business resources

The Industries Most at Risk of Tariff Disruptions—And What They’re Ignoring

3 Jul 2025, 5:15 pm GMT+1

As global trade tensions escalate, the industries most vulnerable to tariffs are the ones least prepared to adapt. Despite mounting data showing where risks lie, many businesses continue to treat tariff disruption as an abstract threat rather than a looming operational reality. The real risk isn’t just in the exposure itself but in the gap between risk and response.

Uncovering the Exposure Gap

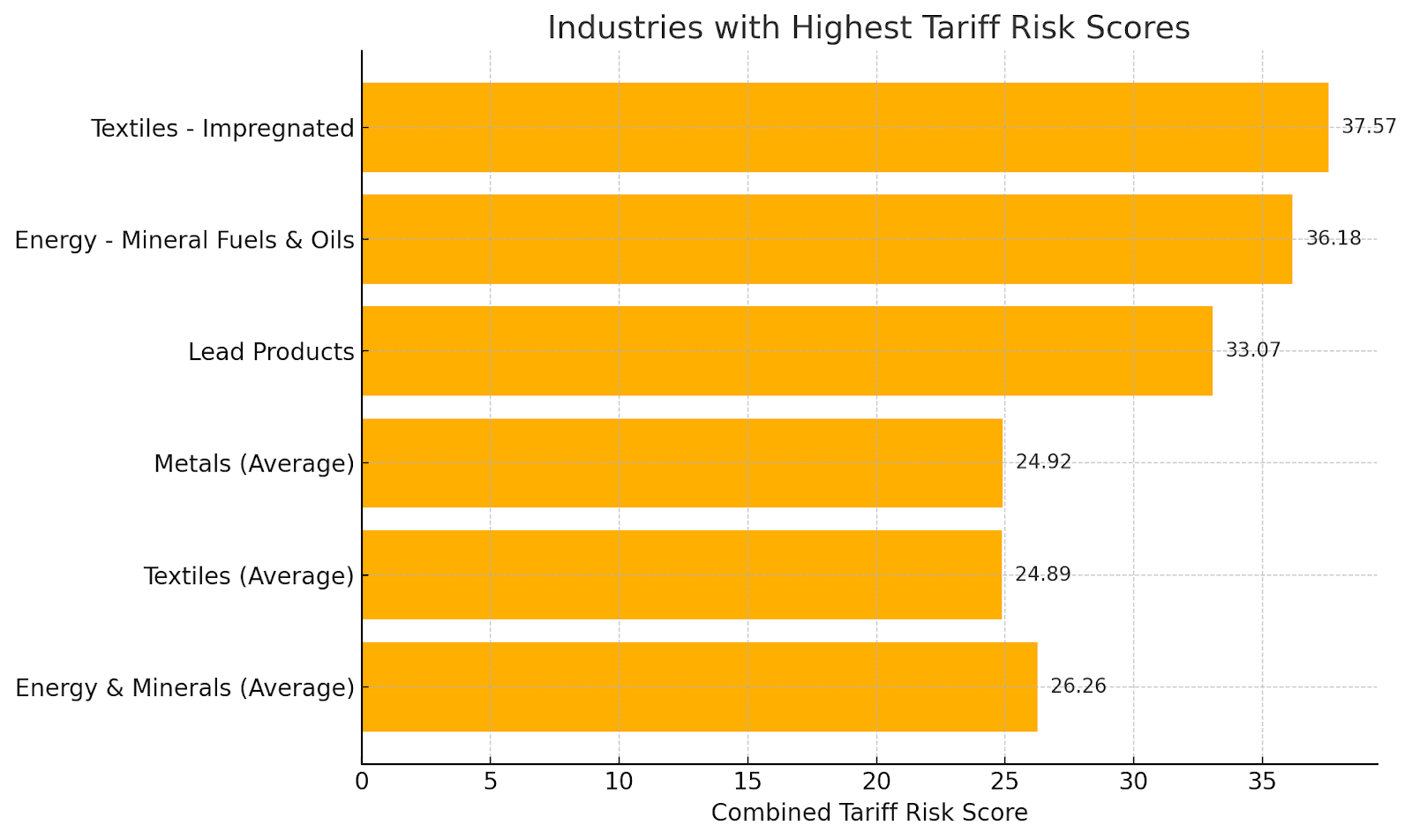

The Kaplan Group recently conducted an exclusive study of U.S. trade data which revealed that while only 2.8% of total trade value falls within the highest-risk tier, this small sliver represents some of the most structurally exposed industries in the country.

