business resources

Navigating Personal Injury Claims: A Legal Guide for Business Leaders

26 Jan 2026, 4:31 pm GMT

Personal injury claims are often viewed as isolated legal events, but for business leaders, they’re something very different: strategic risks with financial, reputational, and governance implications.

Whether an injury happens on company property, through employee actions, or because of a third-party contractor, things can escalate faster than most teams expect.

That’s why Middletown personal injury lawyers, drawing on years of real case experience, agreed to share the patterns they see again and again in this guide, so you can understand what actually triggers claims, how they unfold, and what you can do to protect both your business and yourself.

- Understanding where business liability actually attaches

Business liability extends far beyond obvious hazards, and the most common exposure comes from premises liability, injuries suffered by customers, vendors, or visitors due to unsafe conditions on your property.

This includes retail spaces, offices, warehouses, and any environment under your control. Importantly, liability exists even if an employee or contractor created the hazard.

Commercial general liability policies typically cover:

- bodily injury

- property damage

- personal injury (such as defamation)

- medical payments

But policy limits for businesses are much higher than personal policies, so they invite more aggressive litigation because insurers know substantial money is at stake. Claims become long-term legal events rather than quick settlements.

Gaps in coverage are equally dangerous. If you’re underinsured, uninsured, or violate policy terms, you may face direct financial exposure.

- How negligence and duty of care shape every claim

You likely already know that as a plaintiff, you must prove four elements—duty of care, breach, causation, and damages. But what you also need to know is that businesses are held to a higher standard than individuals because they control the premises and profit from public interaction.

A key concept is foreseeability. You’re not expected to prevent impossible risks—but you must protect against dangers a reasonable business operator would anticipate. E.g., a wet floor, uneven steps, or faulty equipment are foreseeable hazards.

Constructive knowledge is the final critical doctrine. You can’t avoid responsibility by claiming ignorance.

If a hazard existed long enough that you should have discovered it, the law treats that as knowledge.

- When business leaders face personal liability

If a leader directly participates in negligent conduct, the corporate shield disappears. Courts may also pierce the corporate veil if leaders fail to treat the business as a separate legal entity.

In some cases, directors can also face personal exposure when their role shifts from oversight into direct involvement in the conduct that causes harm.

The business judgment rule still offers a degree of protection, but only where choices are made in good faith, with appropriate care, and genuinely aimed at advancing the company’s interests. That is why it is essential to keep clear records of how you reached key decisions, perform meaningful due diligence, and obtain legal guidance when the stakes are high.

- Managing risk through employees and contractors

Companies face vicarious liability for employee negligence when it occurs within the scope of employment (e.g., is connected to job responsibilities, takes place during work hours or on company premises, and represents foreseeable behavior for that role).

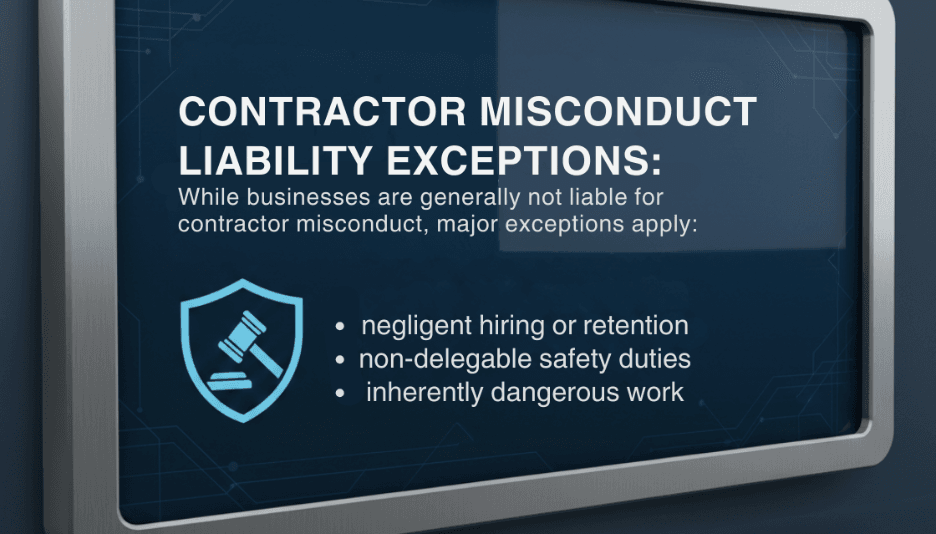

Independent contractors create a false sense of security here:

So, as you can see, if you hire a contractor without verifying qualifications, especially for hazardous tasks, you remain liable for resulting injuries.

Another trap is misclassification. If you control how work is performed, not just the outcome, courts may reclassify contractors as employees. That instantly triggers vicarious liability.

- What damages really cost your business

Besides medical bills, compensatory damages include:

- economic losses (treatment costs, lost wages, future care) and,

- non-economic damages (pain, emotional distress, reduced quality of life), which often exceed medical costs.

Punitive damages are more dangerous. They punish reckless behavior and are often excluded from insurance coverage. This creates direct financial exposure for the company (and sometimes leadership).

Most states apply comparative negligence, meaning damages are reduced based on the plaintiff’s share of fault. Even if your business is only 30% responsible, you still pay 30% of the damages.

- Strategic risk management protects more than profits

Without documentation like:

- maintenance logs

- inspections records

- incident reports

- photos

- witness statements, etc.

- you can't prove you acted reasonably, even if you did. In other words, make sure you're covered at all times.

Prevention also includes regular inspections, prompt repairs, staff training, signage, and security measures. As per OSHA, prevention programs like these reduce incidents significantly, by up to 60%.

Also, keep in mind that insurance is necessary but rarely enough. Policies contain exclusions, which means that leaders must understand coverage limits, notification requirements, and defense arrangements.

As you can see, personal injury claims are governance events for business leaders, and the strongest protection comes from proactive systems.

Share this

Pallavi Singal

Editor

Pallavi Singal is the Vice President of Content at ztudium, where she leads innovative content strategies and oversees the development of high-impact editorial initiatives. With a strong background in digital media and a passion for storytelling, Pallavi plays a pivotal role in scaling the content operations for ztudium's platforms, including Businessabc, Citiesabc, and IntelligentHQ, Wisdomia.ai, MStores, and many others. Her expertise spans content creation, SEO, and digital marketing, driving engagement and growth across multiple channels. Pallavi's work is characterised by a keen insight into emerging trends in business, technologies like AI, blockchain, metaverse and others, and society, making her a trusted voice in the industry.

previous

Finunion Unveils Core Product Capabilities: Instant Verification, Flexible Funding Options, and Real-Time Crypto Swaps

next

How Can European Aerospace Sector Competitiveness Be Boosted?