business resources

How to Automate B2B SaaS Billing for Accurate Revenue Data

27 Nov 2025, 11:41 am GMT

Managing billing in a B2B SaaS business requires accuracy, consistency, and control over recurring revenue. But here’s the challenge. Manual billing processes tend to undermine these because it can invite errors and leave gaps in your revenue records.

In a subscription business model where predictable cash flow matters, even small mistakes can have significant impacts.

That's why many SaaS businesses are turning to automated billing processes. Automation removes repetitive work and enforces consistent billing rules for accurate financial reporting.

In this post, you’ll find practical approaches on how to automate B2B SaaS billing to keep your revenue data audit-ready.

Steps to Automate Your B2B SaaS Billing Process

So, how do you go about implementing automation to maintain accurate revenue data and boost business productivity?

Let’s break it down into clear steps you can follow.

Step 1: Audit Your Current Billing Workflow

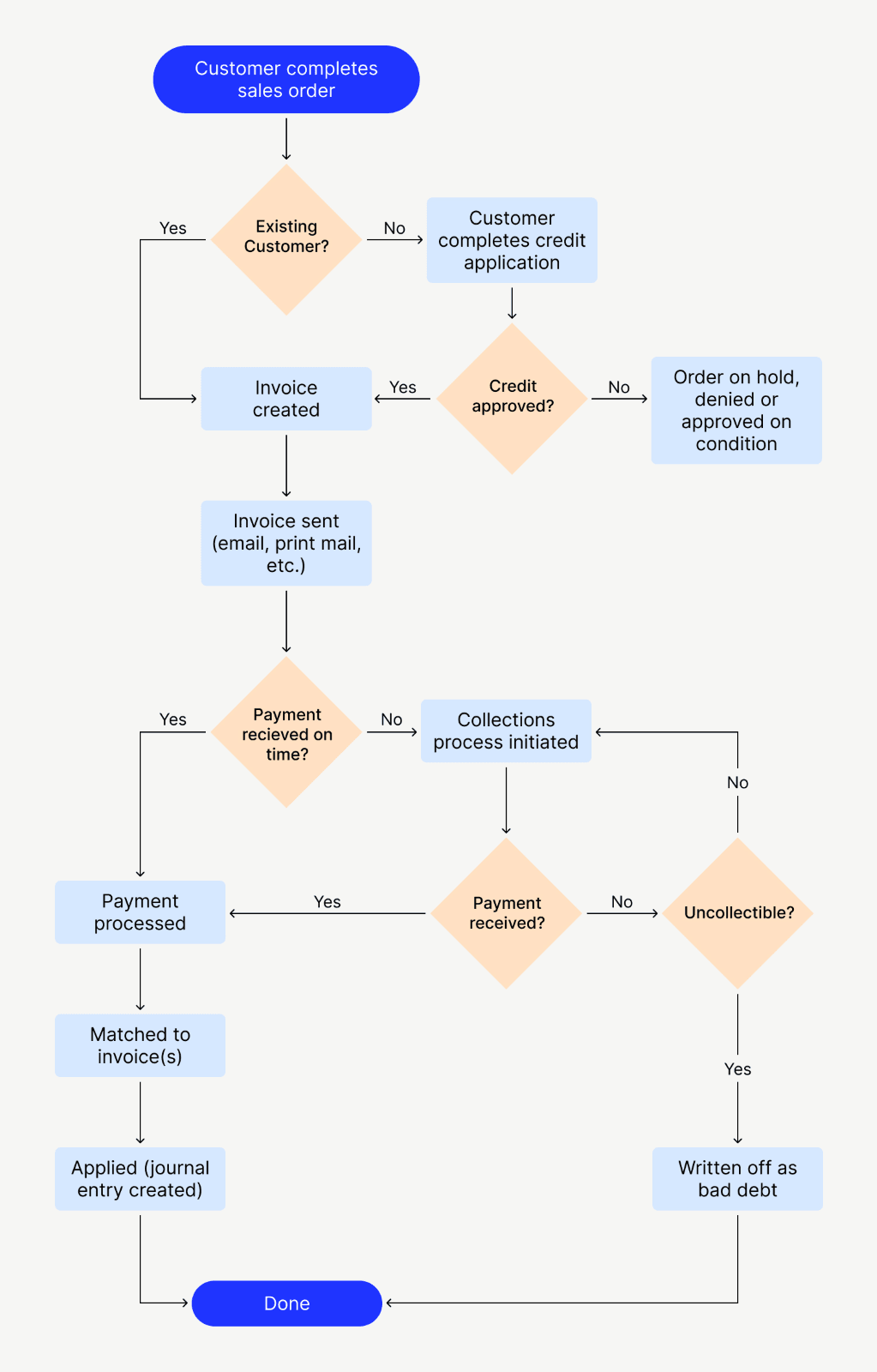

Before you can automate your B2B SaaS billing, you need to understand how your current process works. Start by mapping out every stage of your billing process, from subscription to invoice generation and payment collection.

Here's a typical example of a billing process flow involving several steps and touchpoints.

Look closely at who handles each step and how data moves between systems. Also, review the software and platforms you currently use. Are they integrated or working in isolation?

This will help you see where bottlenecks, delays, and manual errors occur. Once you identify them, you can prioritize which areas need automation first.

Step 2: Choose the Right Billing Platform

The billing platform you choose can affect your automation workflow, how easily it scales, and how accurately it maintains your revenue data.

Factors like the ability to support complex billing structures when choosing a B2B SaaS billing tool.

