business resources

Top Options Analytics Platforms for Traders

5 Jan 2026, 1:33 pm GMT

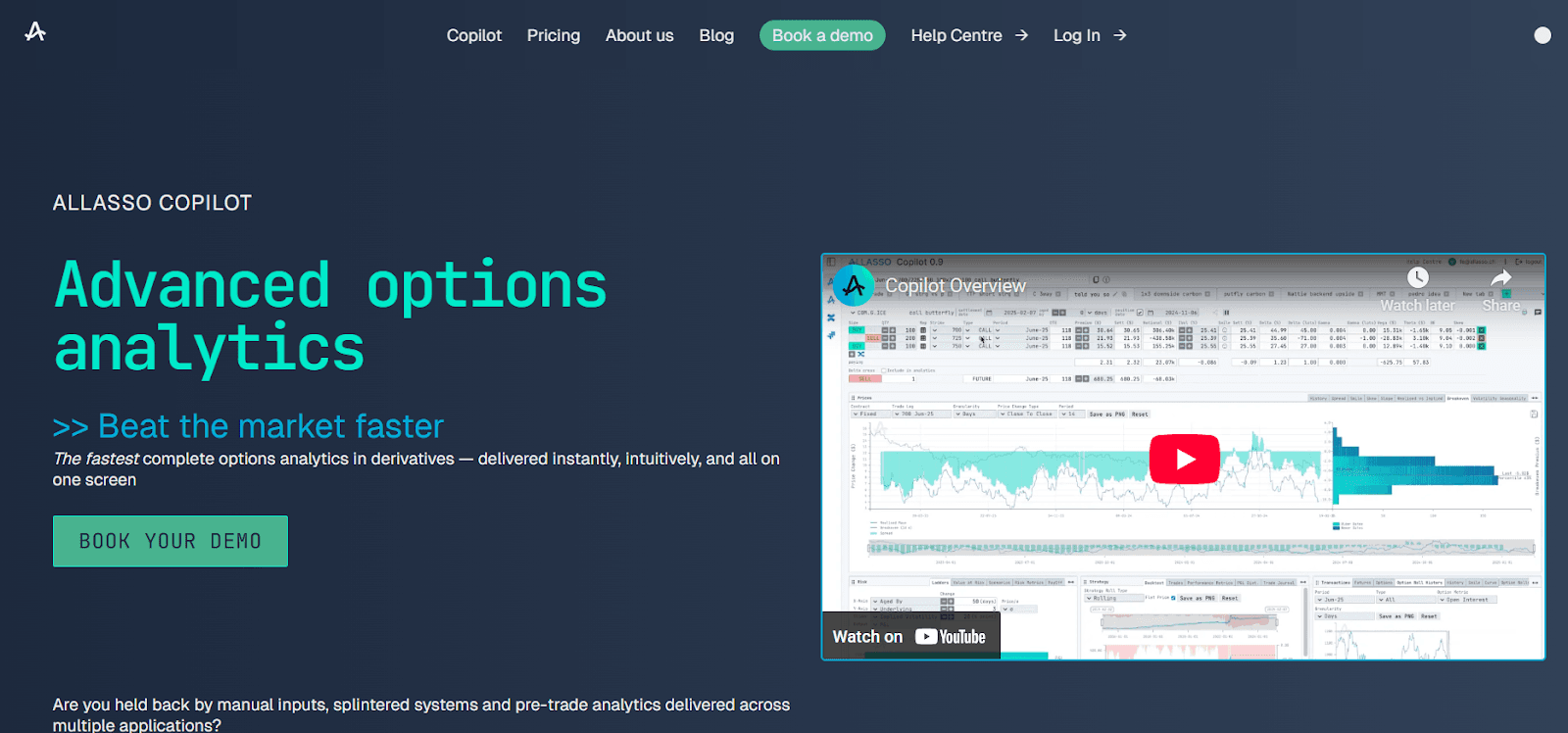

Allasso

Options trading requires accuracy, timing, and a good understanding of risk. As markets become increasingly unstable and strategies become more complex, traders are relying more heavily on advanced analytics platforms to identify opportunities, manage risk, and enhance performance. Modern tools are very important for traders who want to stop guessing and start trading with confidence. They help with everything from modeling volatility to simulating strategies.

Where Strategy Meets Advanced Market Intelligence

It's no longer enough just to find good setups for options trading; you also need to know how those setups work in different market conditions. Top analytics platforms combine real-time data, historical insights, and scenario analysis to help traders test ideas, figure out how likely they are to happen, and guess what will happen before they put their money at risk.

