business resources

Hedera Hashgraph: Future of High-Speed, Low-Cost Blockchain Alternatives

8 Oct 2025, 2:14 pm GMT+1

Hedera Hashgraph: Future of High-Speed, Low-Cost Blockchain Alternatives

The stablecoin market cap of Hedera Hashgraph grew by 91.7% during the first quarter of 2025. As of mid‑2025, the market cap stands near $10.2 billion, with a circulating supply hovering around 42 billion HBAR. Hedera’s fast, low-cost consensus has powered live use cases in CBDCs, NFTs, AI, and tokenised real estate. Institutions like Google, IBM, and the Reserve Bank of Australia are using or testing Hedera.

Hedera Hashgraph is a public distributed ledger technology (DLT) that offers a high-performance, secure, and scalable alternative to traditional blockchain networks. Unlike conventional blockchains, which use a linear chain of blocks to record transactions, Hedera uses Hashgraph, a Directed Acyclic Graph (DAG) structure.

This approach allows Hedera to process thousands of transactions per second (TPS) with low latency, near-zero fees, and improved security. Hedera’s native cryptocurrency, HBAR, powers the network and covers transaction fees, network protection, and governance participation. As a distributed ledger, Hedera supports a variety of applications, including enterprise solutions, decentralised finance (DeFi), and Web3 development.

Created by Dr. Leemon Baird and Mance Harmon, Hedera is governed by a council of up to 39 global organisations. Recently, EQTY Lab achieved a 400,000x performance boost by deploying its Verifiable Compute platform on NVIDIA’s Blackwell chips, in collaboration with SCAN UK and Accenture.

Eric Piscini, CEO of Hashgraph, states:

“In the last few weeks, we’ve seen major strides across the Hedera ecosystem. The Reserve Bank of Australia and Digital Finance CRC’s Project Acacia is exploring digital currency interoperability on Hedera and HashSphere, EQTY Lab has deployed Verifiable Compute on NVIDIA’s Blackwell platform, Grayscale has added Hedera to its Smart Contract Platform Select Fund, and Kraken now supports HBAR funding and trading. This momentum in both tokenization and AI isn’t isolated, it reflects a broader shift where DLT is becoming the trust layer for mission-critical applications. Hedera has a key role to play in this moment.”

Key features of Hedera Hashgraph

- Quick transaction finality: Hedera reaches consensus in just 3 to 5 seconds, removing the need for multiple block confirmations. Its asynchronous Byzantine Fault Tolerance (aBFT) provides a clear advantage in ensuring fast and secure transactions.

- Low transaction fees: Hedera keeps transaction costs under $0.001, making it suitable for high-frequency and micro-payments.

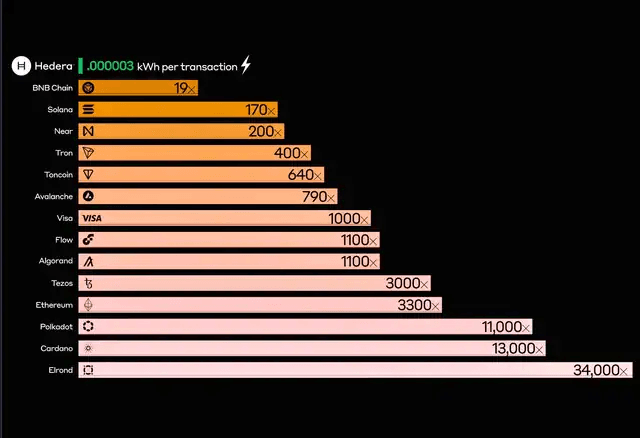

- Sustainable operations: The network is carbon-negative. It uses minimal energy and offsets more CO2 than it emits, supporting global sustainability goals.

- Decentralised governance: A rotating council of major global organisations, including Google, IBM, and Deutsche Telekom, governs Hedera. These organisations share in decision-making and operate nodes on the network.

- High throughput: With the ability to handle up to 10,000 transactions per second, Hedera greatly surpasses many blockchain networks, providing scalability without sacrificing speed or cost.

Recent developments: Ecosystem and network enhancements

Several key developments have shaped Hedera's ecosystem in early 2025:

- Stablecoin usage: USDC issuance on Hedera nearly doubled in Q1, now at a market cap of around $132 million.

