business resources

How Long Does It Take to Build Good Business Credit?

25 Sept 2025, 3:12 pm GMT+1

Short answer: faster than you think, slower than you wish. Most businesses can lay the foundation in a few months, then strengthen it over 6 to 12 months and beyond.

In this guide, we break down the typical timeline, what speeds things up, what slows it down, and what milestones to look for along the way.

What timeline are we talking about?

If you are starting from zero, expect an initial credit profile to begin forming within 30 to 90 days once vendors and lenders start reporting your payments. Many owners see their first third-party score, like Dun & Bradstreet’s PAYDEX, appear once several payment experiences hit the file, often around the 90-to-120-day mark.

Here is where the right tools help. Using business credit building software to track which vendors report, monitor new tradelines, and alert you when data posts can shave weeks off the guesswork and help you spot issues early. The faster you confirm that accounts are reporting, and payments are on time, the faster your file matures.

What speeds it up or slows it down

Speed boosts

- Clean setup. Register the business properly, get your EIN, and open a dedicated business bank account. Lenders and bureaus need to match your legal details and banking footprint.

- Reporting tradelines. Prioritize vendors and cards that actually report to the business bureaus. Some do not, which slows your progress.

- On-time or early payments. PAYDEX in particular rewards paying before terms. Paying early can push you toward an 80 PAYDEX faster.

- Low utilization and steady activity. Regular use with low balances signals healthy cash flow to bureaus and lenders.

Speed bumps

- Vendors that report slowly. New accounts can take 30 to 60 days or more to show up. If a vendor reports quarterly, delays are normal.

- Inconsistent identity data. Name, address, and industry codes that do not match across applications can cause files to split or stall.

- Late payments. A single past-due can set you back months, since payment history is the number one driver across credit models.