Here are some of the best platforms that give traders more information and better tools for making decisions.

1. Allasso: Advanced Options Analytics

Allasso Copilot is a premium options analytics platform made for traders who need very accurate analysis and quick workflows. It combines strategy modeling, historical backtesting, risk visualization, and collaboration tools into one place, all while keeping institutional standards in mind.

Key Capabilities

- Advanced pre-trade analytics that let traders look at risk, reward, and probability for both single- and multi-leg options strategies before they make a trade.

- Strong backtesting features that use historical market data to check strategies, test assumptions, and refine parameters across a range of market conditions.

- Scenario and stress-testing tools that show how strategies might work when volatility, price changes, and time decay change.

- Real-time alerts and monitoring that help traders keep an eye on live positions and respond quickly to changes in the market.

- Structured trade documentation and sharing tools that let teams work together, add notes to strategies, and export professional trade decks.

Why is it the Best Choice?

- Made specifically for options analytics, not for general trading tools.

- There is a good balance between the amount of data and how simple it is to use.

- Great for traders who want to go from making decisions based on gut feelings to checking their strategies against data.

- Great for professional traders, funds, and people who are good at managing complicated portfolios.

Allasso Copilot is a great choice for traders who need options analysis that is accurate, transparent, and flexible. It is a powerful tool for building, testing, and managing complex options strategies because it can combine backtesting, forward simulations, and collaborative workflows.

2. Optionomics

Optionomics is an options intelligence platform that focuses on behavioral and real-time market flow insights. Advanced analytics and AI-driven signals help traders identify odd activity and movements at the institutional level.

Key Capabilities

The most significant features to consider are:

- Real-time analysis of options flow and finding unusual trades.

- AI-powered alerts that show changes in sentiment and volatility.

- Access to historical data for more context and pattern recognition.

- Dashboards that combine flow, charts, and important metrics into one.

- Customizable watchlists to track specific symbols, sectors, or strategies.

- Educational insights and strategy ideas derived from unusual market activity.

For traders looking to identify unusual market activity and obtain flow-based insights, optionomics is a great tool. With its real-time options flow, AI-driven alerts, and sentiment indicators, users can identify trends and potential opportunities before the rest of the market does.

Whether you're trading straightforward contracts or intricate spreads, using historical data and integrated analytics makes it simpler to identify trends, enhance your tactics, and trade with confidence.

3. Thinkorswim

Thinkorswim is a popular platform for trading and analytics that is known for its advanced charting and wide range of options tools. It has a lot of features for making strategies, visualizing them, and figuring out how risky they are.

Key Capabilities

- Full Greeks and probability metrics for detailed options chains.

- Graphs that show the risk of multi-leg strategies.

- Tools for paper trading that let you test strategies without putting your money at risk.

- Highly customizable charts and studies.

- Scanners that are built into find trading opportunities in all markets.

- Templates for strategies and tools for automating tasks to speed up execution.

Thinkorswim provides traders with a comprehensive suite of tools to examine, test, and implement options strategies.

By displaying comprehensive option chains, probability metrics, and risk visualizations, it aids users in comprehending potential outcomes and trade dynamics.

It is beneficial for both novice traders who wish to learn how to use the tools and seasoned traders who wish to enhance their multi-leg strategies in real time because it offers paper trading, sophisticated charting, and customizable studies.

Summing Up

To confidently navigate today's complex derivatives markets, selecting the appropriate options analytics platform is crucial. The best solutions transform raw data into more intelligent choices by assisting traders in comprehending risk, validating strategies, and reacting swiftly to shifting circumstances.

Purchasing sophisticated analytics tools is essential to long-term success if you want to trade with more clarity, consistency, and control.

Take your options trading to the next level by investigating these platforms.

Share this

Peyman Khosravani

Industry Expert & Contributor

Peyman Khosravani is a global blockchain and digital transformation expert with a passion for marketing, futuristic ideas, analytics insights, startup businesses, and effective communications. He has extensive experience in blockchain and DeFi projects and is committed to using technology to bring justice and fairness to society and promote freedom. Peyman has worked with international organisations to improve digital transformation strategies and data-gathering strategies that help identify customer touchpoints and sources of data that tell the story of what is happening. With his expertise in blockchain, digital transformation, marketing, analytics insights, startup businesses, and effective communications, Peyman is dedicated to helping businesses succeed in the digital age. He believes that technology can be used as a tool for positive change in the world.

previous

Raising Future Entrepreneurs: How Story-Based Learning Helps Kids Understand Business Basics

next

Employee Monitoring Software Reviews for HR