business resources

Britain is the leading FinTech centre in the world

8 Sept 2022, 3:37 am GMT+1

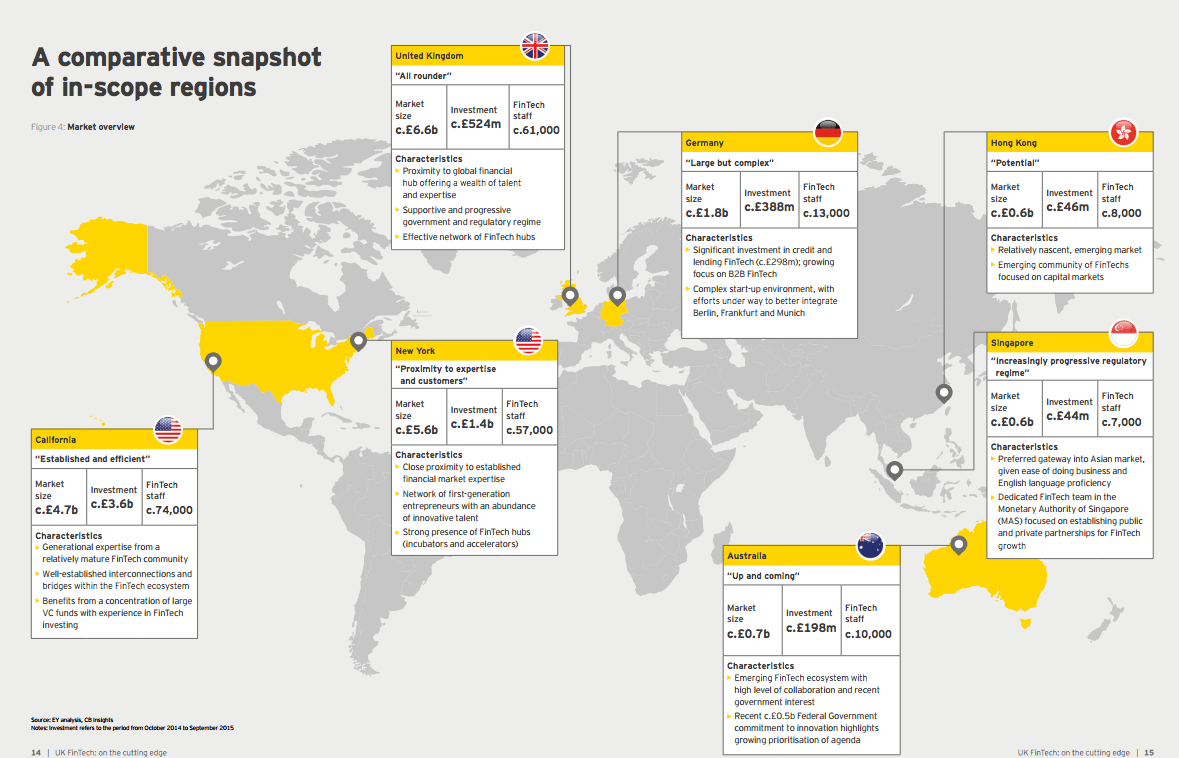

UK London Fintech sector top companies graphicSince 2008, the UK has grown in stature to be the global FinTech capital. A report recent released estimates that the UK FinTech sector represented c.£6.6b in revenue in 2015 and attracted c.£524m in investment. With c.61,000 people employed in the sector (c.5% of the total financial services (FS) workforce), more people work in UK FinTech than in New York FinTech, or in the combined FinTech workforce of Singapore, Hong Kong and Australia. The UK has always benefitted from a large FS industry. However, much of the recent success of the UK’s FinTech sector should be attributed to a well-served and well-functioning ecosystem that has a strong and proactive activity and global footprint.

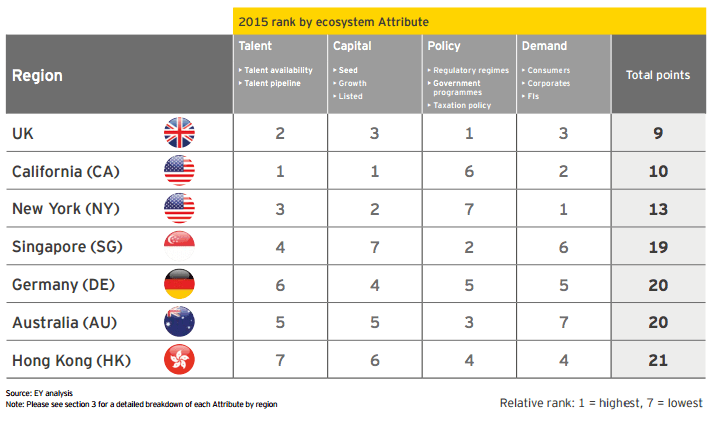

The report ranked Britain first amongst the world’s seven leading FinTech hubs, from Silicon Valley to Hong Kong, having compared these FinTech markets against four key criteria: the availability of talented staff, access to investment, the nature of government and regulatory policy, and the demand for FinTech services.

