business resources

What Is The Best Trading Broker For 2025?

30 Sept 2025, 11:02 am GMT+1

Pinpointing the best trading broker for 2025 really comes down to what you need from a platform. The market, as you know, moves at lightning speed, and having the right set of tools and timely information can make all the difference. We’ve done the legwork, sifting through a host of brokers to see which ones truly shine for different kinds of investors—from those just dipping their toes in the water to seasoned trading veterans. This guide is designed to help you figure out which broker might just be the perfect partner for your investing journey this year.

Key Takeaways

- For a great all-around experience, Fidelity Investments stands out as a top choice, offering a compelling mix of low costs, a vast selection of investments, and excellent money management features.

- Interactive Brokers is a powerhouse option for advanced traders who need sophisticated tools for executing complex strategies, trading internationally, and managing risk.

- Charles Schwab comes highly recommended for new investors, largely thanks to its deep well of educational materials and platforms that are notably easy to navigate.

- When you're on the hunt for a broker, it's wise to weigh factors like fees, the variety of available investments, the platform's ease of use, and the quality of customer support.

- It's worth noting that different brokers excel in particular niches, such as cryptocurrency trading (Robinhood), options trading (tastytrade), or ETF investing (Fidelity).

Understanding The Core Features Of A Top Trading Broker

When you start searching for a trading broker, it’s remarkably easy to get lost in the sheer number of options. At its core, though, a good broker should equip you with the tools and resources to make intelligent investment choices. Think of it like building a house; you absolutely need the right foundation and the right tools to get the job done well. A top-tier broker—that's the one that makes this entire process smoother, whether you're a complete beginner or you've been trading for years.

Essential Tools For Informed Investment Decisions

To make truly sound investment decisions, you need access to reliable information and the means to act on it swiftly. This means having a broad range of investment products at your fingertips, from everyday stocks and ETFs to more specialized options or even cryptocurrencies. The ability to trade different asset classes allows you to diversify your portfolio and chase various strategies. The availability of fractional shares is also a significant plus, allowing investors with smaller amounts of capital to buy portions of high-priced stocks, making expensive companies more accessible.

Here are some of the key aspects to consider when it comes to investment tools:

- Asset Variety: Does the broker actually offer the kinds of investments you're interested in? This could span stocks, bonds, ETFs, mutual funds, options, futures, or even crypto.

- Fractional Shares: This handy feature lets you buy less than a full share of stock, which is a fantastic advantage for smaller accounts.

- Order Types: Do they support more advanced orders beyond the basic market and limit types? These can be incredibly useful depending on your strategy.

The Role Of Real-Time Data And Portfolio Management

Keeping a close eye on your investments and understanding market movements is simply vital. A quality broker provides real-time market data, ensuring you're always aware of current prices and emerging trends. This information is critical for making timely decisions. But it goes beyond just raw data; effective portfolio management tools help you see how your investments are performing at a single glance. This includes clear reporting, performance tracking, and the ability to adjust your holdings with ease.

Key components of portfolio management and data access include:

- Live Market Feeds: Access to up-to-the-minute price quotes and breaking market news.

- Performance Tracking: Tools to monitor your portfolio's gains, losses, and overall value over any period.

- Reporting: Clear, easy-to-digest statements and reports on your account activity and current holdings.

Effective portfolio management isn't just about staring at numbers on a screen; it’s about grasping what those numbers mean for your financial goals and making smart adjustments based on market conditions and your personal strategy.

Related Contents:

which is the best trading broker in 2025

what are decentralized applications dapps in 2025

Leveraging Educational Resources For Confident Trading

It doesn't matter what your experience level is—in the trading world, continuous learning is paramount. The best brokers offer a wealth of educational materials to help you get a handle on different investment concepts, trading strategies, and market dynamics. This might come in the form of articles, videos, webinars, or even live training sessions. Having these resources at your disposal can build your confidence and help you make more informed decisions, which ultimately reduces the odds of making costly mistakes.

You should definitely consider brokers that provide:

- Tutorials and Guides: Step-by-step instructions on how to use their platform and understand core trading concepts.

- Webinars and Live Sessions: Opportunities to learn directly from experts and ask questions in real time.

- Market Analysis: Professional insights and commentary on current market trends and economic events.

