business resources

Rillet Secures $70M Series B to Revolutionise Enterprise Accounting with AI-native ERP

14 Aug 2025, 10:36 am GMT+1

Rillet, the AI-native ERP platform built for modern finance teams, has secured a $70 million Series B funding round, co-led by Andreessen Horowitz and ICONIQ. The new investment brings total funding to over $100 million in just one year. This funding will accelerate Rillet’s mission to modernise financial systems, empower finance teams, and redefine accounting infrastructure.

Rillet, a cutting-edge AI-native enterprise resource planning (ERP) platform, is revolutionising the way finance teams operate. After raising over $100 million in funding within a year, the company has emerged as a frontrunner in the financial tech space.

With a vision to replace outdated accounting software, Rillet promises to provide a smarter, more efficient way for businesses to handle their finances. Co-led by venture capital giants Andreessen Horowitz and ICONIQ, the $70 million Series B funding will drive the company’s rapid expansion and innovation.

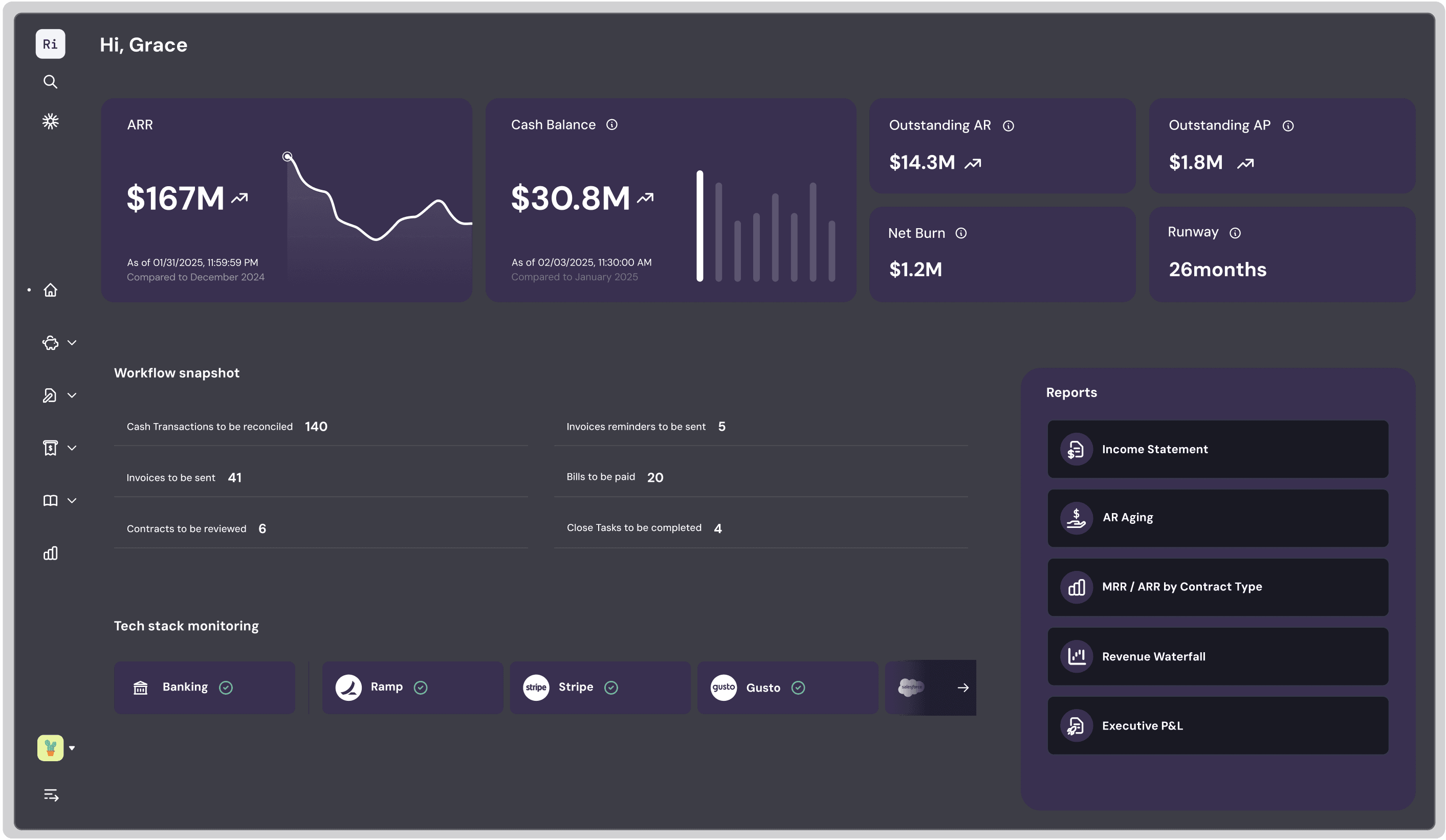

The platform’s success is built on its ability to integrate AI directly into financial workflows, allowing businesses to cut close times, automate processes, and scale with fewer people. In this article, we explore Rillet’s impact on the accounting industry, its growing customer base, and what the future holds for the next generation of finance teams.