- Performance milestone: Hedera recorded over 708,000 daily transactions, fueled by a 103.6% QoQ increase in Crypto Service activity.

- Protocol revenue: Protocol revenue dipped slightly to $232,700, with all services registering declines.

- Ecosystem moves: Extensions via Chainlink’s Cross-Chain Interoperability Protocol (CCIP) and usage by DeFi dApps like SaucerSwap and Bonzo Finance.

- Interoperability: Continued emphasis on interoperability, especially via Hashport with cross-chain token bridging.

Market capitalisation of Hedera Hashgraph (HBAR)

As of mid-2025, Hedera Hashgraph’s market cap is estimated to be around $10.2 billion, with a circulating supply of about 42 billion HBAR tokens. On platforms like CoinMarketCap, Hedera ranks #17, with a 24-hour trading volume of about $319 million. CoinGecko gives a similar market cap figure of $10.21 billion.

However, some sources indicate a drop to $5.8 billion, which puts Hedera at #21 in the rankings. These differences show how the circulating and released supply are defined and measured across various data sources. As a result, Hedera's market cap varies between $5.8 billion and $10 billion throughout 2025, depending on the metrics and data cited.

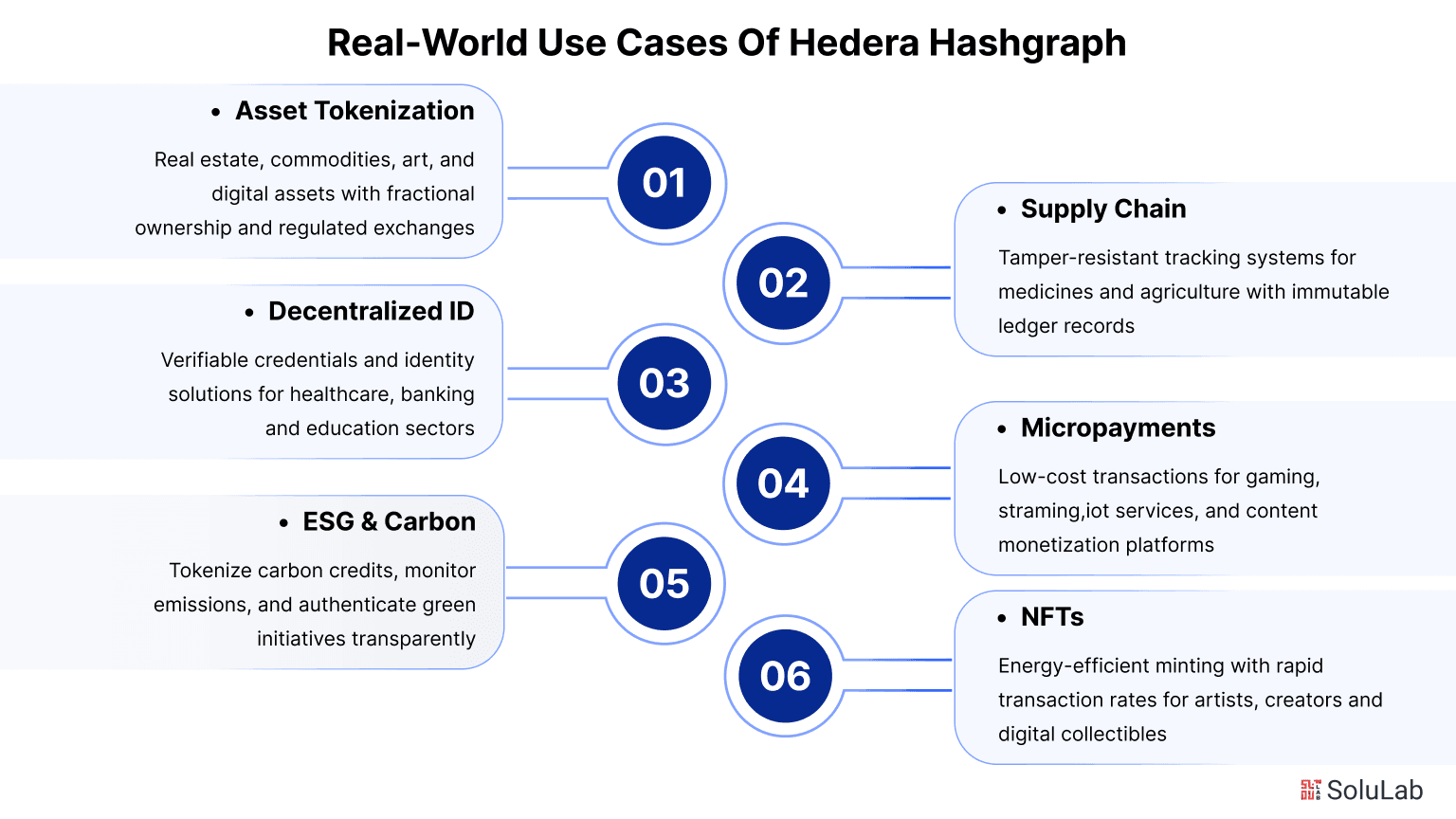

Real-world use cases of Hedera Hashgraph

Hedera Hashgraph’s unique technology is being applied across different industries, offering solutions that improve efficiency, security, and transparency. Here are some key real-world use cases:

- Asset tokenisation: Hedera enables the tokenisation of real estate, commodities, and art. This allows for fractional ownership and the creation of regulated exchanges. It opens up new investment opportunities and makes transactions easier in traditionally illiquid markets.

- Supply chain tracking: Companies like Avery Dennison use Hedera to track goods through supply chains with tamper-proof records. This ensures transparency and accountability, especially in industries like agriculture and pharmaceuticals, where data integrity is crucial.

- Decentralised identity: Hedera is being used to create self-sovereign digital identities. This lets individuals control and share their personal information securely. This is particularly valuable in sectors like healthcare, banking, and education, where secure and verifiable identities are necessary.

