Revealed: Sharing Assets Is Key To Making 5G RAN Affordable

8 Sept 2022, 3:58 am GMT+1

In the first stage of

, cost containment is the number one priority for many cellular operators. A new survey of operators, out now from the

of Rethink Technology Research, reveals the primary tactics which they are adopting to ensure upfront 5G costs are far lower than they were for 4G. Every operator is deploying 5G first in non-standalone mode, which works with the LTE core, and they are also reusing other key assets like sites and backhaul. They want to preserve as much of their existing network investment as possible, and the investment in NSA is lower than it would have been if the 5G NR standards had remained as a single set of specs. However, in future they will migrate to standalone mode and a 5G core, so they need to adopt other cost reduction approaches, to ensure they are not saving money now, but storing up the biggest 5G spending for a few years’ time.

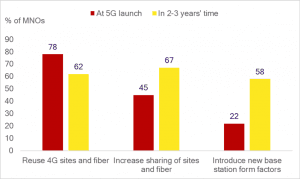

So, the survey shows an increasing tendency for MNOs to share everything from towers to spectrum in order to spread costs across multiple players. And they are introducing totally new base station form factors, notably the ‘mini-macro,’ which looks to be the sweet spot for investment in the early 5G market. This type of base station will enable them to densify the network at lower cost than current options, while preserving full functionality. This

in effect becomes 4G-plus, but with more sophisticated MIMO antennas, allowing the existing site grid to support improved coverage and cell edge QoS, and higher frequency spectrum. Other trends such as cell site densification, and greater virtualization will come later. This report is based on a survey of 78 leading global MNOs about the most important decisions they are making to ensure their physical RANs remain cost-effective in the near term (1 to 6 years). This report examines in detail three ways in which MNOs are looking to make their 5G macro networks efficient and profitable, and to form a strong base for future expansion into newer topologies and markets.

Share this

previous

How Does Compensation Work?

next

Top 10 Strategic Technology Trends For 2020