Keep an eye out for tools that can handle advanced billing scenarios such as:

- Tiered pricing for handling multiple billing plans

- Usage-based billing for products charged based on customer activity or consumption

- Multi-currency support to accommodate global clients

- Revenue recognition compliance to align with standards like ASC 606 or IFRS 15

- Custom reporting for generating accurate, audit-ready revenue data

The B2B SaaS finance experts recommended that Younium is the best option to automate and keep accurate revenue data. However, there are multiple other options also available in the market to choose one as per your requirement.

Step 3: Integrate Your Billing and Accounting Systems

Automation is effective when data flows seamlessly between systems. If your billing platform and business tools work in isolation, you’ll still face manual updates and data mismatches.

Integration simplifies communication across your teams and ensures that every transaction is recorded and reconciled properly.

Start by mapping out which systems need to connect. For most B2B SaaS companies, this includes your billing platform, accounting software, customer relationship management (CRM) system, and payment gateways.

Use secure APIs and data-sharing permissions to protect sensitive information. It’s also a good idea to test the setup using a small batch of customer data before going live.

Step 4: Set Up Automated Workflows

Once your system is integrated, define and set up your billing process automation rules. The goal is to create a predictable and structured process that runs smoothly with minimal manual input. You need to follow the right SaaS onboarding checklist while adopting this system for better results.

Start by defining the triggers, conditions and responses for each billing process. A trigger is an event that tells your system when to take action, while a response is what happens next.

For instance, when a customer’s subscription renews (trigger), the system should automatically generate and send an invoice (response). When you define these logical connections, your automation will handle billing actions without delays or human errors.

Here are a few common workflows to automate:

- Invoice Generation: Automatically create and send invoices based on billing schedules or usage data.

- Payment Reminders: Trigger notifications for upcoming, due, or failed payments.

- Prorated Billing Adjustments: Adjust charges automatically when customers upgrade or downgrade plans.

- Revenue Reporting: Generate monthly or quarterly reports for recognized and deferred revenue.

- Tax Calculations: Apply correct tax rules automatically based on region or pricing tier.

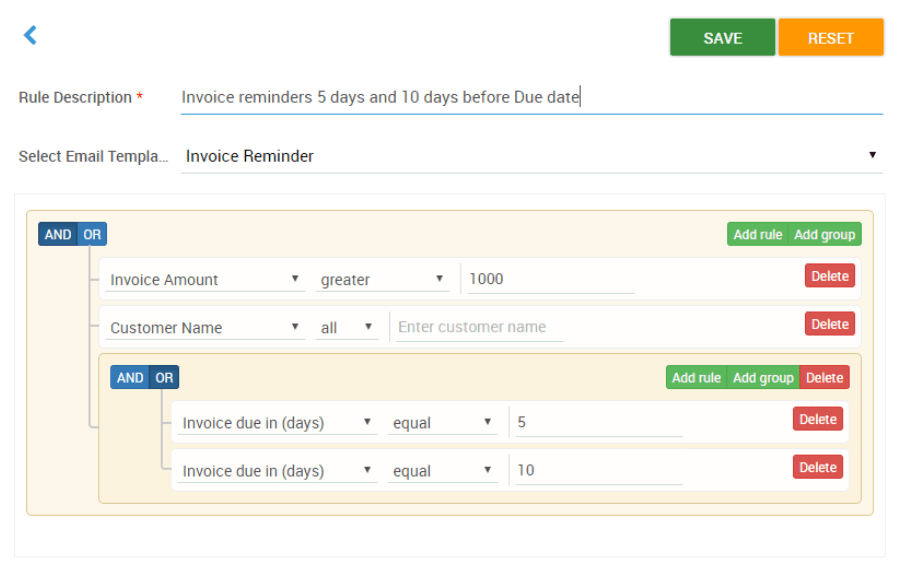

See an example of an automated workflow setup on PayorCRM for invoice reminders including an automation rule and condition.

A professional business consultant can help and explain how automated workflows can boost your team's productivity and reduce operational costs.

Step 5: Test and Monitor

Before going live, run tests across different customer segments and billing scenarios. This step will help you catch issues early and confirm that your automation works the way you expect.

Use sample data to simulate real situations, such as subscription renewals, cancellations, upgrades, and failed payments. Make sure your system responds accurately to each action.

For instance, when a payment fails, does the system send an automatic reminder? When a subscription upgrades mid-cycle, does it adjust the charges correctly?

After testing, move on to the monitoring phase. Even after you go live, keep a close eye on your automated billing for the first few months. Monitor transaction reports, error alerts, and customer feedback to ensure everything runs smoothly.

How to Automate the Billing System to Boost Customer Retention

The Integration of an automated billing and customer service system can maximize the revenue of the SaaS business. Especially for new customers who have multiple questions about billing and features.

The email customer service system like timetoreply can automatically measure customer response time to help SaaS businesses in customer satisfaction strategy formulation. SaaS businesses can integrate and automate a customer service system with their billing system and boost revenue for their business.

To Wrap It Up

You also gain better control over how money moves through your system when you automate your B2B SaaS billing.

Each process runs smoothly and in sync with efficient automation in place. That means fewer delays, fewer mistakes, and a better experience for your customers.

If you want to streamline your SaaS business operation and stay efficient, start now. Build an automated billing system that supports growth and keeps your revenue operations running with ease.

Share this

Himani Verma

Content Contributor

Himani Verma is a seasoned content writer and SEO expert, with experience in digital media. She has held various senior writing positions at enterprises like CloudTDMS (Synthetic Data Factory), Barrownz Group, and ATZA. Himani has also been Editorial Writer at Hindustan Time, a leading Indian English language news platform. She excels in content creation, proofreading, and editing, ensuring that every piece is polished and impactful. Her expertise in crafting SEO-friendly content for multiple verticals of businesses, including technology, healthcare, finance, sports, innovation, and more.

previous

How Can You Tell If a Workplace Truly Values You?

next

Get Your City Skylines Free Download for Android Today!