Evaluating Brokerage Platforms For Investment Needs

When you're searching for a place to trade stocks, ETFs, or other investments, selecting the right brokerage platform is a pretty big decision. It’s not just about where your money sits; it’s about the tools and support you’ll receive to help it grow. You can think of it like choosing a workshop for a project—you need the right tools, a sensible layout, and perhaps some helpful advice along the way. Different brokers are built for different styles of work, so figuring out precisely what you need is the key first step.

Key Criteria For Brokerage Platform Selection

As you begin comparing brokers, a few key things tend to stand out. First, you'll want to look at what you can actually trade. Some platforms might stick to stocks and ETFs, while others open the door to options, futures, or even cryptocurrencies. The range of available assets can really shape what you can do with your money. What about ease of use? If you're just starting out, a simple, clean interface is probably your best bet. If you're more experienced, you might crave something with more sophisticated tools, even if it has a steeper learning curve.

Here are a few points to keep at the front of your mind:

- Asset Availability: What's on the menu? Stocks, bonds, ETFs, options, crypto, futures?

- User Interface: Is it intuitive? Can you easily find what you need and place trades without confusion?

- Research and Data: Does the broker provide quality charts, news feeds, and analysis to help you make decisions?

- Costs: What are the fees for trading, account maintenance, or any other services? Be sure to read the fine print.

Weighted Factors In Broker Research

To get a more objective picture, researchers often assess brokers using a set of weighted criteria. This just means some factors are deemed more important than others. For example, the cost of trading, the variety of investment choices, and the quality of research tools might carry more weight than, say, the number of physical branches a broker has. Trading technology and the overall trade experience are also usually high on that list. These weighted factors help create a more balanced comparison, moving beyond a simple star rating to something more meaningful.

Here’s a glimpse at how some common categories might be weighted:

| Category | Weight |

|---|---|

| Research Amenities | 12.78% |

| Trading Technology | 11.86% |

| Range of Offerings | 11.59% |

| Trade Experience | 10.12% |

| Costs | 10.00% |

Understanding these weighted factors helps you see how different brokers stack up based on what matters most to the broader investing community. It’s a good way to gauge their overall strength across various facets of the service they provide.

Assessing User Experience And Account Services

Beyond the trading tools themselves, how you interact with the broker day-to-day matters a great deal. This includes the design of their website and mobile app, how painless it is to deposit or withdraw funds, and the quality of their customer support when you need it. Do they offer helpful account statements and portfolio analysis tools? For many investors, having access to fractional shares—which let you buy a slice of an expensive stock—is a huge plus, especially for those starting with less capital. Ultimately, good account services mean you can manage your investments smoothly and get help without any unnecessary hassle.

Best Overall Brokerage For Comprehensive Services

When you're seeking a home for your investments, finding a broker that offers a truly comprehensive range of services can make a world of difference. For 2025, Fidelity Investments really stands out as a premier choice for a wide spectrum of investors, whether you're just starting out or have been trading for decades. They've built a strong reputation for providing a solid mix of features, powerful tools, and competitive pricing.

Fidelity Investments: A Leading Choice

Fidelity has cemented its spot as a leading brokerage by keenly focusing on what investors actually need. They offer an incredibly broad selection of investment products, from stocks and bonds to ETFs and mutual funds. What does this mean for you? You can likely find everything you're looking for under one roof. Their commitment to delivering a full suite of services, paired with a user-friendly platform, makes them a formidable contender for the best overall brokerage.

Analyzing Fidelity's Expansive Product Offering

One of the biggest draws to Fidelity is the sheer variety of investment options they put on the table. They provide seamless access to:

- Stocks and ETFs

- Bonds

- Mutual Funds (including a huge selection of no-transaction-fee options)

- Options

- Certificates of Deposit (CDs)

- Managed accounts

This wide array of choices empowers investors to build diverse portfolios that are tailored to their specific financial goals. For those with a keen interest in exchange-traded funds, Fidelity is particularly strong, offering extensive research capabilities and the ability to trade fractional shares of ETFs. This feature makes it much easier to invest in a broad market index without needing a large chunk of cash upfront. The platform also supports trading in a few digital coins, although it's not their primary area of focus.

