business resources

What is a SME Business Loan?

8 Sept 2022, 3:41 am GMT+1

SME Business Loan and Trade Finance - Context

It is a well-known fact that SMEs play crucial role in sustainable growth of regional market. There are various definitions to be found online as to what trade finance and how to get a business loan process. Trade Finance and a business loan is described both as a ‘science’ and as ‘an imprecise term covering a number of different activities’ related with getting funding, loan for s SME. There are a wide range of tools at the SMEs’ disposal, all of which determine how cash, credit, investments and other assets can be utilised for trade. In its simplest form, a giving SME, for example an exporter requires an importer to prepay for goods shipped. The importer naturally wants to reduce risk by asking the exporter to document that the goods have been shipped. The importer’s bank or trade finance provider assists by providing a letter of credit to the exporter (or the exporter's bank) providing for payment upon presentation of certain documents, such as a bill of lading. The exporter's bank than may make a loan to the exporter on the basis of the export contract. The type of document used in the process depends on the nature of the transaction and how evidence of performance can be shown (i.e. bill of lading to show shipment). It is useful to note that banks only deal with documents and not the actual goods, services or performance to which the documents may be relating to.

SME role in UK and Europe

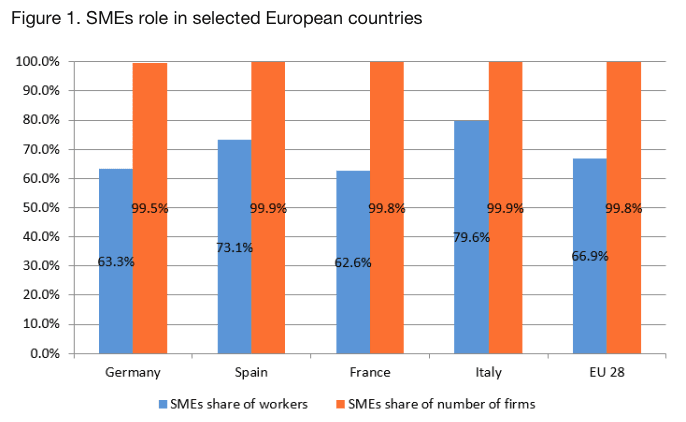

UK has above 5.4 million SMEs and as shown below SMEs are dominating the EU market for number of firms and have above half market share for number of workers. UK is a powerful market for SMEs and there is more and more things in this area special in the area of trade finance. On an EU level Spain and Italy are leading in the terms of importance of SMEs.

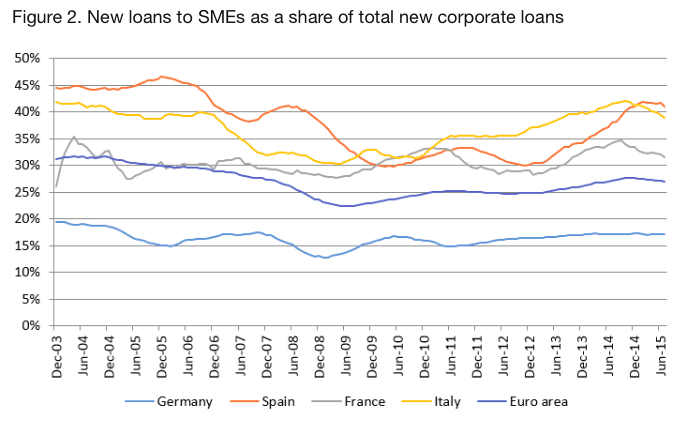

As suggested by WEF, employment share of SMEs in EU account for 66.9% and more than 99% of all firms in the EU are SMEs. As per November 2015, new loans to SMEs were approx.. 27% with peaks at around 40% for Italy and Spain.

Favourable government policy might boost proliferation of start-ups as well as financial programs addressing funding and business loans.

How can a SME get a Business loan or access to best Trade Finance?

Many start-ups today struggle to gain grounds and become fully established investors, due to lack of capital and uncertainties surrounding the business environment. However, with a business loan, small or large business owners will be able to get enough capital that can help boost their businesses and promote them to another level. In this article, we’re going to look at some important things about business loans. Find out below, the meaning of a business loan, how can one obtain a business loan, as well as its advantages.

What Is A Business Loan?

A business loan is an amount or a loan specifically designed and required to fund for business expenses. It’s important to know that business loan can also be referred to as a debt that business owners are obliged to repay based on the loan’s terms and condition. This means, it involves a creation of a debt which will be repaid at an agreed time with additional interest. Many business owners or companies have been using business loans to fund their projects; while it is regarded as the fastest way to source for business capital, it’s also accompanied by some risks especially when collaterals are involved and the borrower is unable to repay his/her loan. In this situation, many financial institutions don’t take it lightly with the borrower (if he/she can’t repay back the loan amount), and it may end up in a serious chaos. However, if the whole thing went well, business loan is one of the best ways of financing for business start-ups.

A Guide To Obtaining A Business Loan

Money is the backbone of every business, without it there is no way a business can stand. As it is rightly said, “money turns the world around”, and so it does in any business. You can’t get money if you don’t spend money; this is the reality of life. Whether you’re into start-ups or you’re already operating on an existing business, you need capital to keep the business alive and yield more profits. Below, you can find tips and guidelines that will make you get a business loan without hassles.

Know the criteria banks look for before giving business loans

This is very important, because different banks have different methods and standards for giving business loans. Therefore, it is always better to consider this so that you can prepare all the necessary requirements for that.

Know the necessary documents needed for acquiring business loans

Different lenders may have different requirements for acquiring business loans. You need to evaluate them one by one, and go for the one you think can make things easier for you.

Chose your lending institution carefully and be truthful

After evaluating the different types of lending institutions available for business loans, the next thing to do is to carefully select the one that best matches your requirements. Also, you will need to be honest, truthful, and just in any of the loan agreement you will be making.

Benefits Of Acquiring Business Loans

While there may be risks involved in collecting business loans, the benefits it has on many businesses cannot be underestimated. Find out below, some of the benefits business owners can get through acquiring business loans.

Getting payment on time and in full

One of the advantages of acquiring a business loan from financial institutions is that, you stand the chance to get funds on time and in full. This will help you to start-up your business and build it up without hassles.

Your lenders do not get involved in running of the business

Another benefit is that, your lenders will not influence how you run your business. They will only help you with funds and allow you to have full control over it. In order words, lenders don’t care how you use your money.

There will be no more obligation with the lender once the borrower has paid off the loans

One of the fascinating aspects of business loan is that, you get the funds, make use of it and multiply your earnings, and then pay back the money in full at the stipulated time. After settling your debt, you will be having a free run of profits without remitting any balance.

Share this

Contributor

Staff

The team of expert contributors at Businessabc brings together a diverse range of insights and knowledge from various industries, including 4IR technologies like Artificial Intelligence, Digital Twin, Spatial Computing, Smart Cities, and from various aspects of businesses like policy, governance, cybersecurity, and innovation. Committed to delivering high-quality content, our contributors provide in-depth analysis, thought leadership, and the latest trends to keep our readers informed and ahead of the curve. Whether it's business strategy, technology, or market trends, the Businessabc Contributor team is dedicated to offering valuable perspectives that empower professionals and entrepreneurs alike.

previous

How To Raise Finance For Your Small Business or Startup With Loans

next

What Are the Types of SMEs Business Loans?