business resources

AI And Taxes: Key Insights, Current Infrastructure & Frameworks

19 Sept 2025, 10:01 am GMT+1

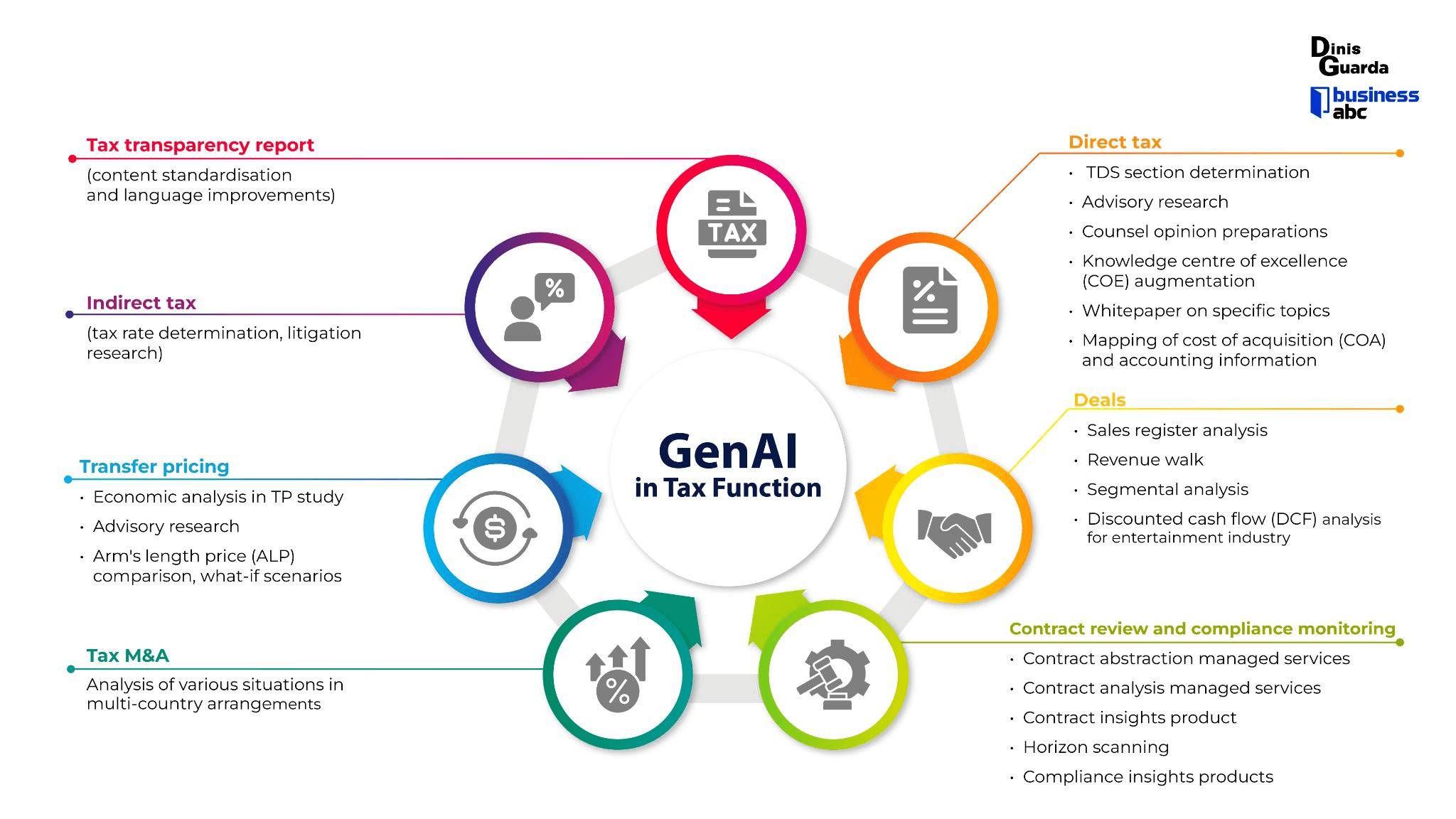

Generative AI (GenAI) for every central area of the tax function is an enabler of transformation: governance & leadership, people, controls, processes, and technology/data, as well as determining whether tasks are more suited for insourcing (done internally) or outsourcing.

Tax administrations worldwide are undergoing a fundamental transformation driven by the adoption of digital technology, the development of regulatory frameworks, and shifting taxpayer expectations.

