business resources

AI in Taxes: Existing Gaps in Global Tax Infrastructure and AI Solutions

24 Sept 2025, 1:25 pm GMT+1

Tax systems worldwide face revenue losses, inefficiency, and fairness issues that traditional methods cannot solve. AI can transform tax administration by automating processes, detecting fraud, improving compliance, and enabling real-time monitoring, helping governments recover billions, close gaps, and deliver better public services.

Tax administrations worldwide stand at a critical juncture where artificial intelligence capabilities converge with regulatory frameworks and operational necessity to create unprecedented transformation opportunities.

This publication presents a comprehensive blueprint for deploying closed, sovereign AI strategies and artificial intelligence agents that operate entirely within national boundaries, while delivering substantial improvements in Tax administrations. AI enables better operations, real-time optimisation, compliance, efficiency, communication with tax players, and improves and facilitates revenue collection.

Governments worldwide face a tax administration crisis that traditional methods cannot resolve. The European Union loses £130 billion annually through VAT gaps averaging 7.0%, while shadow economy activities drain an additional £200 billion from public coffers. These revenue losses translate directly into underfunded healthcare systems, deteriorating infrastructure, and reduced public services that citizens depend on.

The operational challenges are equally severe. Tax administrations struggle with:

- Manual audit selection achieves only 40-60% hit rates, wasting enforcement resources whilst allowing systematic non-compliance to continue.

- Processing backlogs that delay case resolution by months or years, creating uncertainty for compliant taxpayers, whilst enabling sophisticated avoidance schemes

- Reactive compliance monitoring that detects problems only after significant revenue losses have occurred

- Labour-intensive processes where staff spend 40-70% of their time on data manipulation rather than analytical work (EY Global Tax Technology Survey, 2020)

Meanwhile, sophisticated taxpayers exploit regulatory gaps faster than traditional enforcement can respond, creating an unfair advantage for non-compliant actors whilst penalising honest businesses that bear disproportionate compliance costs.

AI as the solution: From manual inefficiency to intelligent governance

Artificial Intelligence offers proven solutions to these systemic problems. Recent BRICS-plus research demonstrates that AI deployment in tax administration creates measurable improvements in institutional quality, with collection efficiency gains of 15-40% across various applications, while strengthening governance frameworks throughout entire economies.

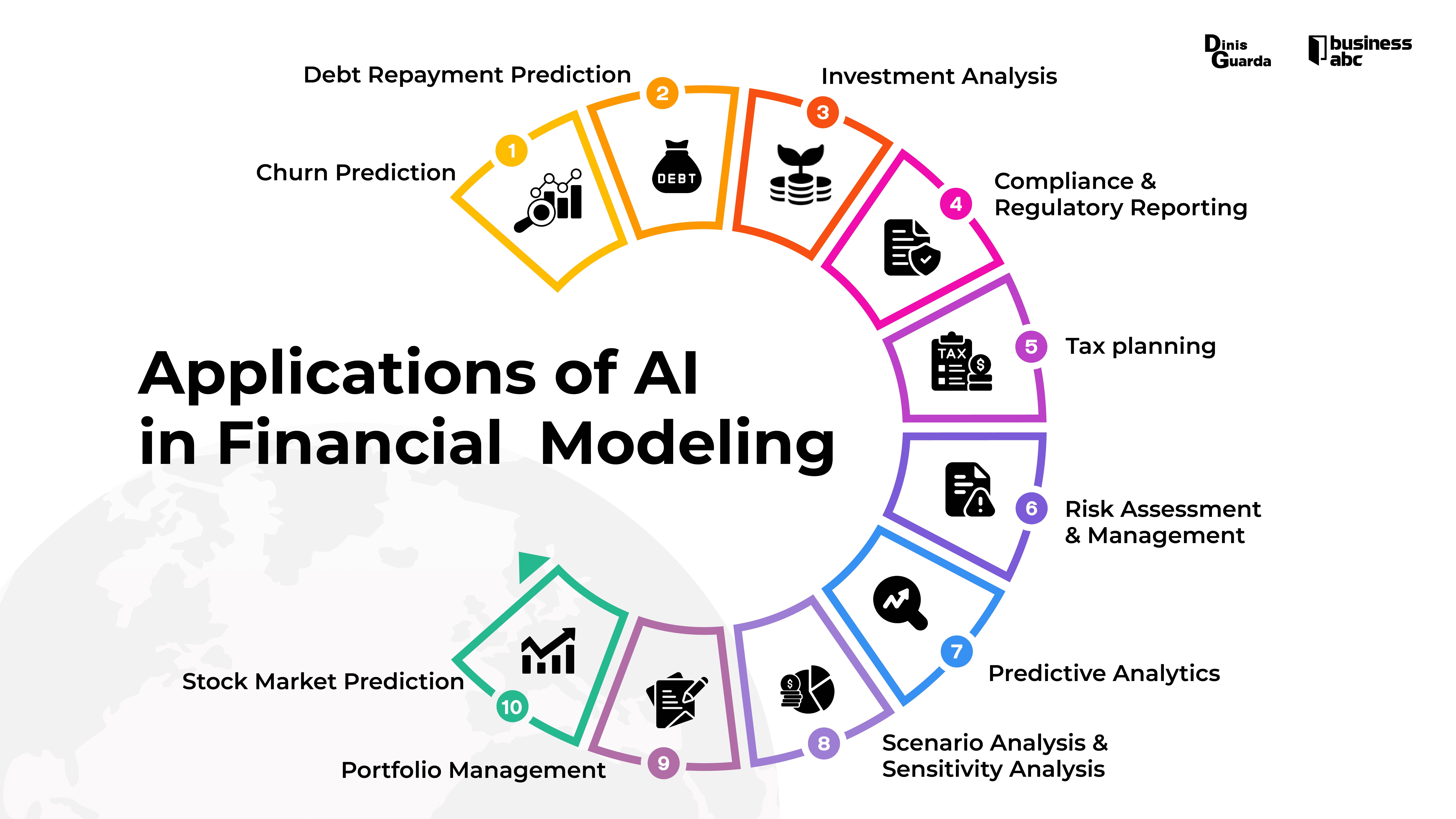

When we examine AI and Taxes, we need to consider how AI will transform and significantly alter the way governments and citizens operate, as well as the role technology will play in enhancing efficiency and reducing government costs.

