business resources

How to Develop a Systematic BTCUSDT Trading Routine

27 Jan 2026, 2:41 am GMT

Trading BTCUSDT requires discipline, planning, and consistency to succeed in highly volatile cryptocurrency markets. Prices can swing dramatically within minutes, and emotional decisions often lead to significant losses. A structured trading routine helps you manage risk, improve timing, and consistently review performance. Following a repeatable, data-driven approach allows traders to make informed decisions, reduce stress, and increase the probability of profitable trades. This article provides a step-by-step guide for developing a reliable BTCUSDT trading routine that can be applied daily.

Setting Up Clear Trading Goals and Parameters

Defining clear objectives is critical for maintaining discipline during trading. Goals may include short-term gains, long-term accumulation, or hedging against market volatility. Traders must assess risk tolerance and allocate capital according to their financial capacity and objectives. Establishing routine parameters improves consistency and reduces impulsive decisions. Parameters may include maximum daily trade size, stop-loss and take-profit thresholds, and daily or weekly time commitments for market analysis and trading. Clear goals also support psychological resilience, preventing panic during sudden price swings. When objectives and boundaries are well defined, following the routine becomes easier, reducing stress while increasing overall performance in BTCUSDT trading.

Understanding BTCUSDT Market Dynamics

BTCUSDT represents the trading pair between Bitcoin and USDT, a stablecoin, and serves as a widely used benchmark for cryptocurrency trading. Its liquidity tends to be high, allowing traders to enter and exit positions with minimal slippage, though volatility remains higher than that of traditional assets. Price swings often follow patterns influenced by technical, fundamental, and sentiment-driven factors. Monitoring trading volume trends and recognizing periods of high or low liquidity are essential for effective decision-making. Key influences on BTC prices include macroeconomic announcements, regulatory updates, and unexpected developments in the blockchain space. Observing a BTCUSDT Zoomex chart helps identify trends, support and resistance levels, and potential breakout points, forming the foundation of any systematic trading routine. Understanding these dynamics ensures strategies are applied in suitable market conditions, increasing effectiveness.

Building a Daily Pre-Trading Checklist

A pre-trading checklist ensures every trading day starts systematically, reducing emotional errors and improving preparation. The checklist should cover essential market and portfolio conditions before executing any trades. Key items include reviewing overnight BTC price action and global market news, confirming liquidity and trading volume, and setting alerts for key support and resistance levels. Monitoring economic calendars for major announcements that affect BTC helps prepare for volatility. Checking portfolio exposure and current open positions helps avoid overleveraging. Daily chart scans, order book verification, and confirmation that all indicators function correctly further solidify routine discipline. Recording deviations from the plan allows continuous improvement and ensures strategies evolve with experience.

- Review overnight BTC price action and global market news.

- Confirm liquidity and volume conditions.

- Set alerts for key support and resistance levels.

- Review economic calendars for major announcements.

- Check portfolio exposure and open positions.

- Scan charts for patterns and trend signals

- Verify order book depth and spread.

- Confirm that trading tools and indicators are functioning.

- Record any deviations from the plan for future learning.

Selecting and Applying Trading Strategies

A systematic trading routine relies on strategies tailored to market conditions. Common approaches for BTCUSDT include trend-following, scalping, swing trading, and range trading. Each strategy requires testing on historical data to validate effectiveness and optimize parameters. Algorithmic or rules-based strategies support consistent execution, reducing emotional interference. Combining technical analysis, indicators, and market sentiment enhances strategy performance. The following table summarizes key characteristics for practical reference:

| Strategy Type | Timeframe | Risk Level | Core Principle | Best Market Condition |

| Trend Following | 1–4 hours | Medium | Ride prevailing trend | Strong directional movement |

| Scalping | 1–15 mins | High | Small profits on frequent trades | High liquidity, low spreads |

| Swing Trading | 4 hours–1 day | Medium | Exploit short-term price swings | Volatile markets with clear support/resistance |

| Range Trading | 1 hour–1 day | Low–Medium | Buy low, sell high within ranges | Sideways markets with defined levels |

Selecting a strategy should consider both the market environment and personal risk appetite. Consistent practice and adjustment of strategies improve long-term results while reducing reactive trading.