- Micropayments: With low transaction fees, Hedera supports micropayments for gaming, streaming services, IoT applications, and content monetisation platforms. This helps businesses adopt new revenue models by efficiently processing small-value transactions.

- ESG and carbon credits: Hedera supports sustainability efforts by allowing the tokenisation of carbon credits. Projects like DOVU use the network to track emissions and ensure transparent offset verification. This promotes environmentally friendly business practices.

- Non-Fungible Tokens (NFTs): Hedera’s energy-efficient network supports the minting and trading of NFTs. Artists, creators, and digital collectors use the platform for fast and affordable minting, with a low environmental impact.

Hedera Hashgraph has formed strategic partnerships with industry giants like Google Cloud, IBM, and Microsoft to enhance its ecosystem. Google Cloud supports Hedera’s network by providing low-latency, high-performance operations and is a member of the Hedera Governing Council, contributing to governance and strategic planning.

IBM has collaborated with Hedera to create a hybrid blockchain solution, combining public consensus with Hyperledger Fabric's privacy features, facilitating stablecoin issuance and CBDC interactions. Additionally, Hedera and Microsoft, along with Accenture and the GBBC, developed the Hedera Guardian platform, which promotes sustainability through digital measurement, reporting, and verification (dMRV) of carbon credits.

The United Nations Framework Convention on Climate Change (UNFCCC) has also partnered with Hedera to develop a blockchain-based carbon data marketplace at COP28, further solidifying Hedera’s role in the global push towards sustainability.

Transaction speed, price trends, fees, and developer activity

Network transaction speed

Hedera Hashgraph offers impressive transaction speeds, capable of handling up to 10,000 transactions per second (TPS), with finality achieved within 3–5 seconds. The network's average finality is 2.9 seconds, reflecting its efficiency. Real-time observed TPS typically averages 10.73, with the network demonstrating a peak of 3,302 TPS in a successful test.

In practical use, Hedera maintains a real-time TPS of 3.85, with a theoretical capacity of 10,000 TPS and a block time of just 2 seconds. This performance surpasses traditional networks, with Bitcoin processing just 7 TPS and Ethereum handling around 30 TPS. Recent transaction volume recorded 13,864 transactions with minimal delays, highlighting Hedera’s ability to process high volumes at scale.