As the Fintech sector is growing globally in terms of investment, employment and the number of FinTechs, but it is far from mature a lot of opportunities are still ahead. The UK special due to his leading position in the financial world has an enviable lead today in FinTech. However, it is a competitive landscape an it is core vital that the UK keeps its hard and smart working pace, particularly as the sector approaches critical mass and starts to deliver a meaningful payback in jobs, innovation and growth. Strong competition is coming from other regions and a lot of places in the world rival for this position as the Fintech will reveal some of the top global corporations in the next years. Most of the UK competitor are actively competing to create best-in-class FinTech ecosystems, environments, and are increasingly progressive in their use of government investment, and regulatory policy to support the next global financial powerhouse FinTechs players. Some places around the world choose to specialise in promising sectors and disruptive technologies, and China is scaling up quickly across the sector. This report and insightful research suggests that in order to maintain its world-leading position, the UK will need to continue to work hard to deliver. The report demonstrates that the UK has a particularly good policy environment for FinTech, with the most supportive regulatory regime, and praised the core organisation - the Financial Conduct Authority (FCA) as one of the most progressive regulatory bodies in the world when it comes to FinTech. Benchmarked ranking of FinTech ecosystems globalUK Chancellor George Osborne, without doubt one of the drivers of this success, said about this recently:

Benchmarked ranking of FinTech ecosystems globalUK Chancellor George Osborne, without doubt one of the drivers of this success, said about this recently:

In 2014 I said I wanted Britain to be the global capital of FinTech. This report says that we have delivered exactly that: we have the most supportive tax and regulatory regimes in the world for FinTech, and we have the world’s leading FinTech ecosystem. But we’re not going to rest on our laurels. I know that we need to do more if we want to maintain this position, and so I welcome the report’s recommendations.

We are defining the future of global banking right here in the UK. This is all part of our long term plan to cement Britain’s position as the centre of global finance.

EY attribute Britain’s No 1 ranking to a deep talent pool, the strong availability of capital for investment in Fintech Start-ups, the most supportive government policy towards Fintech, and high-demand from clients in London’s world-leading financial services sector.

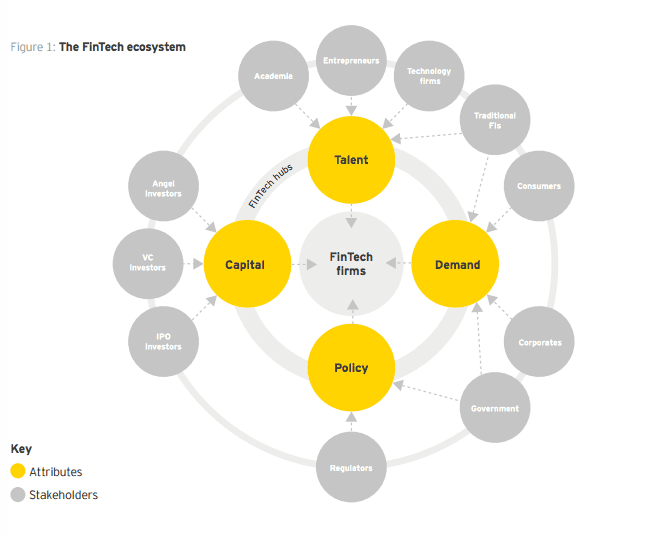

The focus of this report is on benchmarking the FinTech ecosystems, as we believe the strength of the ecosystem provides the strongest indication of the future health of this nascent sector. The report compareed the FinTech ecosystems of seven regions: the UK, California, New York, Germany, Singapore, Hong Kong and Australia. Although the US as a whole leads the Fintech sector in size the UK leads in influence and is in a trajectory to eventual pass US if it continues in this dynamic. Some of the attributes that make the UK sector Fintech a leading ecosystem: What makes the Fintech Leading Cluster Forms attractive, source EY reportThe strengthen of the UK FinTech market is that it combines solid global footprint expertise, a captive market of consumers and a facilitating regulatory framework with a tradition in Finance corporate history and also technological and digital leadership. The report view is based in the fact that a well-functioning FinTech ecosystem is built on four core ecosystem attributes (“Attributes”): 1. Talent: the availability of technical, FS and entrepreneurial talent. 2. Funding - Capital: the availability of financial resources for start-ups and scale-ups. 3. Policy - Regulations: government policy across regulation, tax and sector growth initiatives. 4. Business Demand: end-client demand across consumers, corporates and financial institutions (FIs). Some of the sectors leading the Fintech sector in the UK: Banking and payments, Credit and lending, Insurance, Retail and pensions, Investment management, wholesale banking and capital markets.