Fidelity's Competitive Fee Structure

Keeping costs down is a major consideration for any investor, and this is an area where Fidelity generally shines. They offer commission-free online trading for U.S. stocks and ETFs. For options trades, there's a small per-contract fee, which is quite competitive within the industry. It's also important to point out that Fidelity does not engage in payment for order flow (PFOF) for stock and ETF trades, a practice which can lead to better execution prices for your trades. Their fee structure is refreshingly transparent, helping investors understand exactly what costs are associated with their investments. This dedication to low costs, combined with their extensive services, makes them a compelling choice for almost any investor.

Fidelity's approach to cash management is also worth a mention. They provide robust features for handling uninvested cash, including high-yield options and FDIC insurance coverage up to $5 million. This seamless integration of banking and investing features really simplifies financial management for their clients.

Fidelity's platform is thoughtfully designed to support investors at every level. They provide powerful portfolio analysis tools and account features that help you track your progress and make well-informed decisions. For anyone looking to explore different investment avenues, Fidelity's platform is a truly solid choice. You can find more details about their services and how they stack up against other brokers on sites like Tellidex.

Specialized Brokerages For Advanced Trading Strategies

For traders whose needs go beyond the basics, certain brokerages distinguish themselves by providing highly sophisticated tools and a much wider array of trading options. These platforms are really built for individuals who have a firm grasp of complex strategies and require robust technology to put them into action.

Interactive Brokers For Sophisticated Traders

Interactive Brokers is consistently recognized as a top-tier choice for advanced and professional traders. They offer an extensive selection of assets and global markets, all coupled with incredibly powerful trading platforms. Their Trader Workstation (TWS) platform is a perfect example of their commitment to providing best-in-class functionality. This platform, along with their newer IBKR desktop application, is meticulously designed to help serious traders identify and act on market opportunities with precision.

Algorithmic Trading Capabilities

For those delving into the world of algorithmic trading, Interactive Brokers provides a remarkably strong feature set. This includes a variety of pre-built algorithmic tools, support for several programming languages via their API, and even the ability to practice with algorithmic paper trading accounts. All of this makes it significantly easier for traders to develop, test, and deploy automated trading strategies.

International Trading And Risk Management Tools

Another area where Interactive Brokers truly excels is in international trading. They offer direct access to a vast range of global markets and currency options that most other brokers simply can't match. Their platform also includes advanced tools for managing portfolio risk—a critical component for any serious trader. Features like rebalancing tools, in-depth portfolio analysis, and broad diversification possibilities help traders maintain tight control over their risk exposure.

Here’s a quick look at some of their fee structures for advanced trading:

| Service | Fee Structure |

|---|---|

| Equities/ETFs (Lite) | $0.00 commissions |

| Equities/ETFs (Pro) | Scaled by volume |

| Options (Lite) | $0.65 per contract |

| Options (Pro) | Starts at $0.65 per contract, scaled by volume |

| Futures | Starts at $0.85 per contract, scaled by volume |

| Cryptocurrency | 0.12%-0.18% (volume-based), min $1.75 per trade |

When you're considering a broker for advanced strategies, it's wise to look beyond just the trading tools. The availability of global markets, the depth of research resources, and the flexibility of order types can all have a significant impact on your trading success. And don't forget to consider the platform's stability and the responsiveness of customer support, especially when dealing with high-volume or time-sensitive trades.

Brokerage Options For New And Developing Investors

Starting your investment journey can certainly feel like a big step, and choosing the right brokerage is crucial to making it a smooth one. For those new to the market or still honing their trading skills, the focus should really be on platforms that offer a supportive environment, clear tools, and accessible education. It’s less about finding the absolute cheapest option and more about finding the one that helps you learn and grow your confidence. The best brokerage for a developing investor is one that puts a premium on user-friendliness and educational support.

Charles Schwab: A Strong Foundation For Beginners

Charles Schwab is frequently pointed to as a stellar choice for individuals who are just beginning to invest. They offer a platform that strikes a great balance between robust features and an approachable interface. This means you gain access to a wide range of investment products—from stocks and ETFs to mutual funds—without feeling completely overwhelmed. Their account structures are generally quite straightforward, and they often feature low or no account minimums, which is a huge benefit when you're starting out with a smaller amount of capital.

Educational Content And Training For New Investors

One of the most significant advantages certain brokers offer new investors is their wealth of educational resources. Think of it as having a friendly guide by your side as you learn the ropes. These resources can come in many forms, such as:

- Tutorials and How-To Guides: Step-by-step instructions on navigating the platform, placing trades, and understanding different investment types.