This convergence of technology, regulation, and operations creates both an urgent necessity and an unprecedented opportunity for the deployment of artificial intelligence in fiscal governance.

Generative AI (GenAI) can and will increasingly transform every significant area of the tax function. It divides use cases across tax domains and maps them to these types of GenAI capabilities:

- General data analysis in real time of tax systems

- Document generation

- Document summarisation & retrieval

- Knowledge extraction

- Data querying & analysis

- Data visualisation & image generation

- Timeline of taxes, per year, month, week and capacity to go past future

- Create predictions and scenarios of data

- Real-time AI chatbots and AI Agents that can interact and answer queries and learn as they get more data

Key insights to look

1. Breadth of AI impact in tax

AI impacts nearly every tax sub-domain, from core accounting and compliance to more specialised areas such as transfer pricing, R&D incentives, VAT withholding taxes, HR/payroll outsourcing, and even M&A tax structuring. Suggests AI is not just about automation, but about decision support and knowledge management across the tax lifecycle.

2. Generative AI’s role by capability

- Document generation: automate drafting of tax memos, audit responses, contracts, and compliance documentation.

- Summarisation & retrieval: digest lengthy rulings, regulations, and case law; surface relevant precedents instantly.

- Knowledge extraction: scan vast, unstructured sources (such as tax codes, global treaties, and contracts) to highlight obligations or risks.

- Data querying & analysis: enable conversational analytics across decades of financial/tax data, identifying anomalies, patterns, or risk exposures.

- Data visualisation & image generation: produce dashboards, interactive risk maps, and scenario simulations for CFOs and policymakers.

3. Strategic functional areas AI can enhance

- Risk & compliance: automated risk scoring, early fraud detection, and monitoring of cross-border transactions.

Policy & planning: simulate impact of new tax laws (e.g., Pillar 2, transfer pricing, ESG incentives). - Operations & process: faster onboarding for HR/payroll, streamlined VAT reporting, improved indirect tax workflows.

- Advisory & strategy: support for mergers & acquisitions, equity compliance, and capital treatment decisions.

- Predict scenarios and understand risks and possible areas of success and error.

- Real time data for looking at multiple scenarios and ways to improve solutions.

4. Insource vs outsource balance

- Insourcing: high-value analytics, policy simulations, and risk management often require internal control for confidentiality, accountability, and regulatory oversight.

- Outsourcing: routine data processing, payroll, or specific compliance tasks may be efficiently managed by external providers, with GenAI enhancing their speed and accuracy.

5. Governance & leadership are central

The bottom line of AI strategies reminds us: AI won’t deliver value without a clear definition of KPIs, reskilling, and solid governance. Tax administrations and corporate tax teams need.

- Leadership Frameworks for Responsible Digital Transformation: AI Adoption.

- Controls for fairness, explainability, and compliance with AI regulations (EU AI Act, OECD standards).

- Skilled people (data scientists + tax experts) to supervise AI agents.

- Prepare for disruption as all AI models will impact the entire financial systems of countries.

AI brings a multi-dimensional, real-time, new set of toolkits to tax: automating routine document tasks, augmenting human decision-making with deep knowledge retrieval, and enhancing oversight with analytics and visualisation.

The transformative promise is a shift from reactive, compliance-heavy tax management to proactive, insight-driven fiscal strategy. Governments and corporations can reduce errors, close tax gaps, and plan smarter for future regulatory shifts.