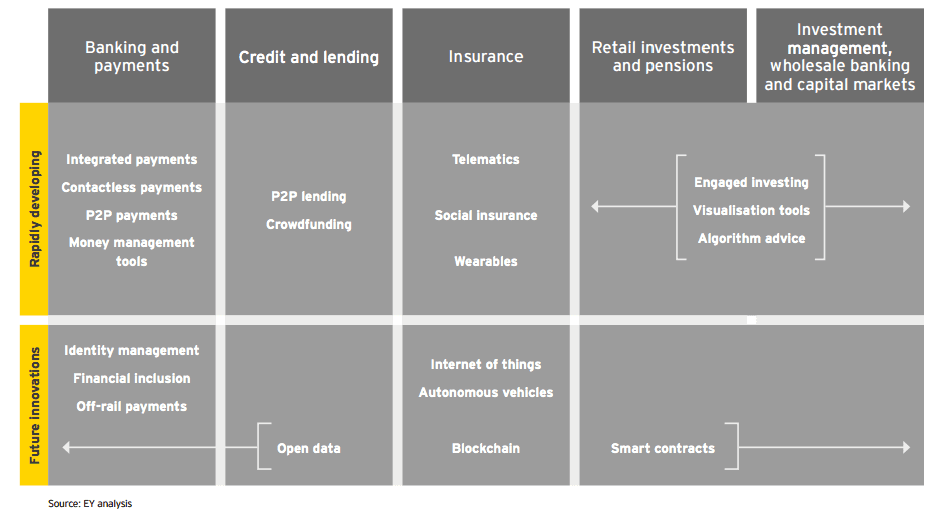

What makes the Fintech Leading Cluster Forms attractive, source EY reportThe strengthen of the UK FinTech market is that it combines solid global footprint expertise, a captive market of consumers and a facilitating regulatory framework with a tradition in Finance corporate history and also technological and digital leadership. The report view is based in the fact that a well-functioning FinTech ecosystem is built on four core ecosystem attributes (“Attributes”): 1. Talent: the availability of technical, FS and entrepreneurial talent. 2. Funding - Capital: the availability of financial resources for start-ups and scale-ups. 3. Policy - Regulations: government policy across regulation, tax and sector growth initiatives. 4. Business Demand: end-client demand across consumers, corporates and financial institutions (FIs). Some of the sectors leading the Fintech sector in the UK: Banking and payments, Credit and lending, Insurance, Retail and pensions, Investment management, wholesale banking and capital markets. Fintech - Areas of innovation by subsector

Fintech - Areas of innovation by subsector

Read EY’s report, UK FinTech: On the cutting edge EY’s conclusions are based on detailed analysis of FinTech practises across the globe, and interviews with over 65 FinTech experts. The report also makes a number of recommendations, in order to ensure that the UK cements its position as the world’s leading FinTech ecosystem. The government welcomes these recommendations, and is considering how best to take them forward. Britain’s FinTech sector supports over 61,000 jobs and generates billions of pounds of revenue for the UK’s economy. Its development has kept the UK’s financial services sector on the cutting edge of innovation, and has increased competition and choice in banking, helping customers and businesses to get better services. UK Fintech - A comparative snapshotof in-scope regions

UK Fintech - A comparative snapshotof in-scope regions

Share this

Contributor

Staff

The team of expert contributors at Businessabc brings together a diverse range of insights and knowledge from various industries, including 4IR technologies like Artificial Intelligence, Digital Twin, Spatial Computing, Smart Cities, and from various aspects of businesses like policy, governance, cybersecurity, and innovation. Committed to delivering high-quality content, our contributors provide in-depth analysis, thought leadership, and the latest trends to keep our readers informed and ahead of the curve. Whether it's business strategy, technology, or market trends, the Businessabc Contributor team is dedicated to offering valuable perspectives that empower professionals and entrepreneurs alike.

previous

Does Every Small Business Need Online Marketing?

next

How To Manage Your Cash Flow With Invoice Finance