- Webinars and Live Sessions: Chances to learn from experts about market trends, investment strategies, and economic news.

- In-depth Articles and Glossaries: Clear explanations of financial terms and concepts that help to demystify the sometimes-confusing world of investing.

Brokers that truly invest in these materials help their users build a stronger foundation of knowledge, which in turn leads to more informed decisions and a lot less anxiety about the trading process itself.

User-Friendly Platforms For Emerging Traders

When you're new to investing, the very last thing you want is a trading platform that resembles an airplane cockpit with far too many buttons. User experience is absolutely paramount. So, what should you look for? Seek out brokers that offer:

- Intuitive Navigation: You should be able to easily find what you're looking for, whether it's research tools, your account information, or the trade ticket itself.

- Clear Visualizations: Charts and data presented in a format that's easy to understand at a glance.

- Simplified Trade Execution: A straightforward, stress-free process for buying and selling your investments.

Many brokers now offer fantastic mobile apps that mirror the desktop experience, allowing you to manage your investments from anywhere. This level of accessibility is important for staying engaged without being tethered to a computer. The goal is to make the act of investing as simple as possible, letting you focus on what really matters: learning and growing your portfolio.

Exploring Niche Trading Opportunities

While a great many investors are perfectly happy sticking to stocks and ETFs, the financial markets offer a rich variety of specialized avenues for those looking to diversify or employ very specific strategies. Understanding these niche areas—and the brokers that cater to them—can open up a whole new world of possibilities for your investment portfolio.

