business resources

What is the Best Accounting Software for Small Businesses?

14 Oct 2025, 1:01 pm GMT+1

Businesses are constantly looking for solutions for invoicing, expense tracking, and tax compliance. 82% of companies plan to invest more in technology to automate and optimise compliance activities. Although platforms like Basetax, Xero, and QuickBooks are the commonly preferred choices, each serves different needs. Which platform provides the right balance of simplicity, automation, and affordability for your business?

Many entrepreneurs start off using spreadsheets or manual records for tracking expenses, filing taxes, and all the other tasks to manage accounts. However, these methods turn redundant as the business scales. PwC’s 2024 study on digitalisation in finance and accounting found that only 15% of Swiss organisations have fully digitised their finance and accounting functions.

Modern accounting tools like Basetax, Xero, and QuickBooks, are built to take the pressure off small business owners. They automate repetitive tasks, generate reports in seconds, and help you stay compliant with HMRC without needing to be a financial expert. Whether you’re a sole trader, a local café owner, or running an online shop, good software can save hours every week and give you a clearer picture of your cash flow.

So, what is the best accounting software for a small business? There isn’t a one-size-fits-all answer. The right choice depends on your goals, industry, and how hands-on you want to be with your finances.

What small businesses really need in accounting software?

Before diving into brand names and pricing, it’s worth stepping back to understand what small business owners truly need from accounting software. Many first-time users are overwhelmed by long lists of features, dashboards, and reports. But in reality, most small businesses need five key things:

- Simplicity- The best accounting software for small businesses should be easy to use, even if you don’t have an accounting background. Most small business owners don’t have time to learn complex systems or accounting jargon. They need a clean, intuitive interface where they can log in, create an invoice, record an expense, and check their bank balance, all within a few clicks.

- Automation- Automation is no longer a luxury; it’s a necessity. Modern accounting software automates repetitive tasks such as sending recurring invoices, matching bank transactions, and calculating tax returns. This not only saves time but also reduces human error. When your system does the heavy lifting, you can focus more on running your business.

- Accurate Reporting- Every business owner needs to know how their business is performing, not just once a year during tax season, but every month or even every week. The right software should offer easy-to-read financial reports that show profit, loss, cash flow, and outstanding invoices.

- Tax Compliance- Tax can be confusing for small businesses, especially with frequent changes in rules. Good accounting software should make tax filing easier by calculating liabilities automatically, generating tax summaries, and integrating with digital tax platforms like HMRC’s Making Tax Digital (MTD).

- Scalability- Your business might start small, but it won’t always stay that way. As you grow, you’ll likely need more features, payroll, multi-user access, or advanced reporting. The best accounting software for small businesses should be flexible enough to grow with you, without forcing you to switch systems halfway.

The best accounting software options in 2025

The market for small business accounting software has grown rapidly. There are dozens of tools promising to simplify bookkeeping, but not all are equally reliable or well-suited to small businesses. Below is a quick overview of the top contenders in 2025 and what they’re best known for:

1. Basetax

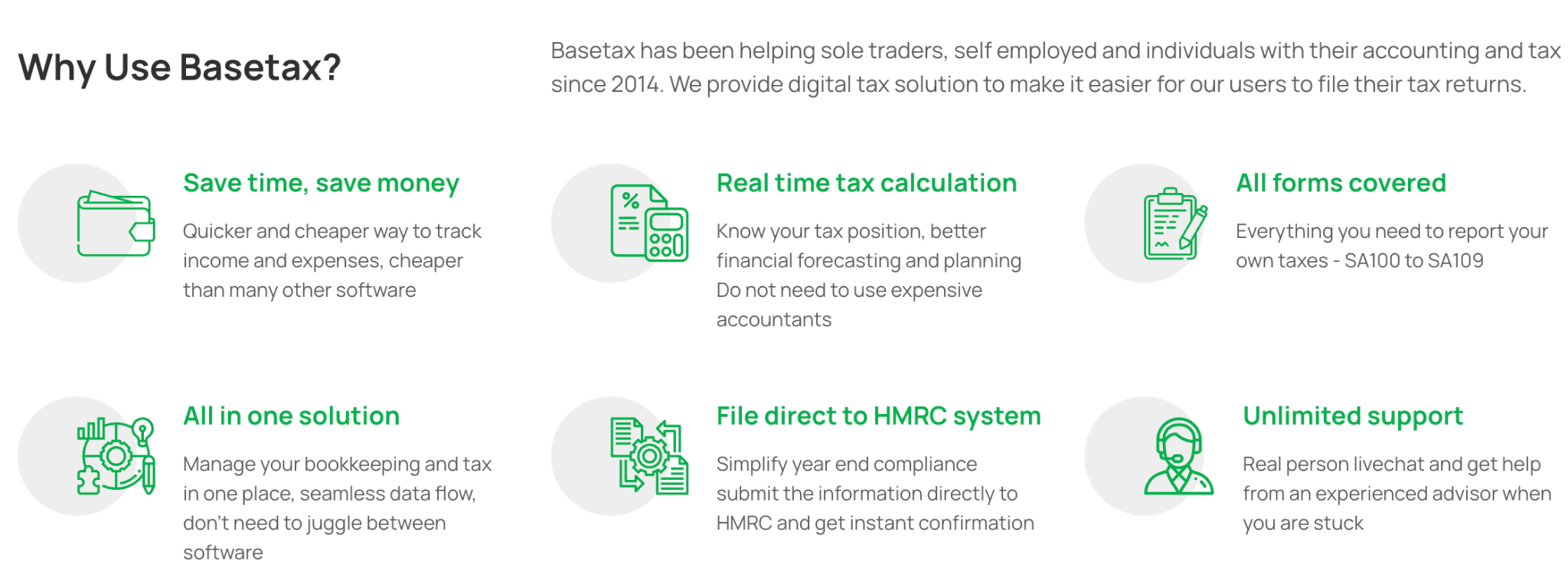

Basetax is one of the most streamlined tools built with simplicity in mind, especially for small business owners, contractors, and freelancers in the UK. It focuses heavily on automation, tax management, and affordability. While it doesn’t have as many integrations as Xero, Basetax stands out for making tax filing and expense tracking painless, even for non-accountants. Basetax supports a wide range of tax forms, including SA100 to SA109, and simplifies year-end compliance by submitting information directly to HMRC for instant confirmation. The free plan allows users to track income and expenses and estimate their taxes.

