business resources

Why Gold Is Watching the Fed’s Next Chair

28 Jan 2026, 4:14 pm GMT

The recent crisis between the United States and the European Union, following President Trump's willingness to annex (or purchase) Greenland, has shaken the markets, especially after the threat of 10% tariffs (which were later supposed to increase to 25%) against the eight European countries that declared themselves in favor of defending Greenland's sovereignty.

On January 22, the EU convened an emergency summit to suspend the trade agreement with the United States. Trump then backed down at Davos, withdrawing the tariffs scheduled for February 1st.

This is not the first time this escalation-backtrack pattern has emerged. Markets have so far proven able to recover losses quickly. Still, the climate of uncertainty remains high, and any negative news stemming from geopolitical turbulence or unexpected economic data can trigger sudden downturns. Especially considering equity valuations at all-time highs (a forward P/E of 22x), which further increase vulnerability to geopolitical shocks.

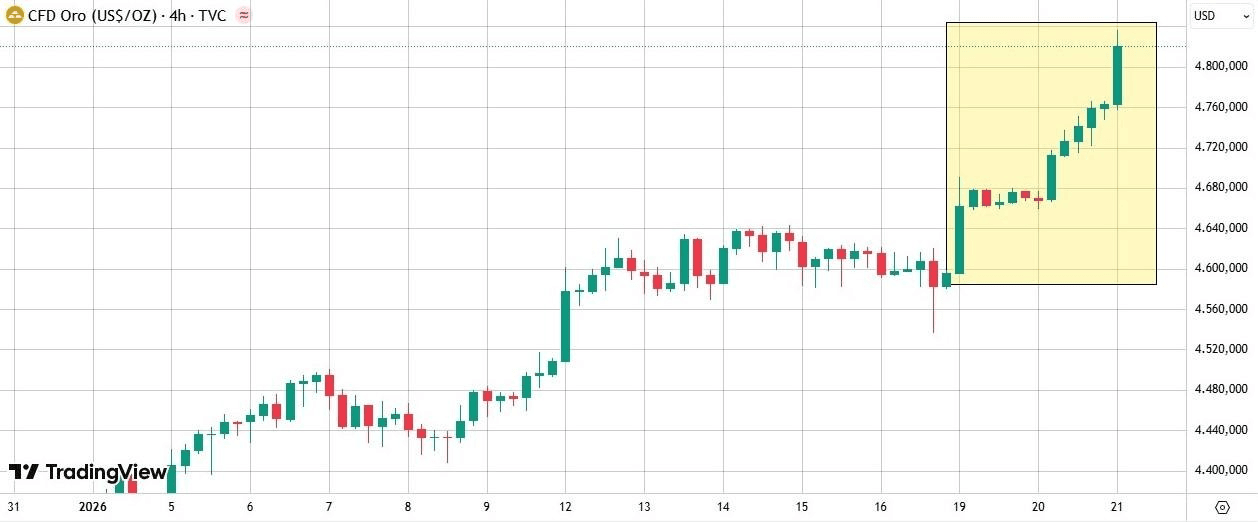

The only asset class that seems untouched by these dynamics and continues to deliver exceptional performance is gold, which on January 22 reached $4,935/oz, marking a 10% increase in one month. Demand for gold from Central Banks remains stable and, as shown in the chart below, it remains a unique store of value amid volatility driven by global instability. Upon news of new tariffs, the gold price saw a sudden surge.