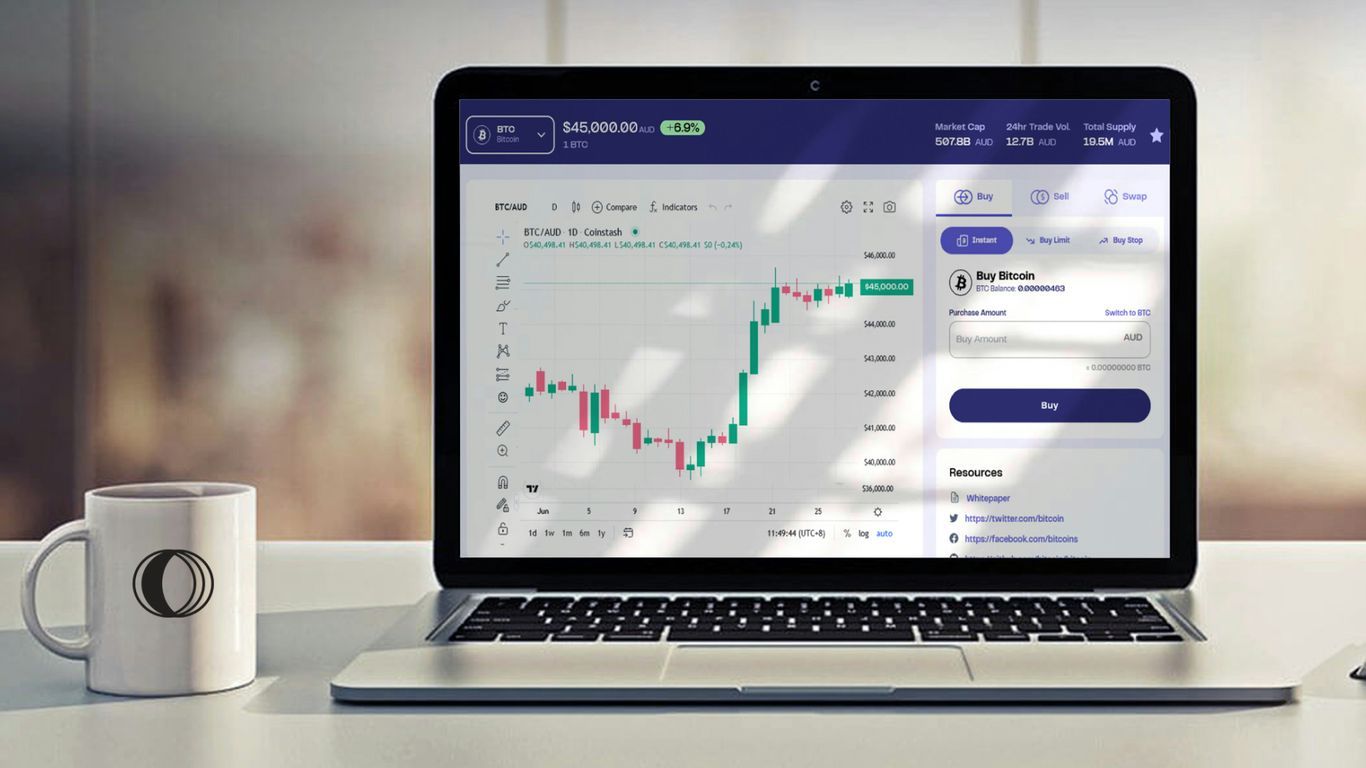

Cryptocurrency Trading Platforms

It's impossible to ignore the explosion of digital assets, and with it, the soaring demand for brokers that facilitate cryptocurrency trading. These platforms often operate a bit differently from their traditional counterparts, focusing on a wide range of cryptocurrencies, from giants like Bitcoin and Ethereum to newer altcoins. When you're evaluating a crypto platform, consider the variety of coins offered, the security measures they have in place to protect your assets (this is a big one), and their fee structure. Some platforms offer advanced trading tools, while others prioritize simplicity for newcomers. It's crucial to find a platform that aligns with your comfort level and trading goals in this notoriously volatile market. Robinhood, for instance, offers commission-free crypto trading, making it an accessible entry point for many.

Options Trading Expertise

Options trading involves contracts that give the buyer the right—but not the obligation—to buy or sell an underlying asset at a specific price on or before a certain date. This can be a complex field, no doubt, but it also provides powerful tools for hedging, speculation, and generating income. Brokers that specialize in options often provide advanced charting tools, sophisticated order entry systems, and deep educational resources tailored to options strategies. They might also feature tools for analyzing options chains, calculating implied volatility, and even backtesting strategies. A broker with a strong focus on options will typically offer competitive pricing, including capped commission structures for larger trades, and robust analytical tools. As an example, tastytrade is widely recognized for its comprehensive suite of options trading features and its commitment to education.

ETF Investment Strengths

Exchange-Traded Funds (ETFs) have become a cornerstone of modern investing, and for good reason—they offer fantastic diversification benefits and are incredibly easy to trade. While most brokers offer access to ETFs, some platforms truly stand out for their ETF selection and related research tools. Look for brokers that provide a vast array of ETFs spanning different asset classes, sectors, and geographies. Additionally, platforms that offer tools for comparing ETFs, analyzing their underlying holdings, and accessing professional research reports can be particularly valuable. Some brokers even offer commission-free trading on a curated selection of popular ETFs, which can significantly lower trading costs, especially for those who invest frequently. The ability to trade fractional ETF shares can also be a major plus, allowing investors to build well-diversified portfolios with smaller amounts of capital.

Mobile Trading And Accessibility

In today's incredibly fast-paced world, the ability to manage your investments from anywhere isn't just a luxury; it's a flat-out necessity. The best trading brokers understand this perfectly and have invested heavily in developing mobile applications that are both powerful and intuitive. These apps allow you to monitor your portfolio, execute trades, and access critical market information right from your smartphone or tablet. The convenience of mobile trading means you're never truly disconnected from your financial goals.

Evaluating Mobile App Usability

When you're sizing up a broker's mobile app, a few key things are worth considering. First off, how easy is it to find what you're looking for? A cluttered, confusing interface can easily lead to mistakes, especially when you're trying to make a time-sensitive trade. Look for apps that boast a clean layout and logical navigation. Second, does the app give you the information you need at a quick glance? This might include your portfolio's current performance, live market prices, and important news alerts. Finally, consider the app's speed and reliability. A slow or buggy app can be incredibly frustrating and could even cause you to miss out on key trading opportunities.

Features For On-The-Go Investing

Beyond the basics of buying and selling, many mobile apps offer some seriously advanced features. Some provide sophisticated charting tools, giving you the ability to analyze market trends directly from your device. Others grant access to in-depth research reports and analyst ratings, helping you make informed decisions without being chained to your computer. Push notifications are also a huge plus, as they can alert you to significant market movements or breaking news that might affect your investments. For those interested in digital assets, some platforms even allow for cryptocurrency trading directly through their mobile app, much like how you might manage other assets on platforms such as Starknet wallets.