Executing Trades with Discipline

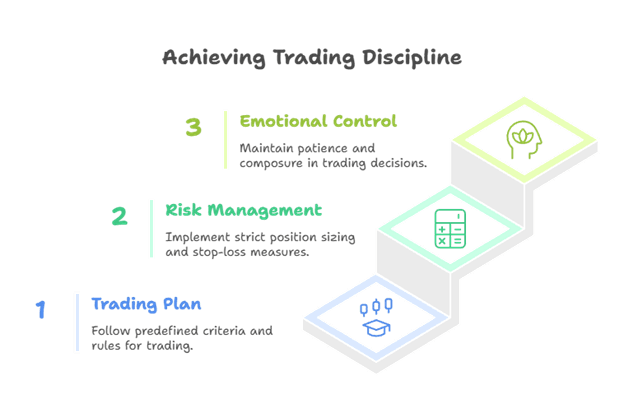

Execution is the most critical phase in a systematic BTCUSDT routine. Sticking to pre-defined entry and exit rules prevents impulsive decisions that often result in losses. Each trade should begin with a clear risk-reward assessment to determine whether potential gains justify exposure. Position sizing is vital for capital preservation and avoiding over-leverage. Implementing stop-loss, take-profit, and trailing stop mechanisms further protects profits and mitigates losses. Maintaining consistency in execution allows traders to trust their strategy even in volatile periods. Discipline during this phase ensures long-term profitability and reinforces confidence in the routine.

Monitoring, Reviewing, and Adjusting the Routine

Maintaining a trading journal is essential for systematic improvement. Every BTCUSDT trade should record entry and exit points, the strategy used, prevailing market conditions, emotional state, and profit or loss outcome. Reviewing trades weekly or monthly identifies recurring mistakes, strengths, and strategy adjustments needed for better results. Continuous assessment ensures adaptation to evolving market behavior. This feedback loop allows fine-tuning of parameters, reinforcing risk management practices, and improving decision-making. Traders who consistently review performance develop a deeper understanding of market dynamics, increasing both confidence and profitability in BTCUSDT trading.

Leveraging Zoomex to Streamline a Systematic Trading Routine

Zoomex provides a professional, user-friendly environment to execute BTCUSDT trading routines efficiently. The platform offers spot and contract trading, supporting flexible strategies for both short-term and long-term traders. Copy trading allows following top-performing traders to learn new approaches and refine personal routines. Fast execution speeds below 10 milliseconds enable precise entries and exits, while robust security measures protect assets during frequent trades. Flexible deposit and withdrawal options maintain liquidity for routine adjustments and strategic shifts. Zoomex combines a professional-grade interface with comprehensive tools, simplifying the implementation of a structured BTCUSDT trading routine.

Integrating Risk Management and Continuous Learning

Advanced risk management techniques enhance the effectiveness of systematic routines. Position sizing, portfolio diversification, and dynamic stop-loss adjustments reduce exposure to extreme market events. Continuous education in trading, market behavior, and technical tools ensures adaptation to evolving conditions. Integrating webinars, courses, and market analysis into a routine strengthens decision-making skills. Learning complements systematic trading by reinforcing discipline, supporting confidence in execution, and promoting long-term consistency. Traders who combine risk management with ongoing education are better prepared to navigate the unpredictable BTCUSDT market.

Conclusion

Developing a structured BTCUSDT trading routine is essential for success in volatile markets. Key components include understanding market dynamics, setting clear goals, building pre-trading checklists, executing trades with discipline, maintaining performance reviews, and implementing effective risk management. Continuous learning and strategy refinement further enhances outcomes. Platforms like Zoomex enable traders to apply systematic approaches efficiently, securely, and confidently. Adopting this structured methodology reduces emotional trading, improves profitability, and provides a clear pathway toward mastering BTCUSDT markets over the long term.

Share this

Peyman Khosravani

Industry Expert & Contributor

Peyman Khosravani is a global blockchain and digital transformation expert with a passion for marketing, futuristic ideas, analytics insights, startup businesses, and effective communications. He has extensive experience in blockchain and DeFi projects and is committed to using technology to bring justice and fairness to society and promote freedom. Peyman has worked with international organisations to improve digital transformation strategies and data-gathering strategies that help identify customer touchpoints and sources of data that tell the story of what is happening. With his expertise in blockchain, digital transformation, marketing, analytics insights, startup businesses, and effective communications, Peyman is dedicated to helping businesses succeed in the digital age. He believes that technology can be used as a tool for positive change in the world.

previous

Top 9 Features of Legal Practice Management Software

next

Scaling EV Fleet Charging as Your Business Grows