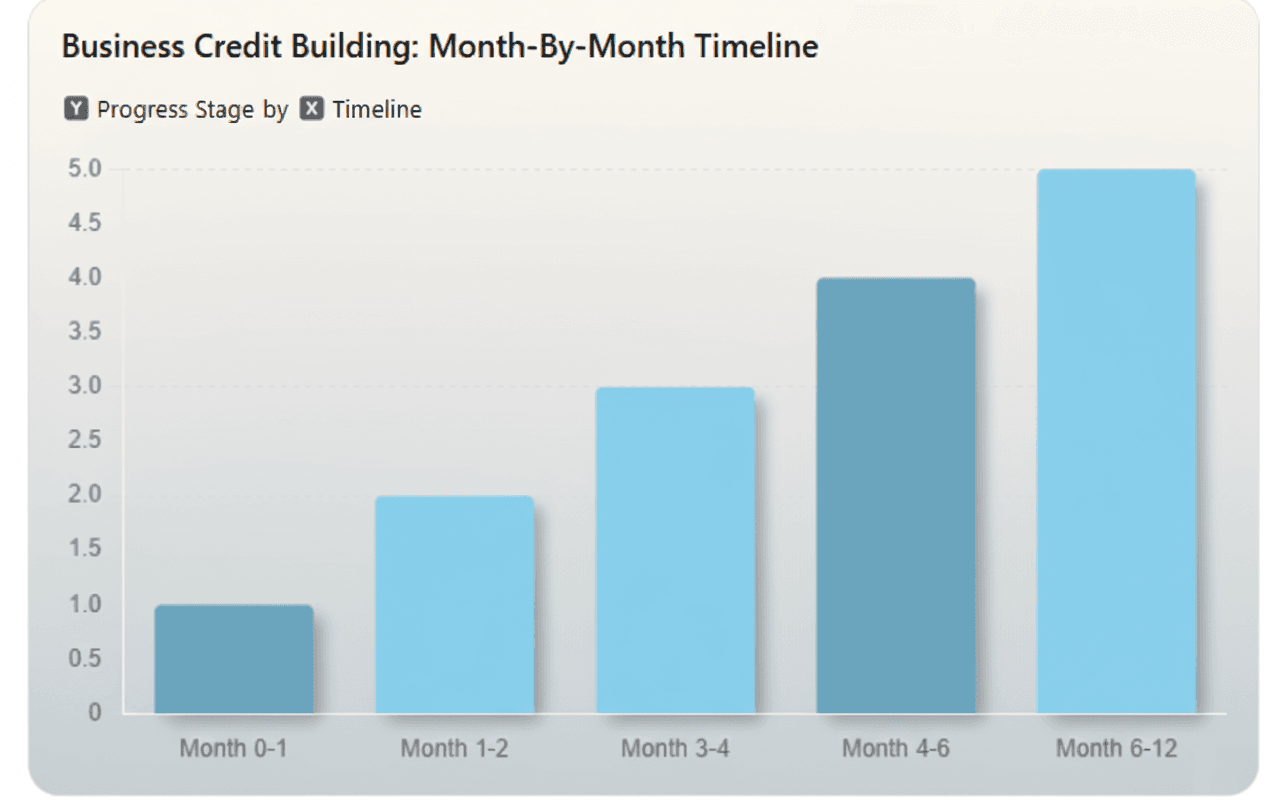

A practical month-by-month timeline

Month 0 to 1

Form or confirm your legal entity, get your EIN, open a business bank account, and apply for two to three vendor accounts that report to Dun & Bradstreet, Experian, or Equifax Commercial.

Month 1 to 2

Start small recurring purchases with those vendors. Pay invoices early. Consider one business card from an issuer that reports to business bureaus. Expect new accounts to take a few billing cycles to appear.

Month 3 to 4

As three or more payment experiences hit your D&B file, an initial PAYDEX score often appears. Keep paying before the due date to push toward 80.

Month 4 to 6

Broaden your file with an additional reporting tradeline if needed. Maintain low utilization and consistent spending. You may start to see better terms with suppliers.

Month 6 to 12

With steady, on-time activity, many businesses reach “good” territory. Lenders begin to consider larger limits and longer terms as the file thickens.

Signs you are on the right track

- You can locate your business credit files and see new trade lines posting across bureaus.

- Your D&B PAYDEX trends toward 80, which reflects prompt or early payments.

- Suppliers proactively offer net-30 or net-60 terms, and card issuers increase limits after reviews.

Data at a glance: typical milestones and sources

Below is a quick snapshot of common timeframes based on reputable guidance. Actual results vary by vendor reporting cycles, industry, and payment behavior.

| Milestone | Typical timeframe | Notes |

| New tradeline shows on report | 30 to 60 days | Some vendors and cards report monthly or even quarterly |

| Initial D&B PAYDEX appears | Around 90 to 120 days | Often after 3 payment experiences are posted |

| PAYDEX meaning of 80 | “Prompt” payment, usually paying on or before terms | |

| Foundational setup steps | Immediate to 30 days | Entity formation, EIN, bank account open |

| Broad “good credit” window | 6 to 12 months | With consistent on-time payments and multiple reporting accounts |

Why these stats matter

- If your new accounts are not showing after two months, follow up. Some suppliers need a reminder to report or require a threshold of activity before they do.

- Aiming for PAYDEX 80 is a practical early goal that correlates with better vendor terms. Paying a bit early tilt the math in your favor.

- The first 30 days are administrative, yet critical. Clean setup prevents file mismatches that delay your scores.

Frequently asked questions

Can I speed it up?

Yes. Choose only vendors that report, pay early, and keep identity data consistent everywhere. Monitoring with a tool that flags new tradelines and alerts you to posting dates helps you act quickly if something goes missing.

Do I need many tradelines?

You can start with two or three that report, then add more over time to “thicken” your file. Each additional, well managed account adds depth.

What if I already have credit but it is thin or mixed?

You are not starting from scratch. Improving a thin or imperfect file still follows the same playbook. Expect months, not days, for meaningful score movement.

Bottom line

Most businesses can establish a visible profile in 1 to 3 months, with “good” credit often attainable in 6 to 12 months of consistent, on-time activity. Set up the business correctly, pick reporting vendors, pay early, and monitor your reports. The timeline is not magic. It is a rhythm you can manage. Do that well, and good terms tend to follow.

Share this

Contributor

Staff

The team of expert contributors at Businessabc brings together a diverse range of insights and knowledge from various industries, including 4IR technologies like Artificial Intelligence, Digital Twin, Spatial Computing, Smart Cities, and from various aspects of businesses like policy, governance, cybersecurity, and innovation. Committed to delivering high-quality content, our contributors provide in-depth analysis, thought leadership, and the latest trends to keep our readers informed and ahead of the curve. Whether it's business strategy, technology, or market trends, the Businessabc Contributor team is dedicated to offering valuable perspectives that empower professionals and entrepreneurs alike.

previous

Digital Transformation Begins With ERP: Making Your Software Work Harder

next

Which Wireless Meat Thermometer Is the Best for Tech Lovers?