Rillet’s rapid growth and success

In just under a year, Rillet has managed to raise more than $100 million in funding, including a recent $70 million Series B round co-led by Andreessen Horowitz and ICONIQ. The funding round also saw participation from Sequoia, Oak HC/FT, and earlier investors. The speed of Rillet's growth has been remarkable—signing over 200 customers and doubling its annual recurring revenue (ARR) in just 12 weeks.

The company’s success can be attributed to its innovative approach to financial systems. Unlike traditional ERPs, which rely on outdated databases and spreadsheets, Rillet integrates smart technology and AI into every aspect of accounting. This allows finance teams to get real-time insights, automate workflows, and achieve faster results with leaner teams.

Rebuilding finance from the ground up

Rillet’s breakthrough lies in its AI-first approach to enterprise accounting. Traditional systems are cumbersome, often relying on spreadsheets and third-party analytics tools to complete tasks. Rillet, however, simplifies this by embedding AI directly into its core system.

The platform’s smart general ledger integrates seamlessly with other financial systems, empowering teams to collaborate in real-time and gain insights immediately after a transaction occurs.

A major selling point for Rillet’s platform is its speed. Companies like PostScript, which has a global operation and $100 million in ARR, close their books in just three days using Rillet.

Similarly, Windsurf, one of the fastest-growing companies in the world, runs its entire finance operation with a lean team of just two people. Rillet’s customers report slashing close times and reducing implementation periods—from 12 months with legacy systems to just 4 weeks with Rillet.

AI-Native ERP for the next generation of businesses

The shift to AI-native financial systems is crucial as companies aim to scale efficiently. Rillet’s platform is a clean-slate approach designed for the modern business environment. Unlike incumbent ERP systems owned by conglomerates like Oracle and Microsoft, Rillet is built from the ground up to serve high-growth companies that need speed, intelligence, and scalability.

Rillet's co-founder, Nicolas Kopp, who served as CEO of N26, understands the frustrations of outdated accounting systems. "As US CEO of N26, I experienced firsthand how frustrating it was to wait weeks for critical business metrics," Kopp explained. "I knew there had to be a better way."

This frustration led him to partner with Stelios Modes, the technical architect behind N26’s payment infrastructure, to build Rillet.

Automation and AI collaboration

Rillet's AI-native platform addresses a critical gap in the finance sector: the automation of routine tasks. According to Accenture, 80% of routine financial operations can be automated, and the accounting industry is facing a severe talent shortage, with 75% of accountants expected to retire in the next 15 years. By automating manual work, Rillet frees up finance teams to focus on strategic analysis, giving businesses a competitive edge in a rapidly changing market.

As Seema Amble, Partner at Andreessen Horowitz, noted, "Rillet is delivering that transformation by rebuilding ERP infrastructure specifically for the AI era." The platform enables finance teams to make smarter decisions, run leaner operations, and gain faster insights, critical advantages in today’s competitive business environment.

Looking ahead: Rillet’s vision for the future

The company’s long-term vision extends far beyond automation. Rillet aims to create a collaborative platform where AI agents and human expertise work together to manage and understand financial performance. The company plans to deepen integrations with other financial technologies and expand its AI capabilities to provide even more powerful insights and automation tools.

"We’re building the infrastructure that will take our customers to the next level and redefine what’s possible when finance teams have truly modern tools," said Kopp.

With several customers preparing to go public on Rillet’s platform in the next 6-12 months, the company is poised to demonstrate that businesses can scale from startup to IPO using AI-native financial infrastructure. This represents a significant shift in how companies manage their financial operations—moving away from traditional, slow-moving legacy systems and embracing the speed, intelligence, and automation of AI.

About Rillet

Rillet is an AI-native ERP platform designed to streamline financial operations for modern businesses. With offices in New York, San Francisco, and Barcelona, Rillet has raised over $100 million from Sequoia, Andreessen Horowitz, ICONIQ, and other investors. The platform enables companies to automate accounting workflows, gain real-time insights, and scale their operations efficiently. Rillet’s customers include high-growth companies like Windsurf, Bitwarden, and Decagon.

About Andreessen Horowitz

Andreessen Horowitz (a16z) is a venture capital firm that invests in entrepreneurs building the future through technology. With $46 billion in committed capital, a16z supports companies across AI, bio + healthcare, fintech, consumer, crypto, and enterprise, helping them scale from seed to growth stages.

About ICONIQ

ICONIQ is a global investment firm that partners with visionary leaders to define the future of their industries. The firm invests in companies at every stage of growth, from inception to IPO, and supports their portfolio companies through their key inflexion points. ICONIQ’s robust portfolio includes companies like Airbnb, Zoom, Snowflake, and 1Password.

Share this

Shikha Negi

Content Contributor

Shikha Negi is a Content Writer at ztudium with expertise in writing and proofreading content. Having created more than 500 articles encompassing a diverse range of educational topics, from breaking news to in-depth analysis and long-form content, Shikha has a deep understanding of emerging trends in business, technology (including AI, blockchain, and the metaverse), and societal shifts, As the author at Sarvgyan News, Shikha has demonstrated expertise in crafting engaging and informative content tailored for various audiences, including students, educators, and professionals.

previous

Humanity Protocol Mainnet Launches, Introducing Privacy-First Digital Identity with zkTLS

next

Save Time and Boost Efficiency: Using Smart Transcription Tools for Meeting Summaries