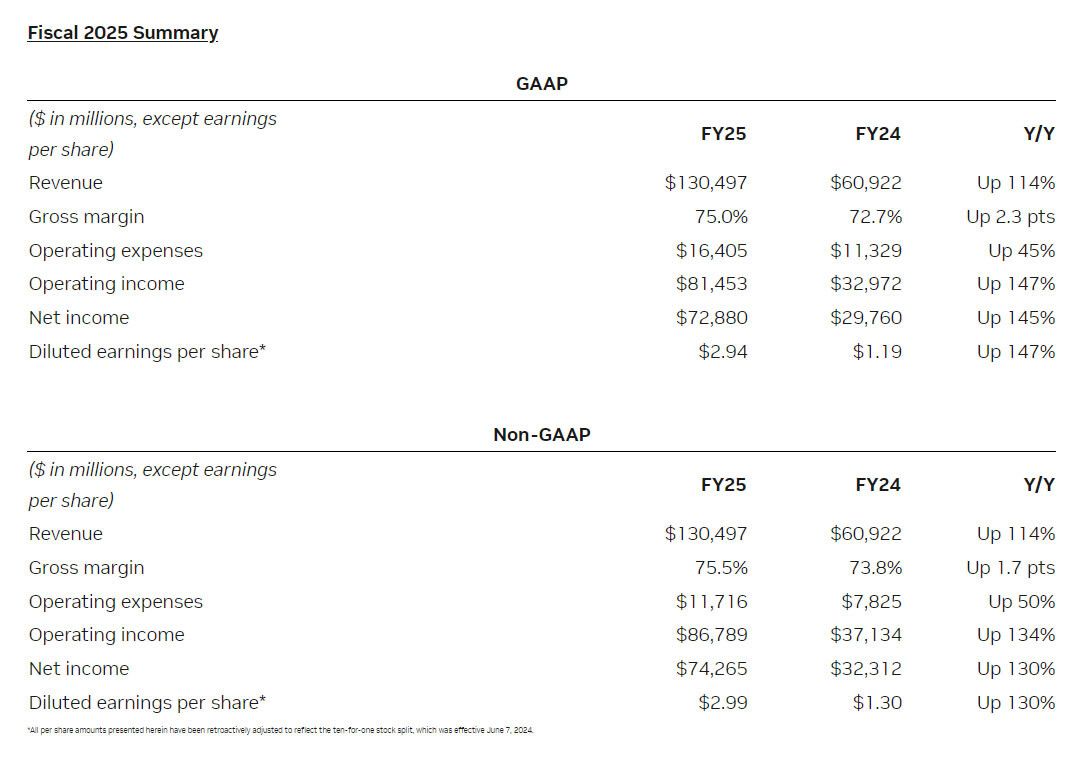

Full-Year Fiscal 2025 Financial Results:

- Revenue: $130.5 billion (up 114% from FY24)

- GAAP Gross Margin: 75.0%, up from 72.7% in FY24

- GAAP Net Income: $72.9 billion (up 145% from FY24)

- GAAP EPS: $2.94 (up 147% from FY24)

- Non-GAAP EPS: $2.99 (up 130% from FY24)

Jensen Huang, founder and CEO of NVIDIA, stated:

"Demand for Blackwell is amazing as reasoning AI adds another scaling law — increasing compute for training makes models smarter and increasing compute for long thinking makes the answer smarter."

The company has ramped up large-scale production of Blackwell AI supercomputers, which generated billions in sales in its first quarter of availability.

According to Huang, "AI is advancing at light speed as agentic AI and physical AI set the stage for the next wave of AI to revolutionise the largest industries."

Data centre business leads growth

NVIDIA's Data Centre segment was the primary driver of its revenue growth. The segment generated a record $35.6 billion in revenue in Q4, reflecting a 16% increase from the previous quarter and a 93% rise from a year ago. For the full fiscal year, the Data Centre segment recorded revenue of $115.2 billion, a 142% increase year-over-year.

Among the key developments in the Data Centre segment:

- NVIDIA announced its role as a key technology partner for the $500 billion Stargate Project.