- Automating Administrative Tasks: AI can automate repetitive tasks, such as data entry, document processing, and form handling. It reduces the need for manual labour, speeds up processes, and cuts administrative costs.

- Predictive Analytics for Budgeting: AI-driven predictive analytics can help governments better forecast economic trends, budget needs, and resource allocation. It could reduce over- or under-spending and lead to more efficient use of public funds.

- Fraud Detection and Prevention: AI systems can detect patterns of fraud and misuse of public resources. By automating the detection process, governments can save money on investigations and prevent financial losses due to fraudulent activities.

- Livability and Healthcare Efficiency: AI can be utilised in government-run healthcare systems to enhance patient care, reduce wait times, and forecast resource requirements. It can help manage costs by identifying areas where medical resources are being underutilised or misallocated.

- Smart Infrastructure Management: AI can optimise the maintenance of public infrastructure, such as roads, bridges, and utilities, by predicting when repairs are needed and reducing unnecessary maintenance costs. Sensors combined with AI can monitor infrastructure health in real-time.

- Optimising Data and Sources of Supply Chains: Governments procure large amounts of goods and services. AI can streamline procurement and logistics, identify inefficiencies to reduce costs, and negotiate more favourable contracts through data-driven analysis.

- Improved 360 Tax Collection cycle: AI can help improve the accuracy of tax assessments, detect under-reporting, and reduce errors in tax filings, which can help increase revenue without increasing tax rates.

- Citizen Services and interacting Chatbots: AI chatbots can handle common queries and provide public services online, reducing the need for government staff to deal with routine inquiries, improving efficiency and reducing staffing costs.

- Energy Management: Governments manage extensive facilities that consume significant amounts of energy. AI can be used to optimise energy usage, reduce waste, and implement smart grid technology that lowers overall operational costs.

- Decision Support for Policymaking: AI can analyse vast datasets to provide insights into the impact of various policy decisions, which enables governments to implement more cost-effective policies by better understanding potential outcomes.

Solving the revenue gap crisis

Real-Time Transaction Monitoring: Italy's Sistema di Interscambio and Spain's Suministro Inmediato process billions of invoices annually, while achieving VAT gaps below 5%, representing a potential revenue recovery of 2-5 percentage points for implementing nations. For a country with £500 billion annual tax collection, this translates to £10-25 billion in additional revenue.

Enhanced Audit Effectiveness: The US Internal Revenue Service's AI-selected audits of large partnerships achieved hit rates exceeding 80%, resulting in hundreds of millions of dollars in additional assessments. This represents a doubling of enforcement effectiveness compared to traditional methods.

Predictive Compliance Management: AI systems identify non-compliance patterns before they mature into significant revenue losses, shifting from expensive post-hoc enforcement to proactive prevention that benefits both taxpayers and revenue authorities.

Solving the operational efficiency crisis

Automated Case Processing: AI systems reduce case processing times by 20-30% in first-year implementation, extending to 40-60% with system maturity. This eliminates backlogs whilst improving taxpayer service quality.

Intelligent Document Analysis: Natural language processing handles complex legal documents, regulatory updates, and case files in seconds rather than hours, freeing analysts for strategic work that requires human judgment.

Workforce Optimisation: Rather than replacing staff, AI eliminates routine data manipulation work, enabling professionals to focus on policy analysis, complex case investigation, and citizen service enhancement.

Solving the compliance fairness crisis

Explainable Decision-Making: AI systems provide clear, auditable explanations for all enforcement actions, ensuring that audit selection and compliance assessment remain transparent and contestable through established legal processes.

Bias Detection and Mitigation: Automated fairness monitoring ensures that AI deployment improves rather than worsens equity in tax enforcement, with statistical controls preventing discriminatory treatment across income levels or demographic groups.

Proactive Taxpayer Assistance: AI-powered guidance systems provide immediate, accurate compliance support, reducing burden for honest taxpayers whilst improving voluntary compliance rates.

Share this

Dinis Guarda

Author

Dinis Guarda is an author, entrepreneur, founder CEO of ztudium, Businessabc, citiesabc.com and Wisdomia.ai. Dinis is an AI leader, researcher and creator who has been building proprietary solutions based on technologies like digital twins, 3D, spatial computing, AR/VR/MR. Dinis is also an author of multiple books, including "4IR AI Blockchain Fintech IoT Reinventing a Nation" and others. Dinis has been collaborating with the likes of UN / UNITAR, UNESCO, European Space Agency, IBM, Siemens, Mastercard, and governments like USAID, and Malaysia Government to mention a few. He has been a guest lecturer at business schools such as Copenhagen Business School. Dinis is ranked as one of the most influential people and thought leaders in Thinkers360 / Rise Global’s The Artificial Intelligence Power 100, Top 10 Thought leaders in AI, smart cities, metaverse, blockchain, fintech.

previous

Road Trip Ready: The Best National Parks in the US for an Epic Cross-Country Adventure

next

Best National Parks Near Major Cities: Easy Escapes from NYC, LA & Chicago