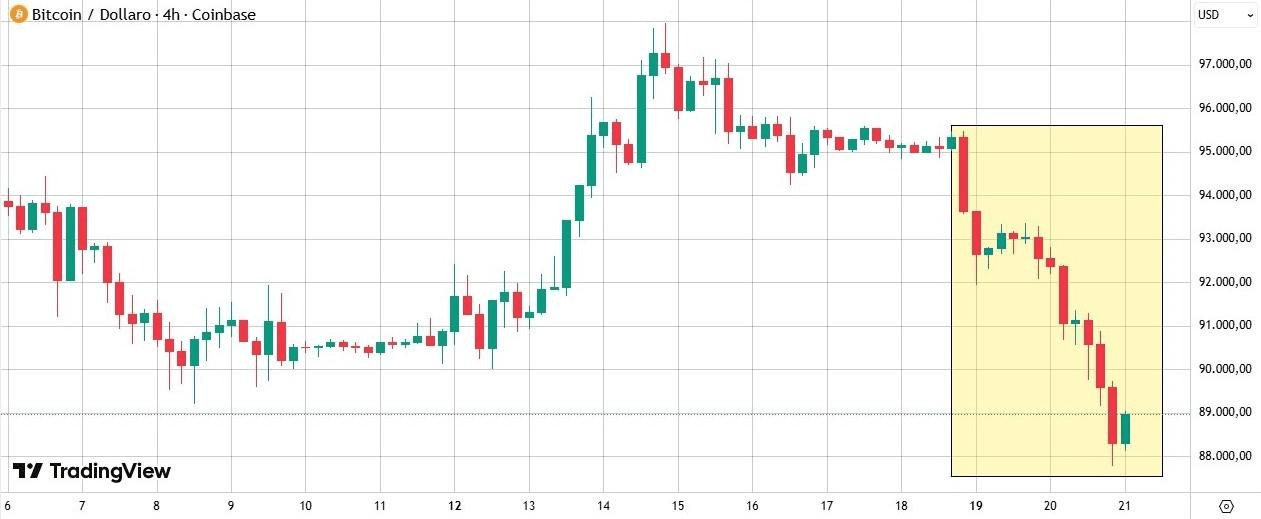

Bitcoin and stock indices, including the so-called Mag7, instead recorded mirror-image declines

|

|

Compressed real rates and a weakened dollar (which also pushed GBP/USD to a four-month high) create a structurally favorable environment for gold. In a geopolitical context where multiple potential conflict fronts are open, commercial and otherwise, gold is the only asset class capable of providing "convexity" — that is, protection against asymmetric risks that indices and other risk assets (like cryptocurrencies) cannot offer.

Consequently, despite the extremely high valuation gold has reached over the past 2 years, if our assessment anticipates a worsening of the global geopolitical landscape, there is room for further purchases.

The Fed Risk

A central point for gold price dynamics revolves around monetary policy. Interest rate management has a significant impact on gold valuations, and, consequently, the focus in the coming months will be on inflation data (still above target) and employment data.

May 2026 will be the deadline for appointing the next Fed Chair. The choice will have significant repercussions: an aggressive rate-cutting policy will further reinforce the current trend. In contrast, if the current consensus prevails — a single 25bp cut in 2026 (final range: 3.25%-3.50%) versus the 5-6 priced in at the beginning of 2025 — gold will face some downward pressure.

Conclusion

Gold reaffirms its status as the only safe haven amid the turbulence of world politics. In a framework of structural conflict, it cannot be absent from any portfolio as protection against a stock market that is beginning to show the first cracks in its fundamentals.

However, analysts' eyes are all on the Fed and how it will be restructured (if this happens): likely the biggest market mover in the coming months.

Share this

Peyman Khosravani

Industry Expert & Contributor

Peyman Khosravani is a global blockchain and digital transformation expert with a passion for marketing, futuristic ideas, analytics insights, startup businesses, and effective communications. He has extensive experience in blockchain and DeFi projects and is committed to using technology to bring justice and fairness to society and promote freedom. Peyman has worked with international organisations to improve digital transformation strategies and data-gathering strategies that help identify customer touchpoints and sources of data that tell the story of what is happening. With his expertise in blockchain, digital transformation, marketing, analytics insights, startup businesses, and effective communications, Peyman is dedicated to helping businesses succeed in the digital age. He believes that technology can be used as a tool for positive change in the world.

previous

Agentic AI in Banking: An Enterprise Guide to Safe, Explainable Autonomy

next

The Fox and The Lion: Machiavelli's Guide to Navigating Liars and Manipulators