Seamless Cross-Platform Integration

It's also incredibly important that the mobile experience works in harmony with the desktop or web platform. Ideally, you should be able to start looking into a trade on your phone and complete it on your computer—or vice versa—without a single hiccup. Your watchlists, account information, and trade history should all sync up automatically and instantly across all your devices. This kind of seamless integration means you can switch between platforms fluidly, adapting to whatever method is most convenient for you at any given moment. This ensures your trading strategy remains consistent, no matter where you are or what device you happen to be using.

A well-designed mobile trading app should aim to mirror the functionality of its desktop counterpart as much as possible, while also being expertly optimized for a smaller screen and touch-based interaction. It's all about providing full access without sacrificing capability.

Final Thoughts on Choosing Your 2025 Trading Broker

As we wrap up our exploration of the best trading brokers for 2025, it’s abundantly clear that today's landscape offers a wealth of options for investors of all stripes. With major markets like the S&P 500, gold, and Bitcoin experiencing significant movement, having the right tools and a reliable platform is more critical than ever. We've seen that Fidelity stands out as a top all-around choice, especially for its low costs and extensive range of services. For those who need more advanced features, Interactive Brokers remains a powerhouse contender, particularly for international trading and complex strategies. Meanwhile, beginners will likely find Charles Schwab to be a welcoming entry point, thanks to its exceptional educational resources. Ultimately, the best broker for you will always depend on your personal investing style and long-term goals. Take the time to consider what features matter most to you—whether it's rock-bottom fees, a user-friendly platform, deep research tools, or specific asset availability—to make a truly informed decision for your investment journey.

Frequently Asked Questions

What makes a trading broker a good choice for 2025?

A top trading broker for 2025 is one that offers helpful tools to help you make smart investment choices. This really means having real-time information about your investments, easy ways to manage your money, and resources that help you learn and trade with more confidence. Of course, good customer support and fair, transparent pricing are also incredibly important.

How do I pick the right trading platform for my needs?

To choose the best trading platform for you, start by thinking about what you want to achieve with your investments. You'll want to consider things like the types of investments offered, how easy the platform is to use, what the costs are, and the level of support you can expect. Looking at reviews and comparing different brokers based on your personal goals is always a smart way to go.

Which brokers are best for beginners?

For anyone new to trading, brokers like Charles Schwab are an excellent place to start. They provide a ton of learning materials, platforms that are easy to get the hang of, and plenty of helpful guidance. Using a 'paper trading' account, which lets you practice with fake money, can also be a fantastic way for beginners to get comfortable before putting real money on the line.

What are the advantages of using a broker like Interactive Brokers?

Interactive Brokers is a fantastic choice for more experienced traders. It provides advanced tools for complex trading strategies, access to a wide range of international markets, and great features for automated trading. It also comes equipped with powerful tools for managing risk and discovering new investment opportunities.

Are there specific brokers for trading things like cryptocurrencies or ETFs?

Yes, absolutely. Some brokers specialize in certain types of trading. For example, Robinhood is well-known for making cryptocurrency trading quite simple. On the other hand, Fidelity is often praised for its strengths in trading Exchange Traded Funds (ETFs) and offers a massive range of investment choices in general.

How important is a mobile app when choosing a broker?

These days, a good mobile app is very important for trading on the go. The best apps are intuitive to navigate and offer nearly all of the features you'd find on the desktop version. This freedom allows you to check on your investments, make trades, and stay updated from just about anywhere.

Share this

Peyman Khosravani

Industry Expert & Contributor

Peyman Khosravani is a global blockchain and digital transformation expert with a passion for marketing, futuristic ideas, analytics insights, startup businesses, and effective communications. He has extensive experience in blockchain and DeFi projects and is committed to using technology to bring justice and fairness to society and promote freedom. Peyman has worked with international organisations to improve digital transformation strategies and data-gathering strategies that help identify customer touchpoints and sources of data that tell the story of what is happening. With his expertise in blockchain, digital transformation, marketing, analytics insights, startup businesses, and effective communications, Peyman is dedicated to helping businesses succeed in the digital age. He believes that technology can be used as a tool for positive change in the world.

previous

Responsible Gaming in JetX: How to Avoid Gambling Addiction

next

Mastering Digital Presence: Strategies for Unshakeable Online Authority