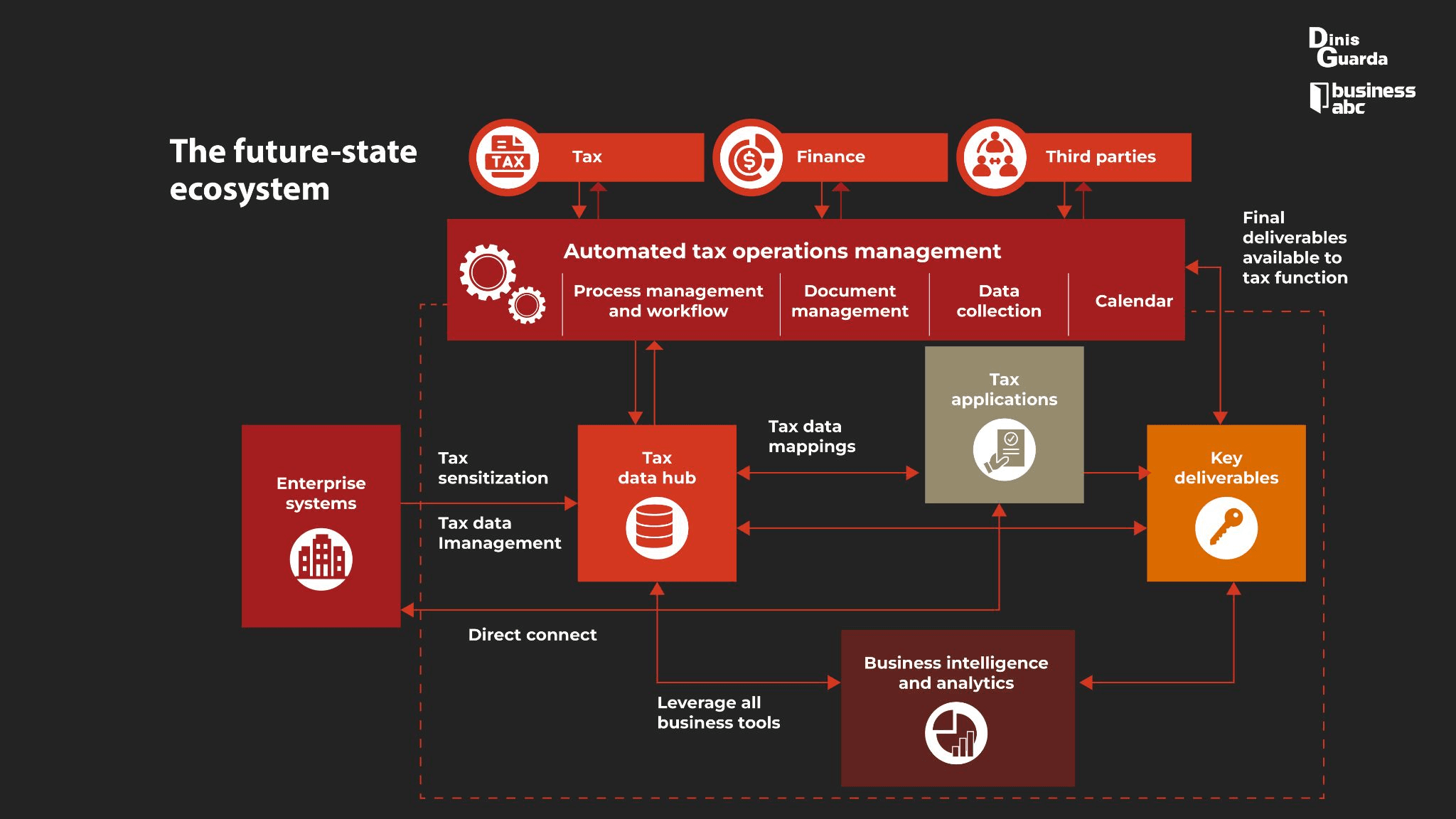

Digital Infrastructure Maturation

The foundation for AI-enhanced tax administration has been established through decades of digitisation. Electronic filing systems now process the majority of tax returns in developed nations, creating vast datasets suitable for machine learning applications. Real-time reporting systems, mandatory e-invoicing, and digital payment platforms generate continuous data streams, enabling near-instantaneous compliance monitoring.

The OECD's Tax Administration 3.0 framework envisions "seamless, natural-systems" integration where tax compliance becomes embedded in business processes rather than requiring separate reporting activities. This vision depends critically on AI capabilities to process vast data volumes whilst maintaining accuracy and taxpayer service quality.

The European Union's e-invoicing adoption illustrates the scope and impact of this transformation. Italy's Sistema di Interscambio processes over 3 billion invoices annually, whilst Spain's Suministro Inmediato de Información handles similar volumes. These systems generate petabytes of structured transaction data ideal for AI analysis, enabling fraud detection and compliance monitoring at previously impossible scales.

Regulatory Framework Stabilisation

The European Union's AI Act, which enters into force in August 2024 with staged implementation through 2027, provides precise regulatory requirements for high-risk AI applications, including audit selection and compliance assessment. These requirements, rather than constraining AI deployment, establish the governance frameworks necessary for the responsible implementation of AI at scale.

The UK's AI Playbook (2025) and Generative AI Framework for HMG (2024) provide complementary guidance for public sector AI deployment, emphasising procurement standards, deployment monitoring, and performance measurement. This regulatory clarity reduces implementation uncertainty whilst establishing democratic accountability mechanisms.

