business resources

AI Startups Secure Record-Breaking $10.4 Billion in Funding by Q1 2025

18 Feb 2025, 0:51 pm GMT

AI startups raised $10.4 billion in early 2025, marking a record-breaking first quarter. Major investments, including xAI’s $10 billion and Figure AI’s $1.5 billion, fuelled growth. The US led with $189 billion of total AI funding. AI outpaced fintech and semiconductor sectors, maintaining strong investor confidence in innovation.

The artificial intelligence (AI) sector has witnessed an unprecedented surge in venture capital (VC) investments, setting a record-breaking start to 2025. Despite market uncertainties, investor interest in AI-driven innovations remains strong, driving substantial funding rounds across the industry.

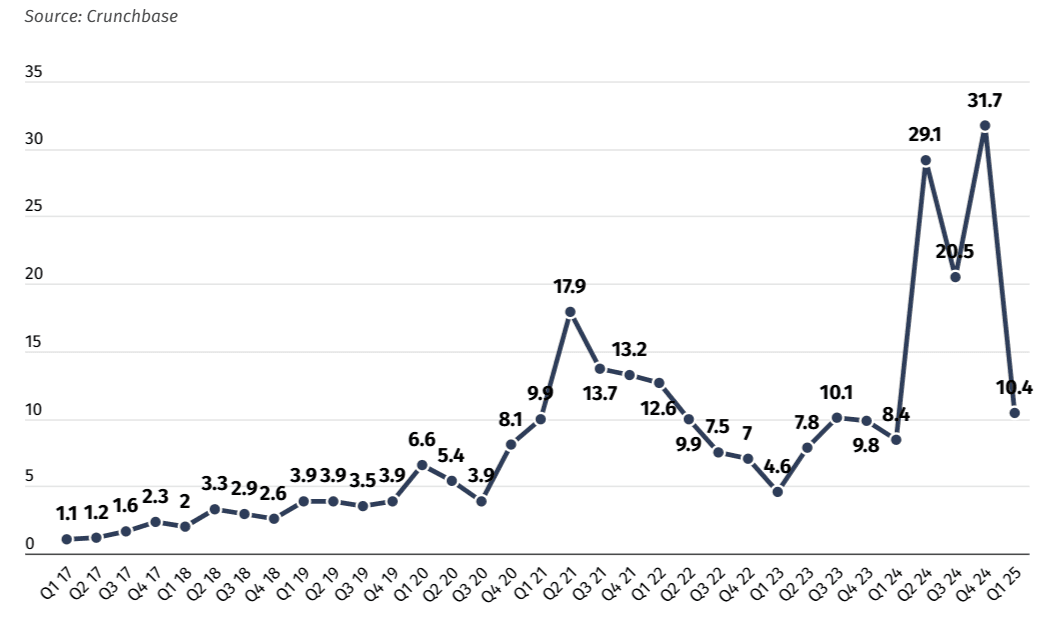

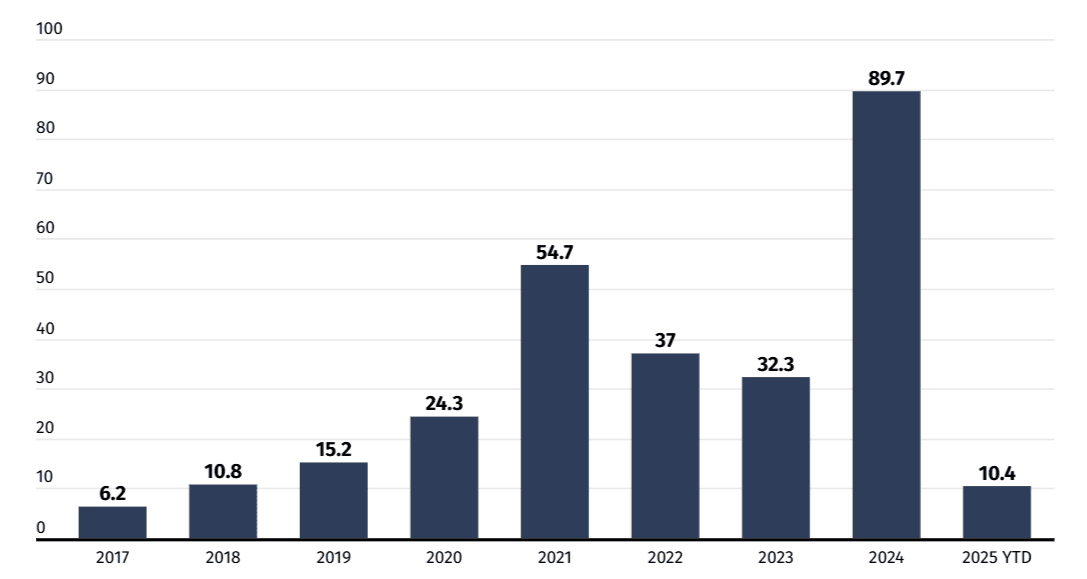

Over the past year, AI startups secured a historic $89.7 billion in funding rounds, the highest amount ever recorded in a twelve-month period. However, the strong funding momentum has carried over into 2025, with AI startups raising an impressive $10.4 billion year-to-date. This figure surpasses the first-quarter funding total of 2024 by $2 billion and establishes Q1 2025 as the most successful first quarter for AI investments.

Major investments and industry developments drive growth

Investor enthusiasm has been fuelled by several key developments within the AI industry. Notable investment rounds include Elon Musk’s xAI, which is in discussions to raise $10 billion, and Figure AI, currently negotiating a $1.5 billion funding round. Additionally, major technology companies, such as Meta, have been expanding AI applications, including the development of AI-powered humanoid systems, further attracting investment interest.

VC firms have also shifted focus towards practical AI solutions, urging startups to accelerate their technological advancements. This push for innovation, combined with high-profile funding rounds, has contributed to the record-breaking pace of AI investments in early 2025.

Comparison with other high-growth sectors

AI startups continue to lead in VC funding compared to other high-growth industries. Since the beginning of 2025, AI companies have raised three times more than fintech startups ($3.3 billion), 40% more than semiconductor firms ($6.4 billion), and are just $1.7 billion behind the biotech sector ($12.1 billion).

The total amount raised by AI startups to date has now reached $287 billion, with the United States accounting for the largest share. US-based AI companies have secured approximately $189 billion, representing 65% of the total funding. California remains the focal point of AI investment within the country.

Asian AI startups have also garnered significant investor attention, accumulating $52.1 billion, while European companies have secured $34.5 billion. Among AI subfields, machine learning startups lead in funding activity, with $131 billion raised, followed by AI software firms at $83.4 billion.

Outlook for AI investment in 2025

The AI sector’s record-breaking start to 2025 highlights the continued confidence of investors in AI-driven technologies. With significant capital inflows and ongoing advancements in AI applications, the industry remains a dominant force in the global technology market. As startups accelerate development and expand their capabilities, AI investment trends are expected to maintain strong momentum throughout the year.

Share this

Himani Verma

Content Contributor

Himani Verma is a seasoned content writer and SEO expert, with experience in digital media. She has held various senior writing positions at enterprises like CloudTDMS (Synthetic Data Factory), Barrownz Group, and ATZA. Himani has also been Editorial Writer at Hindustan Time, a leading Indian English language news platform. She excels in content creation, proofreading, and editing, ensuring that every piece is polished and impactful. Her expertise in crafting SEO-friendly content for multiple verticals of businesses, including technology, healthcare, finance, sports, innovation, and more.

previous

Data Security in Digital Transactions

next

How To Start A Box Truck Business: A Step-by-Step Guide