- Textile - Impregnated (fabrics infused with materials to add durability, waterproofing, or fire resistance) holds the top risk score at 37.57, with nearly 99% of its trade value concentrated in three countries: Canada, Mexico, and China.

- The Energy – Mineral Fuels & Oils sector ranks close behind, with 56.01% of trade dependent on China alone.

- Lead Products exhibit a staggering 83.02% exposure to Canada, placing them in a precarious position should cross-border tensions flare.

But here’s the more troubling trend: across these industries, many aren’t taking active steps to reduce their exposure. Data shows that while most companies are attempting to address these challenges, nearly a third of companies are not.

Excuses That Cost

Despite clear data on which industries are most exposed to tariff risk, preparedness remains low across high-risk sectors.

Industries such as textiles, energy, and base metals exhibit high tariff exposure driven by a combination of country concentration, supplier reliance, and limited diversification. Yet many businesses within these sectors have not implemented even basic tariff mitigation strategies such as risk scoring, contingency planning, or sourcing flexibility.

In fact, during the analysis, we found that risk scores were often highest in sectors with relatively low trade volumes, such as textiles (average risk score: 24.89; total trade value: $1.59B), suggesting that smaller or mid-size industries are both more vulnerable and less likely to have resources allocated to risk management.

So, why the lack of preparedness?

Industry leaders frequently cite reasons like:

- “We’ve used the same suppliers for 20 years—it’s too complex to change now.”

- “Tariffs are temporary. We’ll ride it out.”

- “Sourcing alternatives are too expensive.”

- “We’d rather absorb the costs than lose production time.”

These rationales leave companies increasingly exposed as trade volatility grows.

What the Data Tells Us

The most important insight from our study isn’t just which industries are exposed. It’s how deeply concentrated their trade relationships are.

These narrow relationships mean that even small shifts in trade policy can produce outsized operational and financial consequences, from price hikes to supply shortages to payment delays.

Moreover, industries with high concentration risk often lack supplier redundancy or alternative sourcing plans. In the event of tariff escalation or geopolitical strain, these sectors will face increased freight costs, slower fulfillment, and a higher likelihood of customer contract breaches or financial strain.

Why Tariff Risk Can’t Be Ignored

Tariff risk is not a niche financial concern but a strategic operational threat. The longer businesses wait to address it, the more painful the correction becomes.

Worse, tariff disruption doesn’t just affect direct importers or exporters. The ripple effects extend through credit terms, delivery times, inventory costs, and even customer loyalty. A single disruption in a concentrated supply chain can result in cascading payment delays and contract defaults throughout the entire network.

Our analysis shows that industries with the highest tariff risk scores also tend to be the most concentrated, both geographically and supplier-wise. That combination makes them uniquely vulnerable to rapid destabilization—the kind that erodes balance sheets and investor confidence alike.

A Framework for Proactive Planning

Tariffs may be a geopolitical lever, but their impact is entirely local when it comes to business outcomes. To stay ahead of the risk curve, high-exposure industries must implement proactive tariff mitigation strategies that go beyond traditional credit checks.

Here’s what businesses should be doing now:

- Add tariff exposure scoring to quarterly financial reviews. Just like interest rates or inflation, tariff volatility must be tracked and modeled as part of regular reporting.

- Conduct country and supplier concentration audits. Identify if 50%+ of your trade flows through one country or supplier, and model disruption scenarios.

- Reevaluate your sourcing strategy. Shifting even 15–20% of sourcing to alternate markets can create the flexibility needed to absorb short-term shocks.

- Adjust credit risk models. Companies in high-risk industries should not be treated the same as those with diverse, balanced portfolios.

- Engage cross-functional planning teams. Tariff mitigation is not just the CFO’s job. It touches procurement, operations, finance, and legal.

Looking Ahead

With global trade becoming more fragmented, the likelihood of recurring tariff shocks is high. The industries most exposed are also the ones most likely to suffer a domino effect of delayed payments, supplier churn, and operating margin collapse.

But the good news is that risk exposure doesn’t have to mean risk failure. Businesses that act now by assessing tariff risk in every financial review and building contingency plans can protect not just their margins, but their reputations.

In the end, it’s not tariffs that determine who wins or loses. It’s how prepared you are when they hit.

Share this

Dean Kaplan

Author

Dean Kaplan is president of The Kaplan Group. He writes about business debt collection & contract negotiations & provides financial advice.

previous

WhatsApp API Web Service: An Expert Guide for 2025

next

Understanding Workers’ Compensation: A Simple Guide for Employees