The BRICS-plus research demonstrates that nations with clearer AI governance frameworks achieve better long-term outcomes from the deployment of AI in tax administration. Regulatory certainty enables larger investments in infrastructure and skills development, creating sustainable competitive advantages in fiscal governance capability.

Technological Capability Convergence

Large language models have achieved sufficient capability and efficiency to support government-scale deployment whilst maintaining accuracy and explainability requirements. Recent advances in model compression, fine-tuning efficiency, and inference optimisation enable sophisticated AI capabilities on government-controlled infrastructure without requiring external cloud dependencies.

Graph neural networks and modern time-series analysis methods can now process the complex, interconnected datasets typical of tax administration. Entity relationship modelling, beneficial ownership analysis, and economic network effects become computationally tractable at national scale.

Explainable AI techniques, including SHAP values, attention visualisation, and counterfactual analysis, provide the transparency necessary for democratic accountability whilst maintaining predictive performance. Resolves the traditional trade-off between model accuracy and decision explainability that previously limited the adoption of government AI.

Economic and Social Drivers

Post-pandemic fiscal pressures create an urgent need for improved tax administration efficiency. Many nations face increased spending obligations whilst managing economic uncertainty that affects traditional revenue sources. AI-enhanced tax administration offers sustainable efficiency improvements without requiring proportional increases in human resources.

The BRICS-plus research reveals significant positive correlations between the deployment of AI in tax administration and broader institutional quality measures. Enhanced tax collection capabilities strengthen governance frameworks, improve public service delivery, and create positive feedback loops that support economic development.

Reducing the shadow economy represents a significant opportunity for AI-enhanced compliance monitoring. The European Commission estimates that shadow economic activity costs EU member states over €200 billion annually in lost tax revenue. Real-time transaction monitoring and AI-powered pattern recognition can significantly reduce these losses through improved detection and prevention capabilities.

Competitive Necessity

Nations implementing advanced AI capabilities in tax administration gain significant competitive advantages in economic development. Improved revenue predictability enables better fiscal planning, enhanced compliance reduces business uncertainty, and efficient administration attracts international investment by demonstrating institutional capability.

The research reveals a growing divergence between AI adopters and laggards in terms of tax administration effectiveness. Early adopters achieve compound advantages through learning effects, data accumulation, and institutional capacity development that become increasingly difficult for followers to replicate.

Technical Maturity Convergence

Critical technical components have reached production readiness for government deployment. Sovereign cloud platforms provide the security and control required for sensitive government data whilst supporting AI workloads. Modern data governance frameworks enable compliance with privacy regulations whilst supporting analytical requirements.

MLOps (Machine Learning Operations) practices have matured sufficiently to support the deployment, monitoring, and maintenance of enterprise-scale models. Automated model validation, drift detection, and performance monitoring enable the reliable operation of AI systems with appropriate human oversight.

The convergence of technical capability, regulatory clarity, and economic necessity creates a unique window for transformative AI deployment in tax administration. Nations seizing this opportunity will establish sustainable advantages in fiscal governance, whilst those delaying face increasing competitive disadvantage and missed revenue opportunities.

This timing coincides with generational workforce transitions in many tax administrations, creating opportunities to integrate AI capabilities with modernised operational practices whilst retaining institutional knowledge through structured transition processes.

Share this

Dinis Guarda

Author

Dinis Guarda is an author, entrepreneur, founder CEO of ztudium, Businessabc, citiesabc.com and Wisdomia.ai. Dinis is an AI leader, researcher and creator who has been building proprietary solutions based on technologies like digital twins, 3D, spatial computing, AR/VR/MR. Dinis is also an author of multiple books, including "4IR AI Blockchain Fintech IoT Reinventing a Nation" and others. Dinis has been collaborating with the likes of UN / UNITAR, UNESCO, European Space Agency, IBM, Siemens, Mastercard, and governments like USAID, and Malaysia Government to mention a few. He has been a guest lecturer at business schools such as Copenhagen Business School. Dinis is ranked as one of the most influential people and thought leaders in Thinkers360 / Rise Global’s The Artificial Intelligence Power 100, Top 10 Thought leaders in AI, smart cities, metaverse, blockchain, fintech.

previous

How to Improve Productivity: 7 Essential Strategies

next

Why Robotics and Smarter Automation Tools Are Essential