- Cloud service providers, including AWS, Google Cloud, Microsoft Azure, and Oracle Cloud, are integrating NVIDIA GB200 systems into their AI infrastructure.

- A partnership with AWS has made NVIDIA DGX™ Cloud AI computing platform and NVIDIA NIM™ microservices available through AWS Marketplace.

- Cisco is incorporating NVIDIA Spectrum-X™ into its networking solutions for AI infrastructure.

- More than 75% of the world’s top 500 supercomputers now operate on NVIDIA technologies.

- NVIDIA collaborated with Verizon to integrate AI and accelerated computing with Verizon’s private 5G network.

- Industry collaborations include partnerships with IQVIA, Mayo Clinic, and Siemens Healthineers for advancements in genomics, drug discovery, and medical imaging AI.

Gaming and AI PC market developments

NVIDIA's gaming revenue declined in Q4, reporting $2.5 billion, down 22% from the previous quarter and 11% year-over-year. However, full-year gaming revenue reached $11.4 billion, reflecting a 9% annual increase. Key announcements in the gaming segment include:

- The introduction of GeForce RTX™ 50 Series graphics cards powered by the Blackwell architecture.

- Launch of the GeForce RTX 5090 and 5080, which offer up to twice the performance of previous models.

- Debut of NVIDIA DLSS 4 technology, enhancing AI-driven rendering, and NVIDIA Reflex 2, which reduces PC latency by up to 75%.

Professional visualisation and robotics innovations

The Professional Visualisation segment recorded Q4 revenue of $511 million, increasing 5% from the previous quarter and 10% year-over-year. Full-year revenue in this category rose by 21% to $1.9 billion.

Key announcements include:

- The launch of NVIDIA Project DIGITS, a personal AI supercomputer for researchers and students.

- Expansion of NVIDIA Omniverse™ for AI-driven robotics and autonomous systems.

- NVIDIA Media2, an AI-powered content creation and streaming initiative.

The Automotive and Robotics segment reported Q4 revenue of $570 million, marking a 27% sequential increase and a 103% year-over-year growth. The full-year revenue for this segment was $1.7 billion, up 55% from fiscal 2024.

Key developments include:

- Toyota’s decision to build its next-generation vehicles on NVIDIA DRIVE AGX Orin™.

- Hyundai Motor Group’s partnership with NVIDIA for AI-driven manufacturing and robotics.

- The launch of NVIDIA Cosmos™, a generative AI platform adopted by robotics and automotive companies such as Uber and Agile Robots.

Outlook for fiscal 2026

NVIDIA provided guidance for the first quarter of fiscal 2026:

- Expected revenue of approximately $43.0 billion, with a margin of error of ±2%.

- GAAP gross margin forecasted at 70.6%, with non-GAAP gross margin at 71.0%.

- Operating expenses projected to be around $5.2 billion (GAAP) and $3.6 billion (non-GAAP).

The company also announced that it will distribute a quarterly cash dividend of $0.01 per share on April 2, 2025, to shareholders of record as of March 12, 2025.

Investor relations and forward-looking statements

Colette Kress, NVIDIA’s executive vice president and CFO, provided further commentary on the quarter, which is available on NVIDIA’s investor relations website. The company also hosted a conference call for analysts and investors, the recording of which will be available for replay.

NVIDIA has cautioned that forward-looking statements in the earnings report are subject to risks, including economic conditions, technological developments, competitive market dynamics, and regulatory factors.

Share this

Himani Verma

Content Contributor

Himani Verma is a seasoned content writer and SEO expert, with experience in digital media. She has held various senior writing positions at enterprises like CloudTDMS (Synthetic Data Factory), Barrownz Group, and ATZA. Himani has also been Editorial Writer at Hindustan Time, a leading Indian English language news platform. She excels in content creation, proofreading, and editing, ensuring that every piece is polished and impactful. Her expertise in crafting SEO-friendly content for multiple verticals of businesses, including technology, healthcare, finance, sports, innovation, and more.

previous

AI And Accelerated Computing In Healthcare: NVIDIA's Showcase At J.P. Morgan Healthcare Conference

next

Aer Lingus Business Class: Ground vs Travel Experience