Price and value trends

Hedera’s price has shown positive growth, with the trading price hovering around $0.24, up approximately 4% in the last 24 hours, although down by 10% from $0.27 a week prior. The historical high of $0.401 was reached on January 17, 2025. The current value fluctuates between $0.23 and $0.27, with a year-to-date increase of 349.4%, signalling a strong recovery from previous lows. Price forecasts suggest potential growth to $0.20 by year-end, with some predicting a range between $0.30 and $0.90.

Transaction fees

Hedera operates with a fixed transaction fee structure, paid in HBAR and adjusted based on the current exchange rate. A typical HBAR or token transfer costs around $0.0001 USD, regardless of the transaction size. The average fee for HBAR transactions is $0.001 USD, with finality in 3–7 seconds. A recent update introduced zero-cost Ethereum transaction relay fees, further enhancing Hedera’s cost-efficiency.

Hedera’s predictable, fixed-fee model offers stability, especially when compared to the fluctuating fees seen in other blockchain networks. Smart contract operations may incur slightly higher dynamic gas fees, but these remain a fraction of Ethereum's costs. All fee structures are governed by the Hedera Council to ensure alignment with network policies.

Developer activity

While direct public statistics on developer activity are limited, the introduction of Hedera Improvement Proposal (HIP) 1084 indicates ongoing protocol-level development. The Hedera documentation portal is regularly updated, providing tools and resources for developers. Major partnerships with companies like Google, IBM, and Boeing underscore enterprise-level investment in the Hedera platform.

Growth in stablecoins, tokenization, and AI-related use cases signals strong developer traction. Additionally, community-driven tools such as HashPack and Blade wallets continue to mature, supporting further adoption and integration of Hedera’s ecosystem.

Hedera Hashgraph: Governance, smart contracts, and security features

Governance and council members

Hedera Hashgraph is governed by a council of up to 39 prominent global organisations, including industry leaders like Google, IBM, LG, Boeing, and Deutsche Telekom. The council oversees critical functions such as network pricing, protocol upgrades, and strategic decision-making.

While this governance model ensures enterprise-grade stability and accountability, it does limit the level of decentralisation within the network. The asynchronous Byzantine Fault Tolerance (aBFT) consensus mechanism, combined with council governance, strengthens the network’s resilience and fairness, enabling it to deliver secure and efficient services.

Smart contracts usage

Smart contract activity on Hedera has seen significant growth, with daily active contracts rising by 213.3% in Q1 2025, from 200 to 600, peaking at 6,300 contracts by March 28, 2025. Key updates like HIP-755 and HIP-756 have enabled smart contracts to manage scheduled transactions directly. Hedera’s support for Solidity ensures compatibility with Ethereum’s development tools, such as Ethers, HardHat, and Foundry.

The network provides fixed, low-cost execution with complete Miner Extractable Value (MEV) resistance, ensuring fair ordering for all smart contract executions. Additionally, Hedera’s carbon-negative status enhances the environmental benefits of deployed smart contracts, while tools like the Asset Tokenization Studio enable compliance with ERC-1400 standards.

Security and consensus metrics

Hedera employs a BFT consensus to achieve high security and efficiency, with the network maintaining 100% efficiency by eliminating stale blocks. Its energy-efficient design ensures minimal environmental impact, distinguishing it from many other distributed ledger technologies.

Studies suggest that Proof-of-Stake (PoS) models, like Hedera’s, can provide guarantees similar to those of Proof-of-Work (PoW) models but with far less energy consumption. Hedera's use of virtual voting enhances its resistance to Sybil attacks, and its diverse council contributes to the network’s oversight, ensuring a robust and secure governance framework. This structure protects the network from manipulation, including censorship and centralisation, while ensuring transaction finality in mere seconds.

Share this

Himani Verma

Content Contributor

Himani Verma is a seasoned content writer and SEO expert, with experience in digital media. She has held various senior writing positions at enterprises like CloudTDMS (Synthetic Data Factory), Barrownz Group, and ATZA. Himani has also been Editorial Writer at Hindustan Time, a leading Indian English language news platform. She excels in content creation, proofreading, and editing, ensuring that every piece is polished and impactful. Her expertise in crafting SEO-friendly content for multiple verticals of businesses, including technology, healthcare, finance, sports, innovation, and more.

previous

Regression Testing Best Practices and What Is Stress Testing in Software Testing?

next

Restoring Classic Ford Cars: Where to Start and What to Avoid