2. Xero

Xero, based in New Zealand, is trusted by millions of small businesses across the UK and beyond. Xero is cloud-based, easy to use, and integrates with over 1,000 business apps, from banks to payment platforms. It’s known for its beautiful design, powerful reporting, and automation tools.

3. QuickBooks Online

QuickBooks remains a household name in the accounting world. It’s packed with features, including payroll and project tracking. However, it can feel a bit heavy for very small businesses or sole traders who want a lighter, faster experience.

4. FreshBooks

FreshBooks shines in invoicing and time tracking. It’s an excellent choice for freelancers and service-based businesses that bill clients by the hour. However, it’s less robust for advanced reporting or tax management.

5. Sage Business Cloud Accounting

Sage is one of the oldest names in accounting software. Its cloud version has modernised significantly, offering a solid all-round package. It’s particularly good for UK-based small businesses that value compliance and local support.

Each of these tools can handle the basics: invoicing, expense tracking, and reporting. But when we talk about finding the best accounting software for small businesses, two platforms, Xero and Basetax, often come up in conversation. They represent two ends of the spectrum: one is a full-featured, established platform trusted by accountants worldwide; the other is a modern, simpler alternative designed to make tax and bookkeeping straightforward.

6. Financial Cents

Financial Cents takes a different tack by assisting small accounting teams in maintaining organizational efficiency behind the scenes, whereas the majority of accounting tools concentrate on bookkeeping and tax management. This platform for workflow management was created especially for bookkeepers and accountants who work with numerous clients. It guarantees that deadlines are fulfilled and nothing is overlooked with features like task tracking, document sharing, client communication, and workflow automation. Financial Cents serves as the final link in the chain for startups or small businesses that are already using programs like Xero or QuickBooks but find it difficult to effectively manage their workload.

Why Basetax stands out?

Choosing the best accounting software for your small business often comes down to two things: how comfortable you are with managing your own finances and how much automation you’d like the system to handle for you.

Feature / Aspect | Xero | Basetax | Notes |

| Target Users | Small to medium-sized businesses, growing teams, and accountants | Freelancers, contractors, and small business owners | Xero suits growing operations; Basetax is simpler for solo operators or small teams |

| Ease of Use | Moderate learning curve; feature-rich interface | Very easy to use; minimal setup | Basetax prioritises simplicity and clarity |

| Invoicing | Yes, fully customisable with templates | Yes, straightforward and fast | Xero offers more design flexibility; Basetax keeps it simple |

| Expense Tracking | Yes, automatic bank feeds, receipts upload | Yes, with simple categorisation | Both handle basic expense tracking effectively |

| Tax Compliance | Supports HMRC & Making Tax Digital; may require add-ons for full automation | Fully compliant with HMRC & MTD; automated calculations | Basetax focuses heavily on UK tax automation |

| Reporting | Advanced reporting: P&L, balance sheets, cash flow, budgets | Core reports: P&L, cash flow, tax summaries | Xero is more detailed, and Basetax is easy to read |

| Integrations | 1,000+ apps, including payment processors, CRMs, e-commerce | Limited but essential integrations | Xero is better for complex ecosystems; Basetax keeps it lean |

| Payroll | Available as an add-on | Not included | Xero can handle multi-employee payroll; Basetax is suited for self-employed or small teams |

| Cloud Access | Yes, fully cloud-based | Yes, fully cloud-based | Both accessible on desktop and mobile |

| Mobile App | Yes, iOS and Android | Yes, iOS and Android | Both allow invoicing, expense tracking, and basic reporting on the go |

| Multi-User Access | Yes, multiple users with permissions | Limited | Xero scales for teams; Basetax mainly for solo or small team use |

| Pricing | Ignite £16/month; Grow £37/month; Comprehensive £50/month; Ultimate £65/month (all excluding VAT) | Free plan available; paid services for tax return filing and annual accounts | Basetax is generally more affordable, a pay-per-service model vs Xero subscription tiers |

| Customer Support | Email, knowledge base, community forums | Responsive email and in-app support | Basetax support is personal and straightforward |

| Best For | Businesses needing scalable, feature-rich accounting with multiple integrations | Freelancers or small business owners wanting simplicity, automation, and stress-free tax handling | Xero grows with the business; Basetax keeps bookkeeping and taxes simple |

The best accounting software is the one that fits seamlessly into your day-to-day operations, saves you time, and gives you confidence in your financial data. With tools like Basetax, Xero, and QuickBooks, small business owners now have powerful options to choose from.

Share this

Shikha Negi

Content Contributor

Shikha Negi is a Content Writer at ztudium with expertise in writing and proofreading content. Having created more than 500 articles encompassing a diverse range of educational topics, from breaking news to in-depth analysis and long-form content, Shikha has a deep understanding of emerging trends in business, technology (including AI, blockchain, and the metaverse), and societal shifts, As the author at Sarvgyan News, Shikha has demonstrated expertise in crafting engaging and informative content tailored for various audiences, including students, educators, and professionals.

previous

The Intersection of Social Work and Healthcare: A Collaborative Approach

next

How Social Influences Shape Perceptions of Wellness